Expansion in New Lows Deflates Bull Market Narratives

It's a new month and there is no shutdown, but stocks are still struggling.

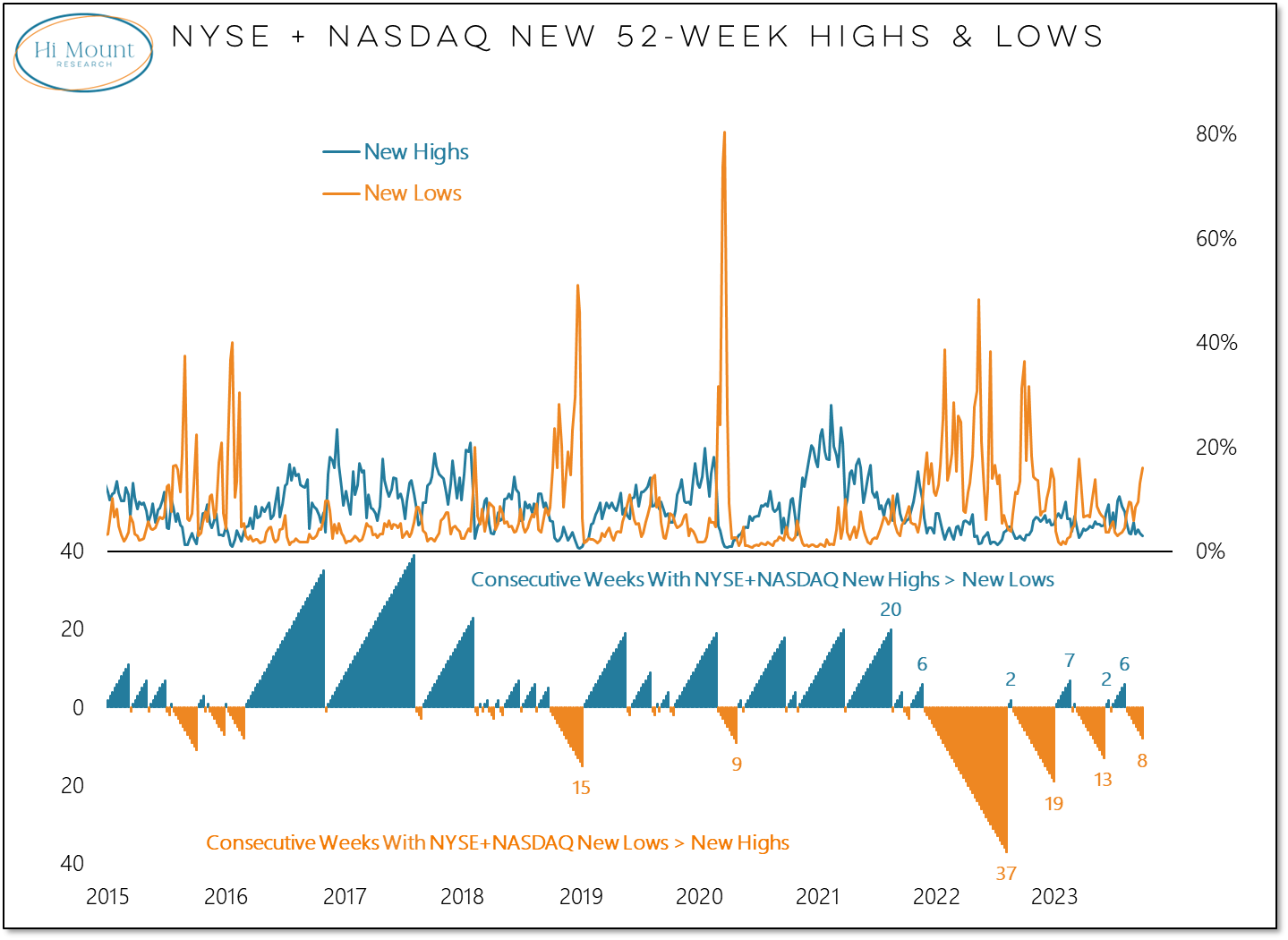

Key Takeaway: More new lows than new highs for weeks on end is not a pattern typically associated with bull markets. In both the US and around the world, new lists continue to expand. The absence of bull market behavior suggests a continuation of an elevated risk environment where return of capital trumps return on captial.

More Context: On the NYSE + NASDAQ, new lows have outpaced new highs for 8 weeks and counting. New highs continue to contract and new lows continue to expand. This behavior is at odds with hopes and claims that a new bull market has emerged, even as day-to-day and week-to-week volatility has subsided in 2023.

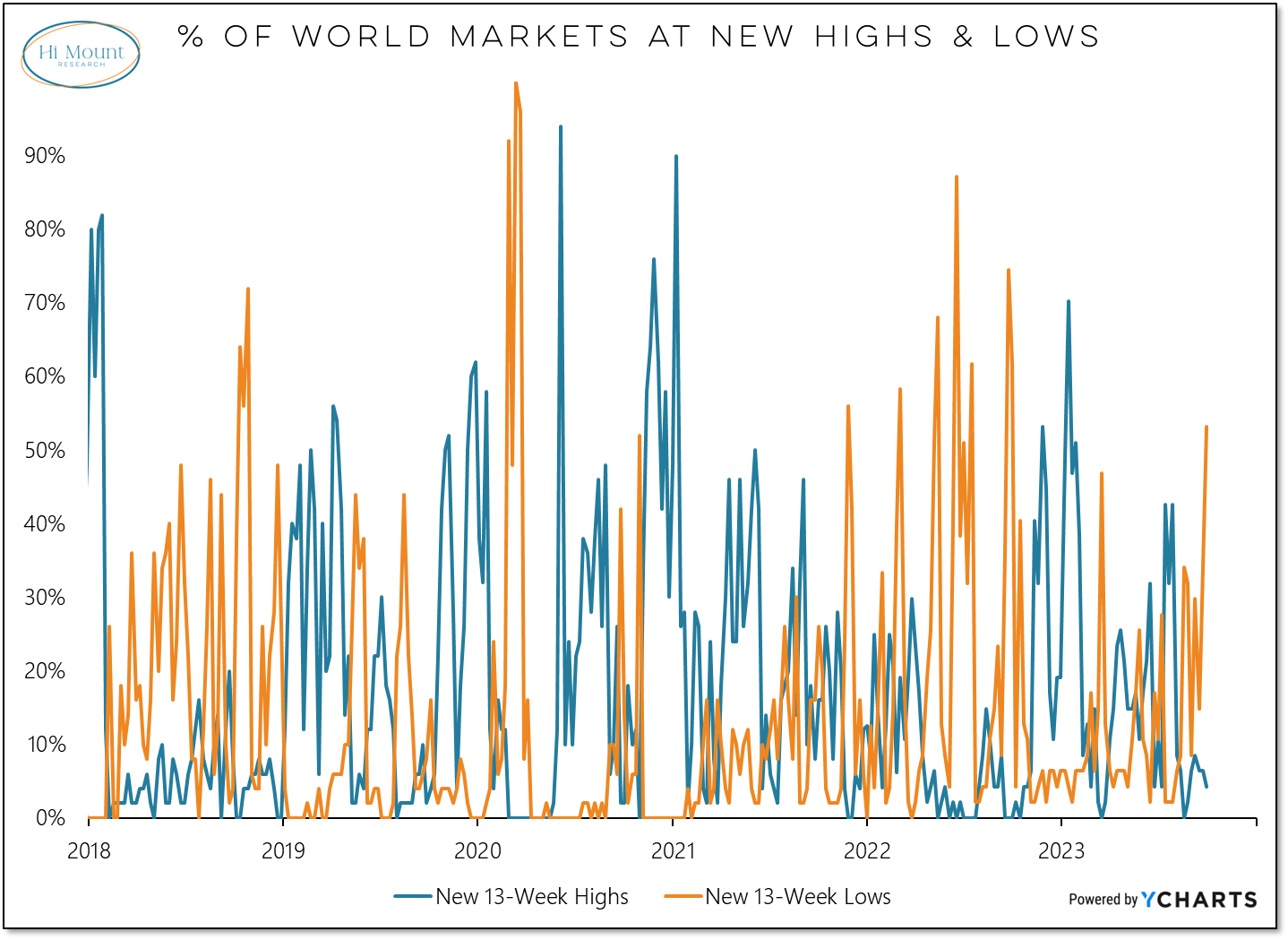

The prevalence of new lows is both deep and wide.

At the industry group level, the breadth improvement seen over the summer was short-lived and new 52-week lows are now as expansive as they have been all year.

The percentage of ACWI markets hitting new 13-week lows last week exceeded its early 2023 peak and is now at its highest level in over a year.

The expansion in new lows and the trend deterioration that has brought it about is resulting in a sea of red across our various relative strength rankings. Our rankings tables reflect relative leadership even as conditions weaken on an absolute basis. One exception to this are short-term bond funds which are seeing improving relative trends and are making news highs (e.g. BIL on our Macro ETF rankings).

Paid subscribers can keep reading and review the latest update to our various relative strength rankings.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.