Equity Market Trends: Bumpier But Not (Yet) Broken

The noisier it gets, the more important it is to tune out distractions

Portfolio Applications update: We have published updates to our Blue Heron Systematic Portfolios. On an asset allocation basis, our model has increased exposure to bonds, while from an equity sector perspective, exposure to Energy, Utilities and Real Estate has increased.

Our latest Relative Strength Rankings reflect a shift in leadership toward bonds and away from global equities. Summary tables for both the Blue Heron Models and the Relative Strength Rankings are available after the subscriber break below.

Bond yields are falling and stock market volatility has roared back to life. Equity investors generally prefer falling bond yields over rising bond yields, but quick moves in either direction can be disruptive. That appears to be the case right now.

If the yield on the 10-year T-Note can remain above 3.25%, the recent up-tick in stock market volatility probably fades quickly. The next step would be to rebuild risk appetite on the part of investors. After deteriorating for some time, our cross-asset risk appetite indicator moved in to Risk Off territory last week.

But not everything has broken down. We still have 10 of 11 sectors above their 200-day averages. The index tends to hold up well when that is the case.

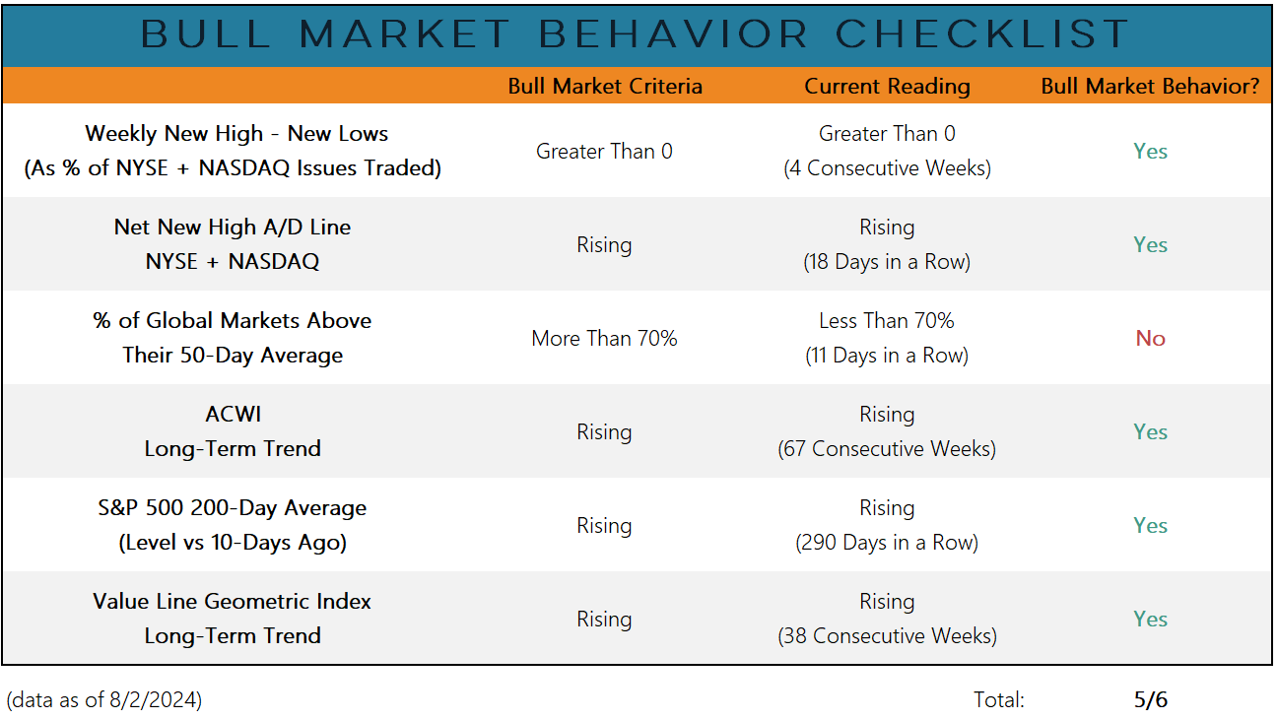

Our Bull Market Behavior Checklist remains at 5 out of 6 indicators remaining positive.

Given how stocks finished last week and are starting this week, this checklist is likely to show some deterioration the next time it is updated. From a tactical perspective, however, even if breadth fades, surging volatility could keep our Fear or Strength model positive.

Two longer trends to keep an eye on are the relationship between stocks and bonds and the relationship between long-term Treasuries and high-yield bonds.

Both are moving toward regime changes that could signal a more defensive posture from an asset allocation perspective:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.