Equities Have Been In Lead, But They Are Not The Only Source Of Strength

With trends rising, asset allocation shifts are about staying in harmony with relative leadership

Portfolio Update: we’ve updated our Blue Heron Portfolios. Portfolio Applications subscribers can download the report here or keep reading for a summary of the changes.

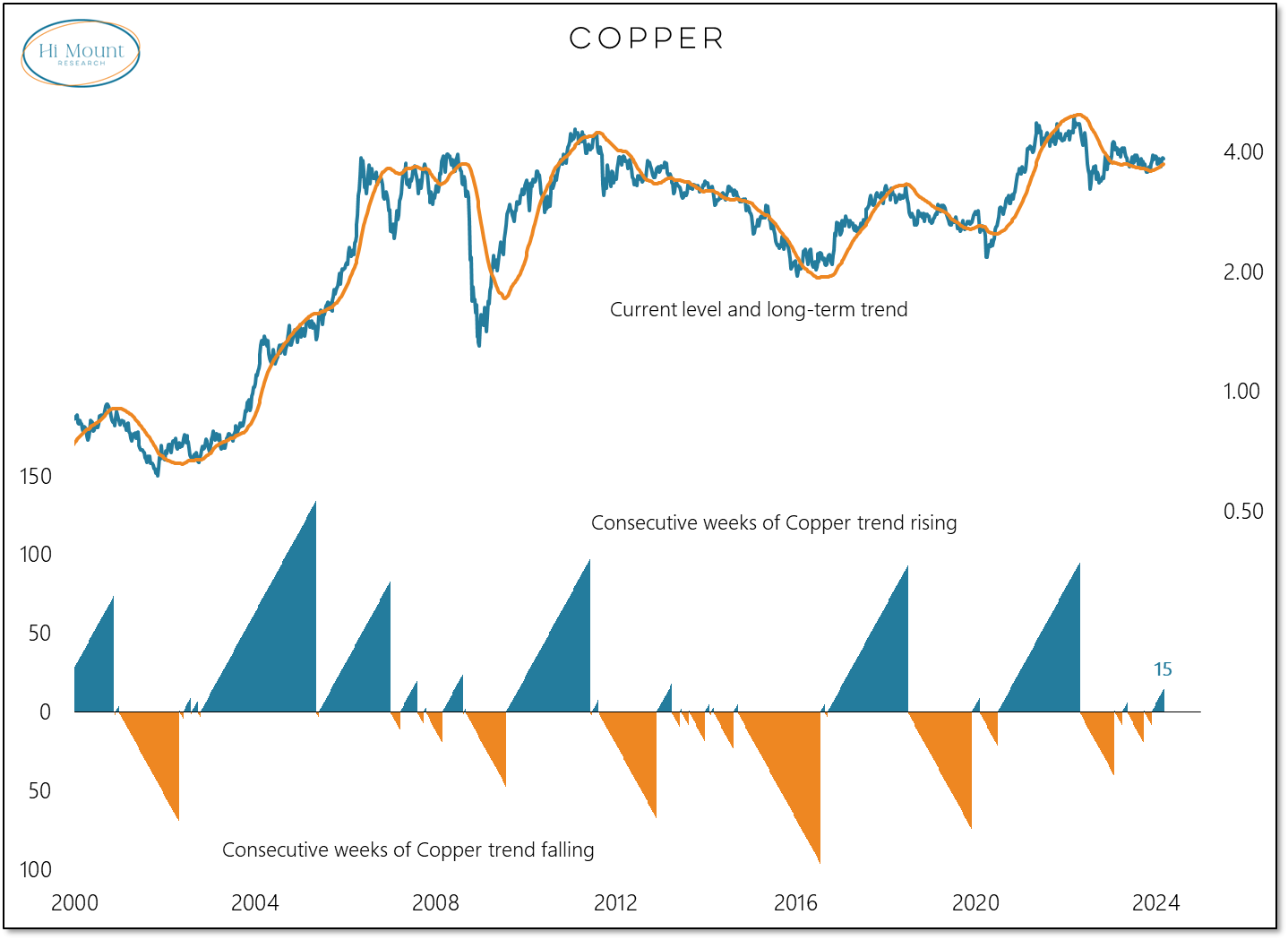

Key Takeaway: Copper has broken the downtrend off its 2022 peak. While it has yet to break above last summer’s highs, the trend is turning.

Zooming out, we can see that the longer-term trend for Copper has turned higher.

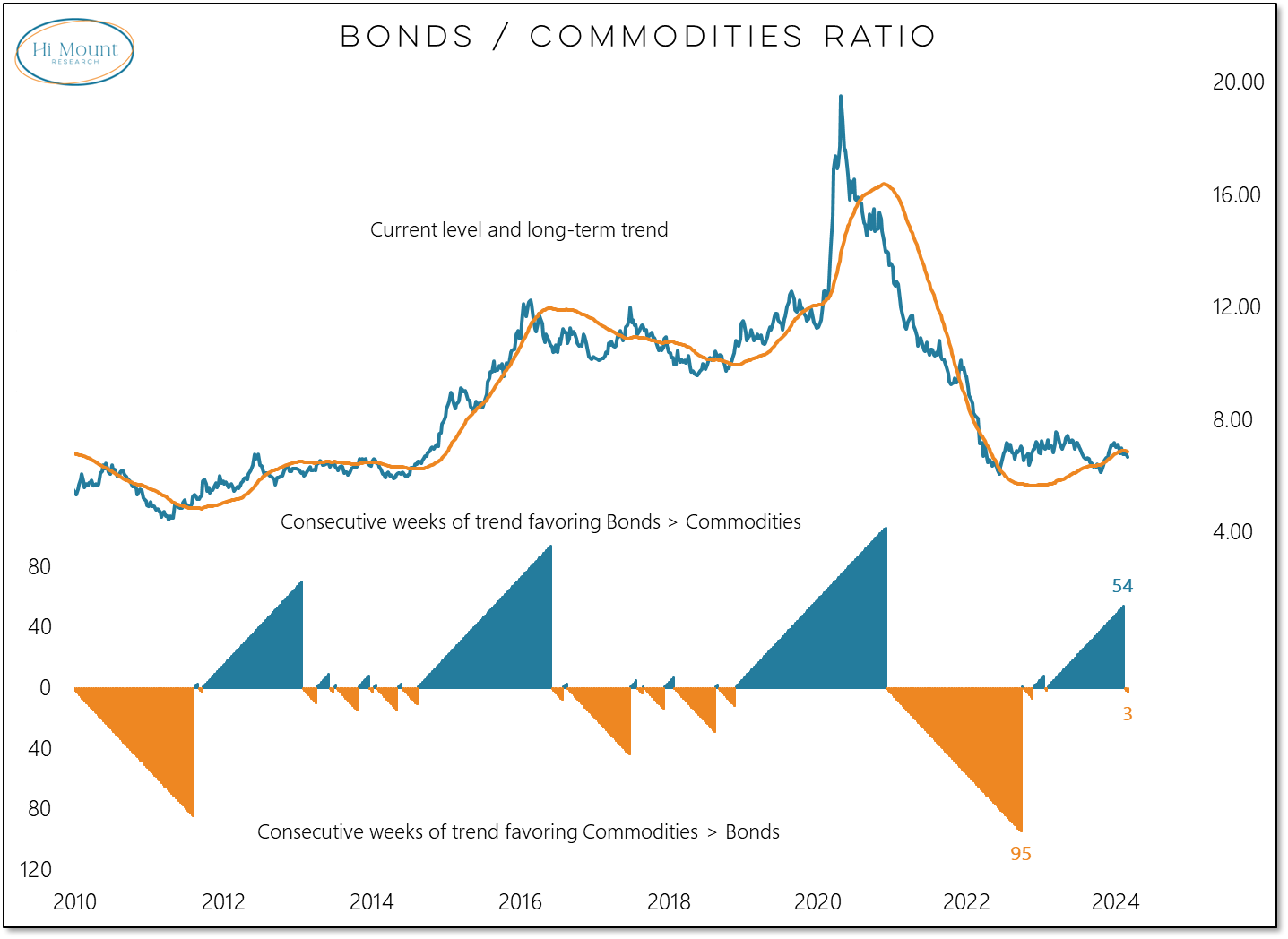

That has coincided with an improving trend in commodities overall - to the point now that commodities are trending higher relative to bonds.

Our asset allocation model, and our systematic ETF portfolio based on that model, have picked up on this shift.

Subscribers can keep reading for a summary of our Blue Heron composite model is positioned in this environment of widespread trend strength as well as our latest Macro ETF relative strength rankings.

We’ll take a closer look when we update the Bull Market Behavior Checklist later this week but for now remember that New Highs Are Bullish and Breadth Is Strong.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.