Fed: Not Done But Taking A Breather

Economic growth is already sputtering as the Fed remains focused on its fight against inflation

Key Takeaway: The Fed used its June meeting to hit pause on the rate hike cycle, but signaled that two additional rate hikes in the second half of the year are likely.

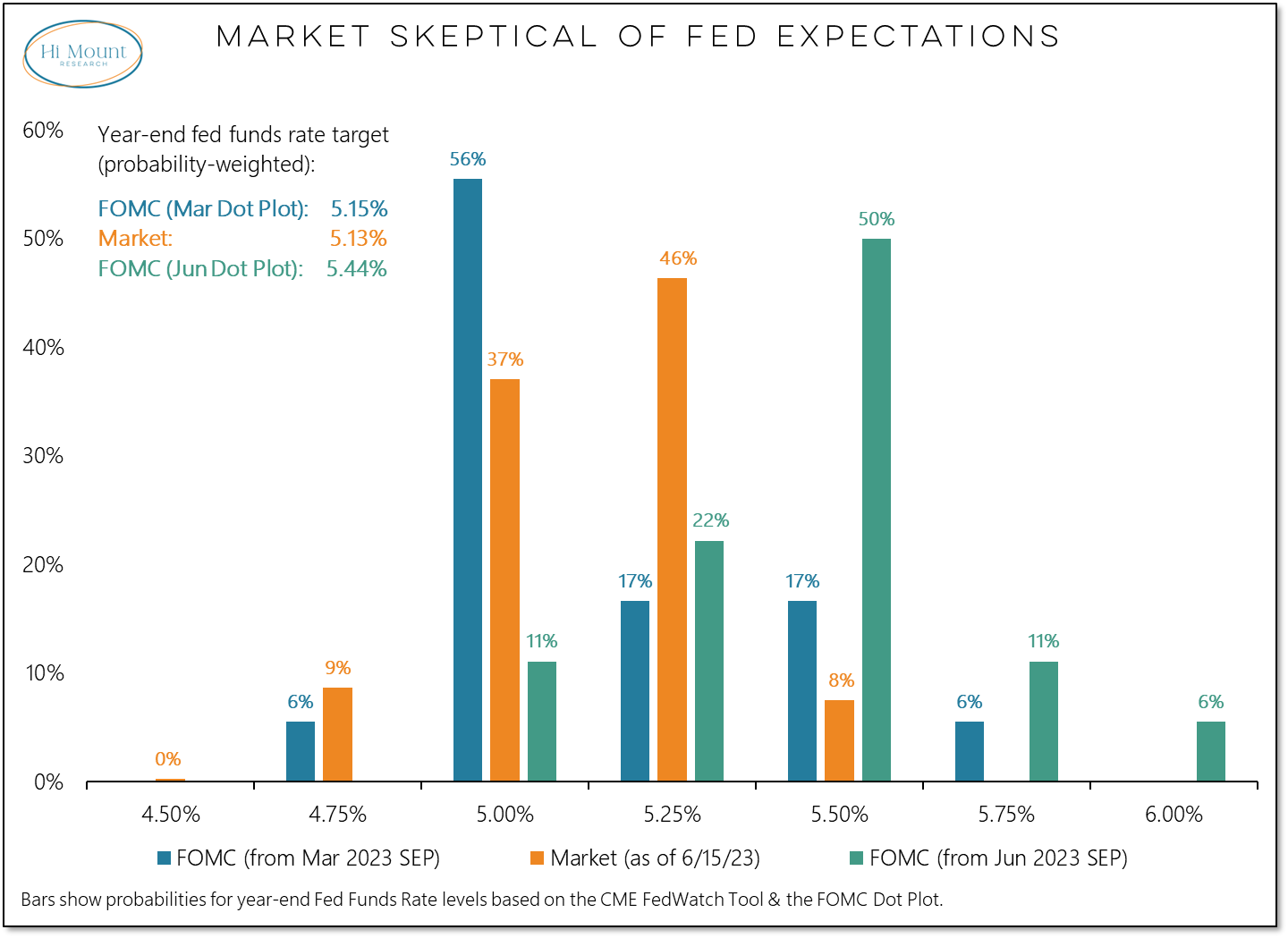

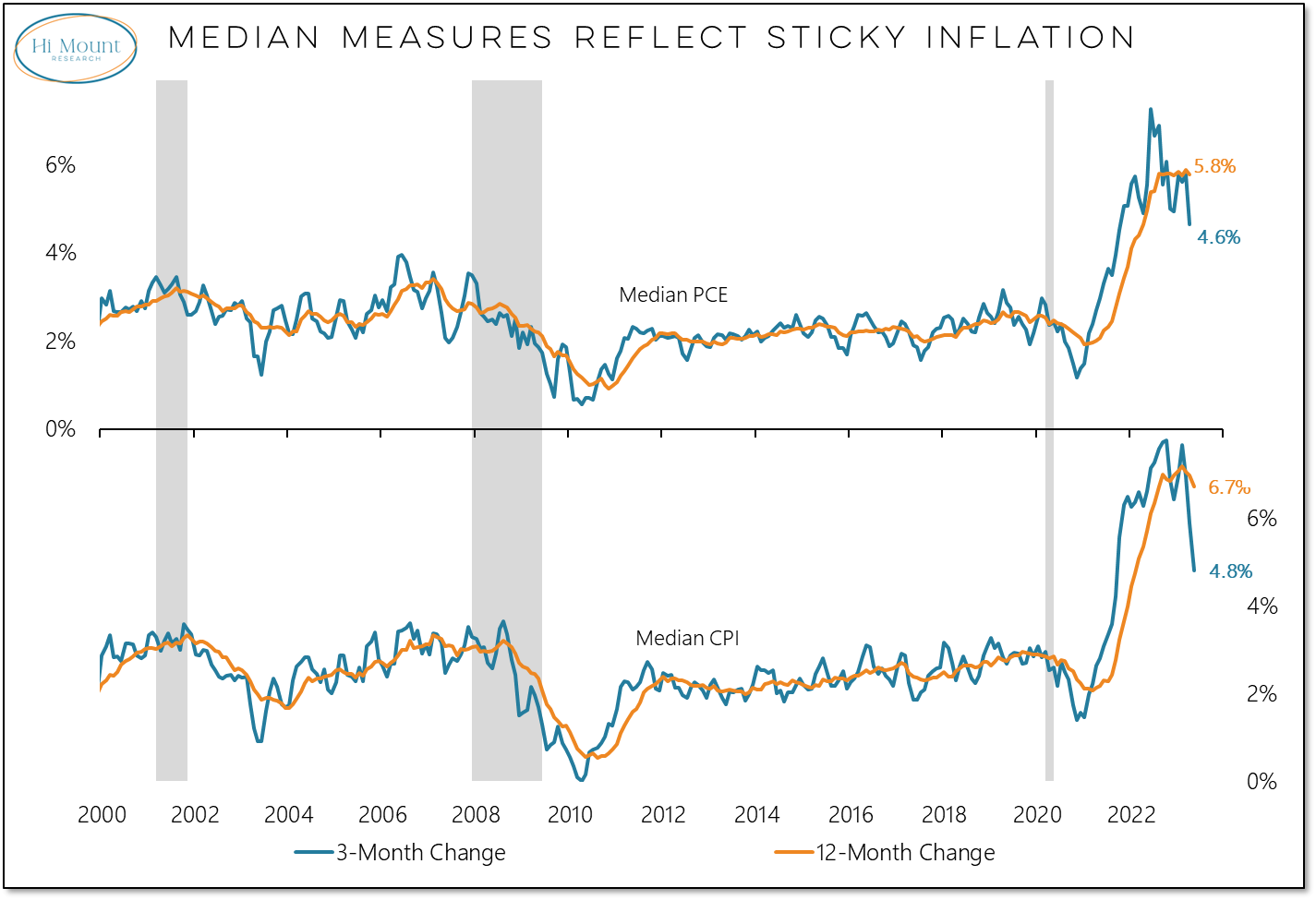

More Context: The market has caught up to where the Fed was in March when it comes to where rates will finish the year. But with inflation remaining persistent, the Fed has had to update its expectations. The latest dot plot shows a majority of FOMC members expect rates to be 50 basis points higher by year-end. While noisy headline inflation has eased substantially, median measures of inflation (which tend to be more stable) show that inflation remains uncomfortably high. The Fed got distracted by headline inflation when it cut rates in 2019 - it cannot afford to repeat that mistake again.

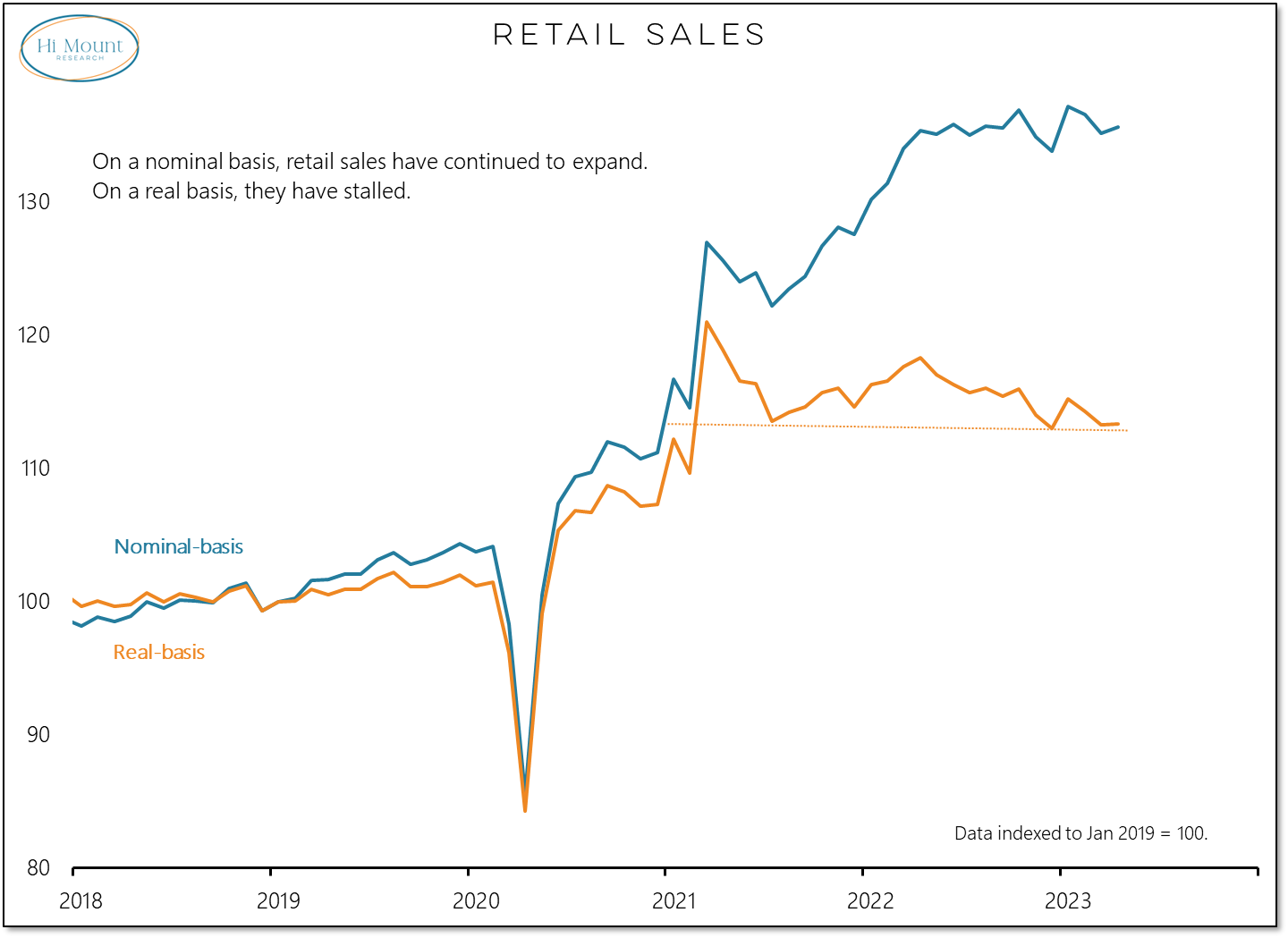

Higher Prices, Less Activity: While fighting inflation is the Fed's top priority, it becomes more challenging as economic conditions deteriorate. When the effects of inflation are stripped away, economic growth is stalling. Retail sales data shows that shoppers are spending more but not buying more. Adjusted for inflation, weekly paychecks have dropped back to pre-COVID levels.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.