Fed Pivot Fuels Broad Strength

Upside volume surges as net new highs reflect a change in character.

Key Takeaway: Collapsing bond yields on expectations of a Fed pivot provided a boost to stocks. Unlike previous rally attempts this cycle, what is happening beneath the surface may be even stronger than what is showing up in the headlines.

Two examples:

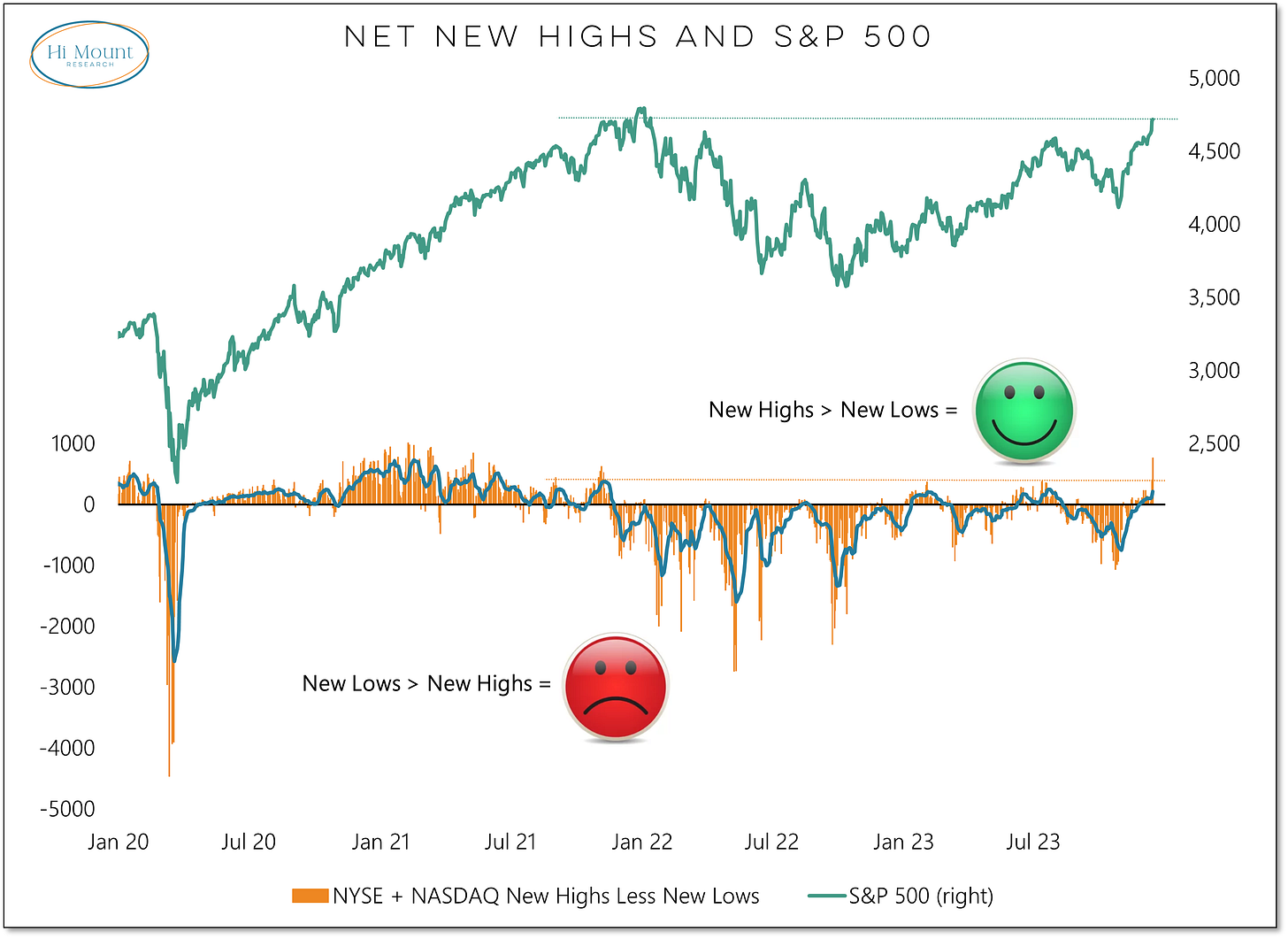

Net new highs (NYSE+NASDAQ) made brief forays into positive territory earlier this year, but this week’s expansion reflects the changing character of the rally. Net new highs not only exceeded their most recent peak, but yesterday reached their highest level since Q1 2021.

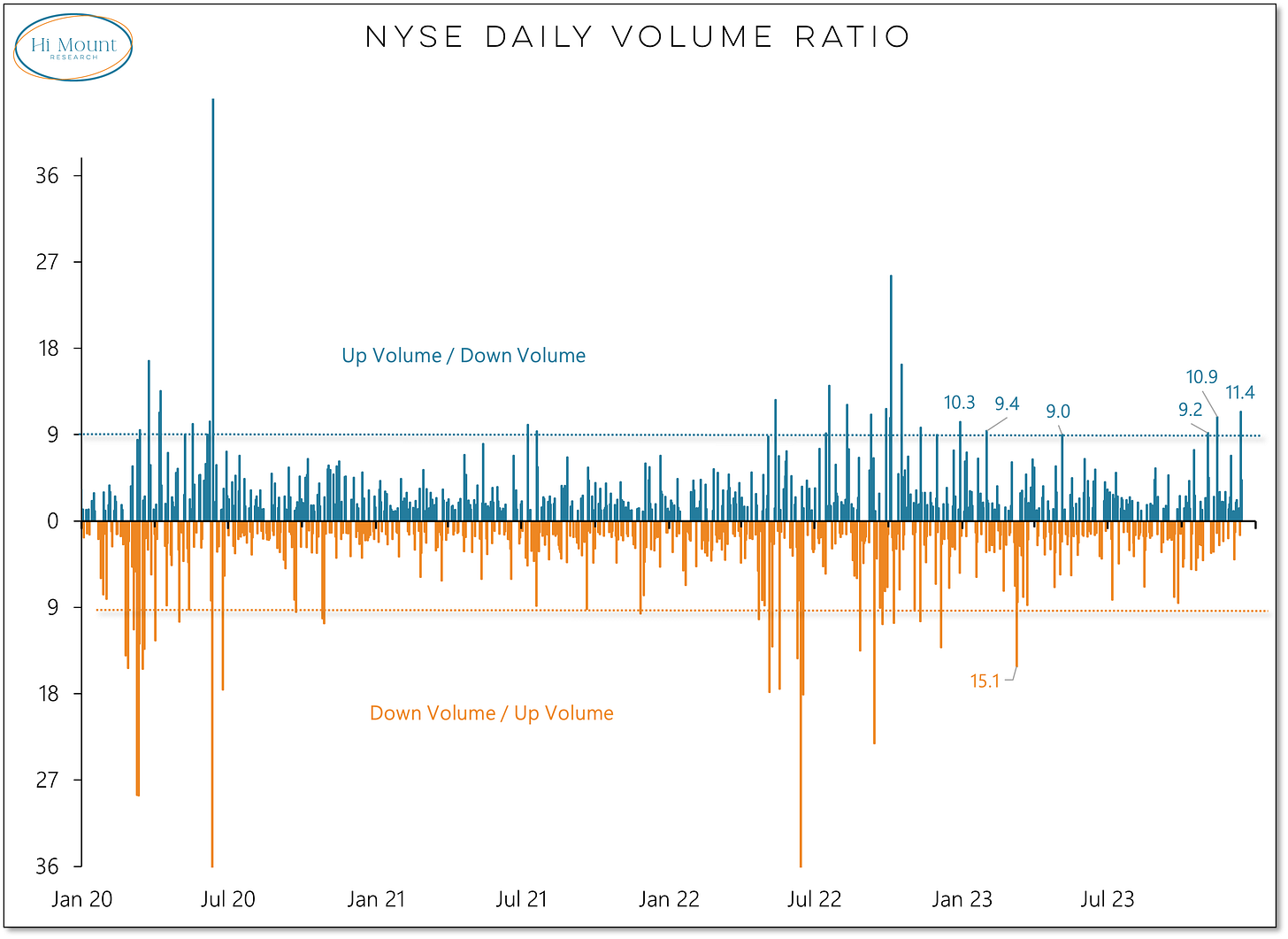

This week also produced the best upside/downside volume day on the NYSE in over a year and the third day of better than 9:1 upside volume since the beginning of November.

Would all this be better without the cover story of a Fed pivot? For sure. But it is strength nonetheless and indicates more robust participation than we have seen of late. As such, the bullish case deserves the benefit of the doubt.