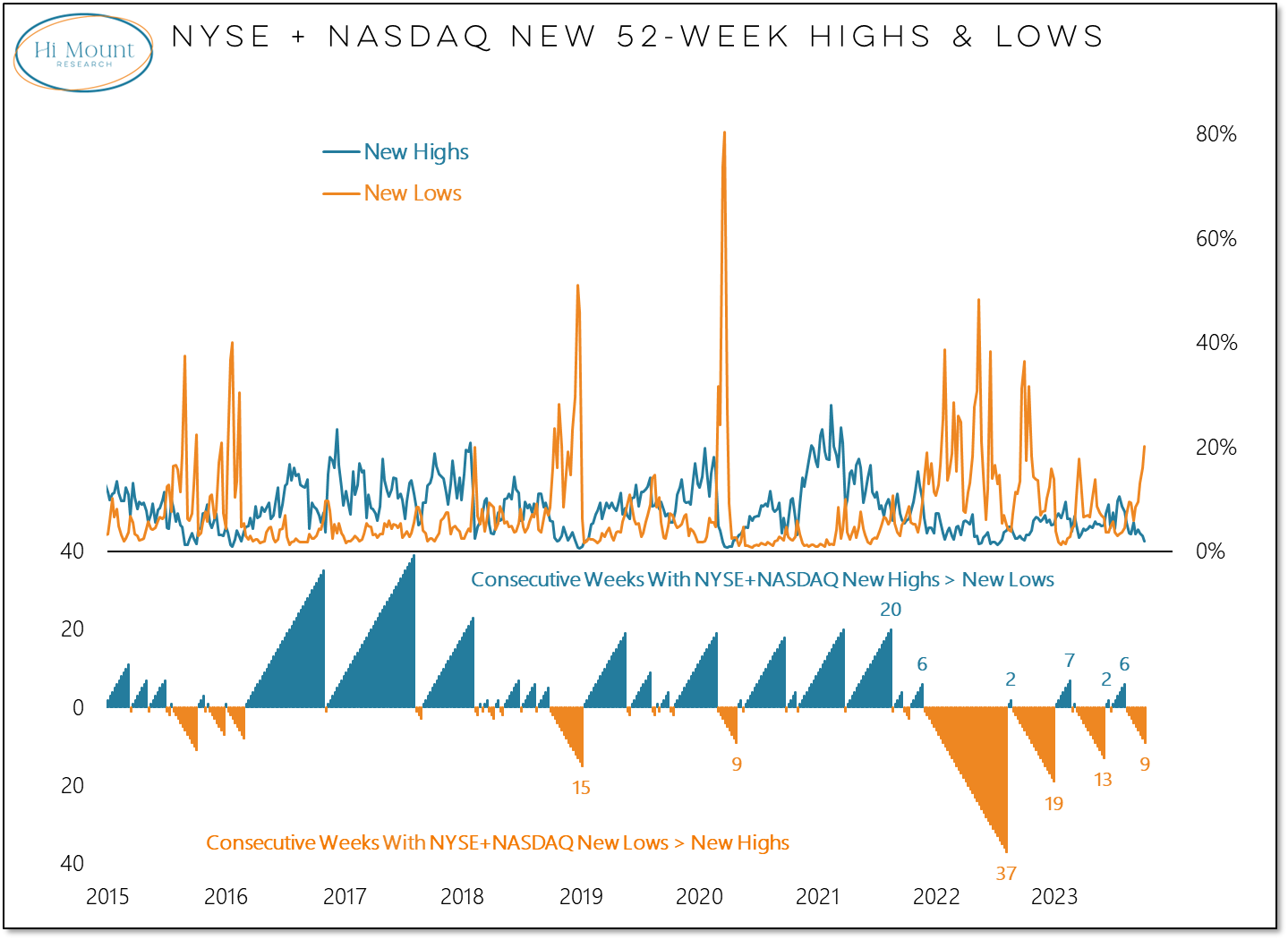

Key Takeaway: New lows have exceeded new highs for nine weeks and counting and the new low list continues to expand. New lows last week climbed to their highest level since the S&P 500 was bottoming in October 2022.

More context: History suggests it is hard for strength in the S&P 500 to be sustained when more stocks are making new lows than new highs. The index's current reliance on just a handful of stocks could challenge this patten, but from where I stand it is too early to declare that this time will turn out differently. Instead, my focus will remain on managing risk and not fighting the tape.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.