Evaporating Optimism Allows Pessimism To Persist

Incomplete long-term turn in breadth and sentiment leave stocks vulnerable to more volatility

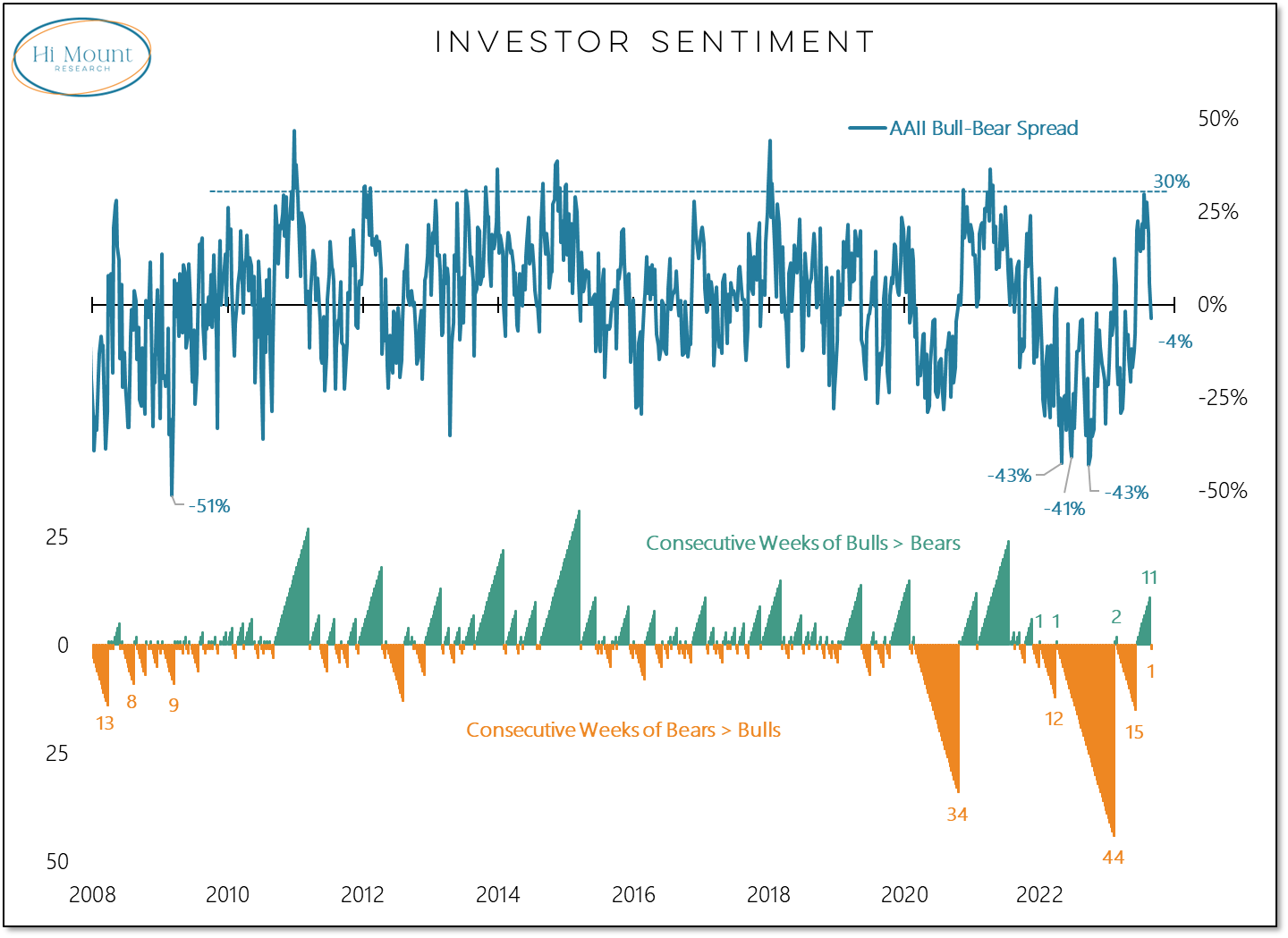

The crowd continues to retreat from excessive optimism. After the AAII bull-bear spread peaked at 30% in July, it has fallen in 4 of the past 5 weeks. This week's AAII surveyed showed more bears than bulls for the first time in 12 weeks.

Across our suite of sentiment surveys we are seeing a significant shift toward pessimism that reinforces (and is reinforced by) the challenging price and breadth action in recent weeks.

In our Three for Thursday video update (Sideways Action In An Environment For Not Losing Money) we zoom out for context. Stocks remain range bound while the longer-term breadth and sentiment improvements that could fuel further gains have stalled.

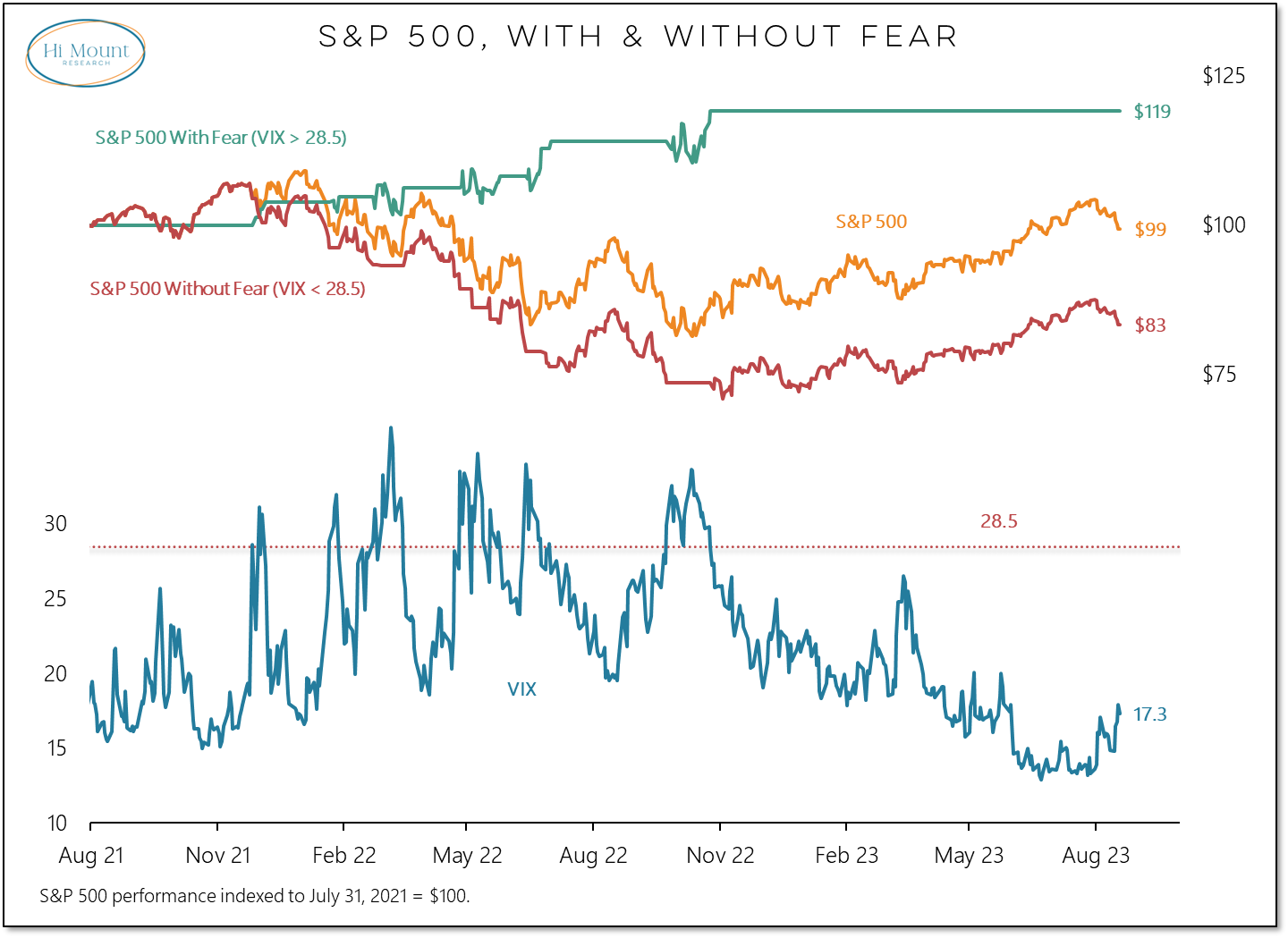

Since it's my birthday, I decided to share a bonus fourth chart in the video: From a short-term perspective, our VIX-based model suggests this is an environment where the focus should be on managing risk rather than pursuing opportunity.