Generals Falter While Army Keeps Calm & Carries On

Concerns about widespread optimism, lost leadership and potential divergences are narrative-driven talking points. The evidence shows strong breadth and a persistent risk-on environment.

Portfolio Applications Subscriber note: as a reminder, we published updates to the Systematic Blue Heron Portfolios last week. Stay tuned for updates to the Discretionary Dynamic Portfolios and the cyclical Weight of the Evidence later this week.

Key Takeaway: Last year’s leaders are stumbling, but elsewhere, new highs are plentiful and trends are strong. Our Fear or Strength Model remains positive. Our Relative Strength Rankings show equities remain the leaders from an asset class perspective and within the US, mid-caps have turned higher relative to large-caps.

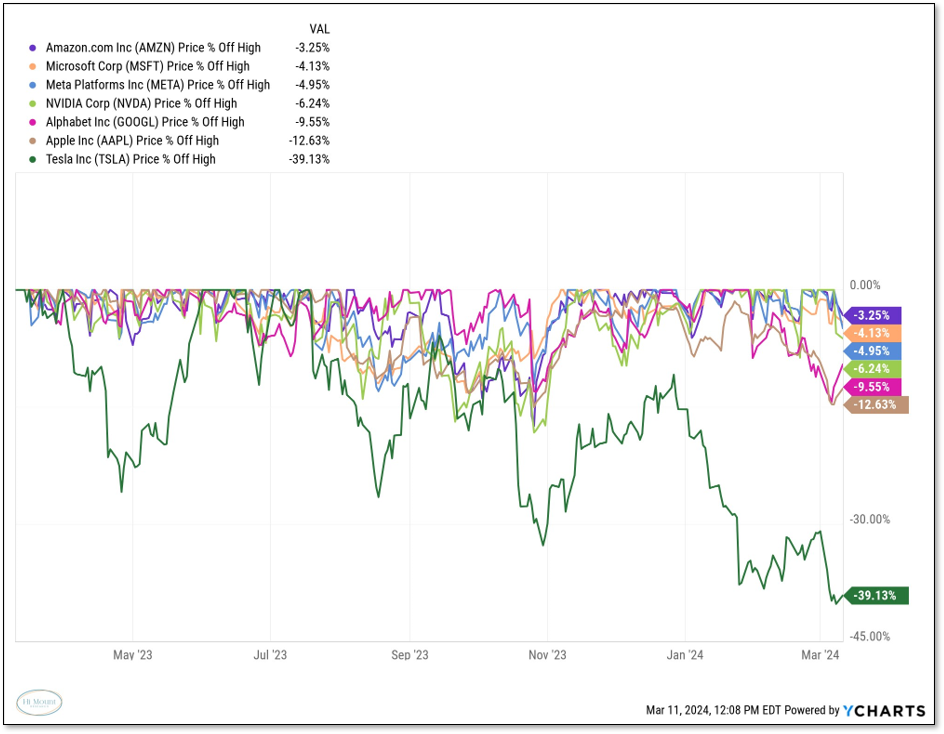

Last year’s leaders are becoming this year’s laggards and market heavyweights are in retreat. But elsewhere we see more evidence of breaking out than breaking down.

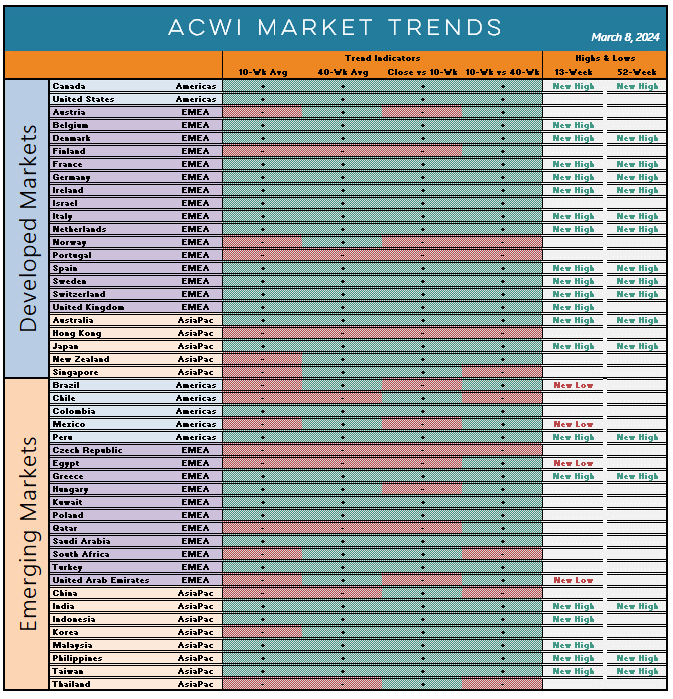

More than one-third of the country-level ACWI indexes made new 52-week highs last week.

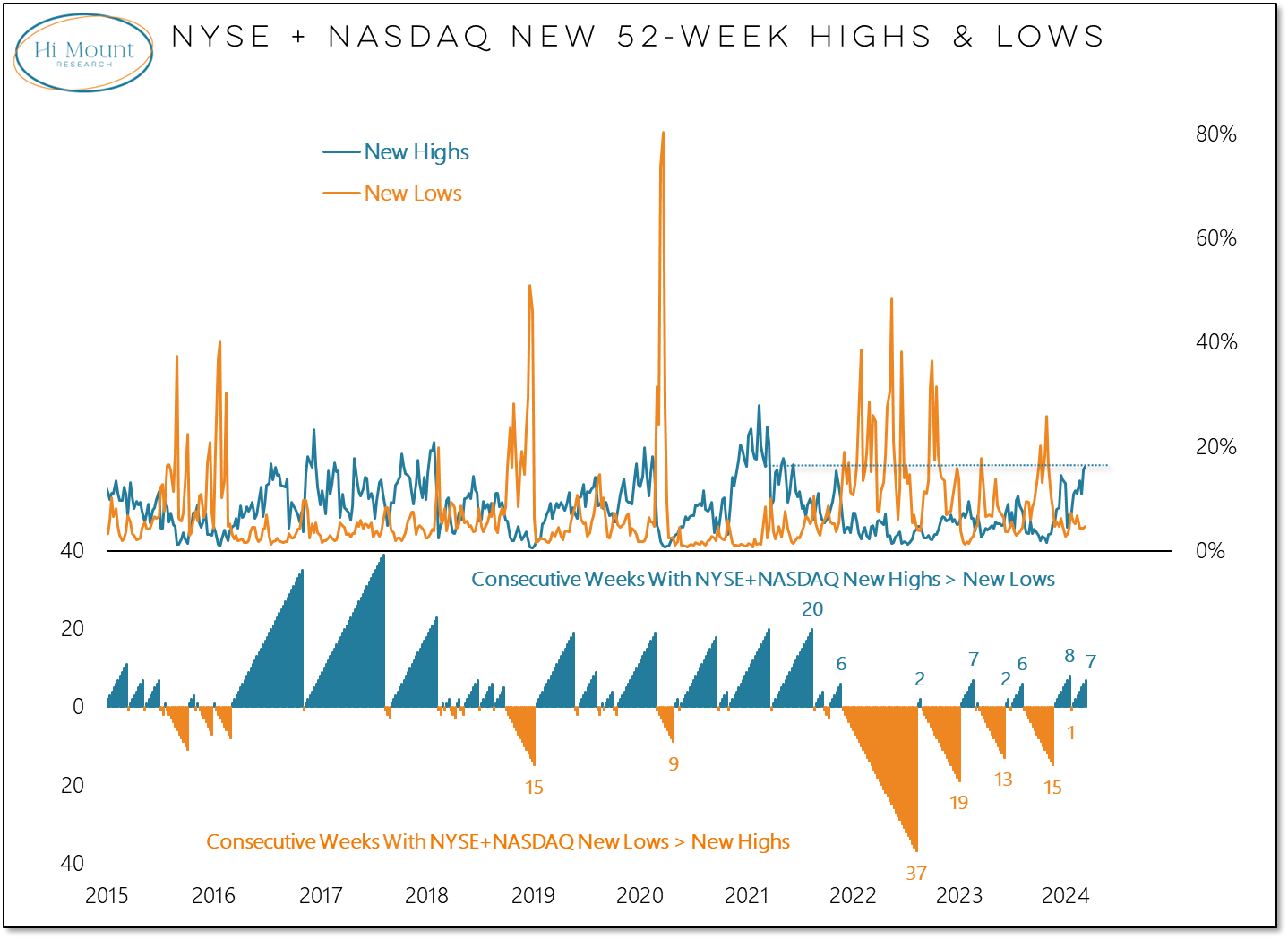

While the US was not on the new high list at the country-level last week, new highs within the US were plentiful. The number of stocks making new highs on the NYSE+NASDAQ reached its highest level since the summer of 2021.

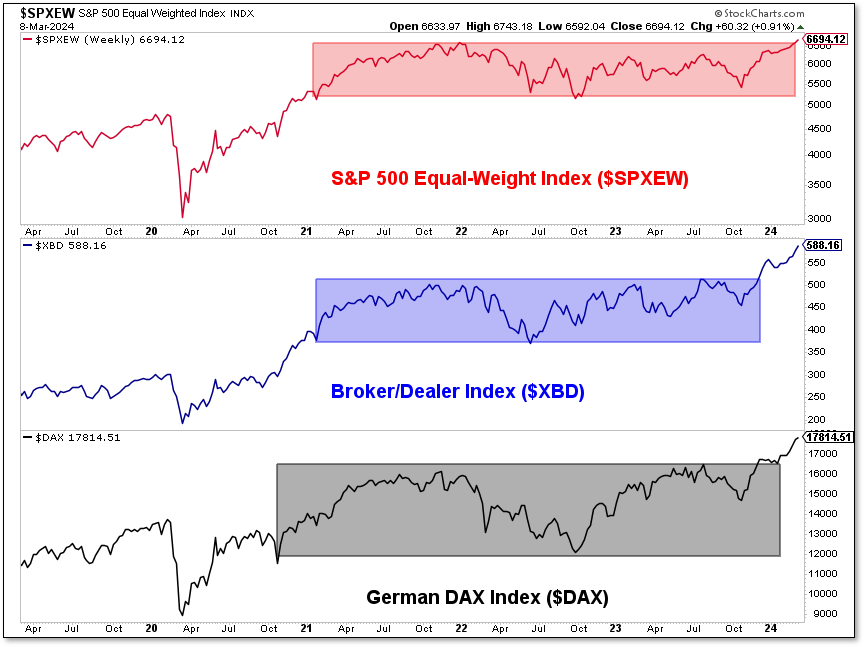

The S&P 500 Equal-Weight Index, Broker-Dealer Index and German DAX all finished last week at new all-time highs as multi-year consolidations move into the rearview mirror.

Paid subscribers can keep reading for the latest summary of our Fear or Strength model and Relative Strength Rankings.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.