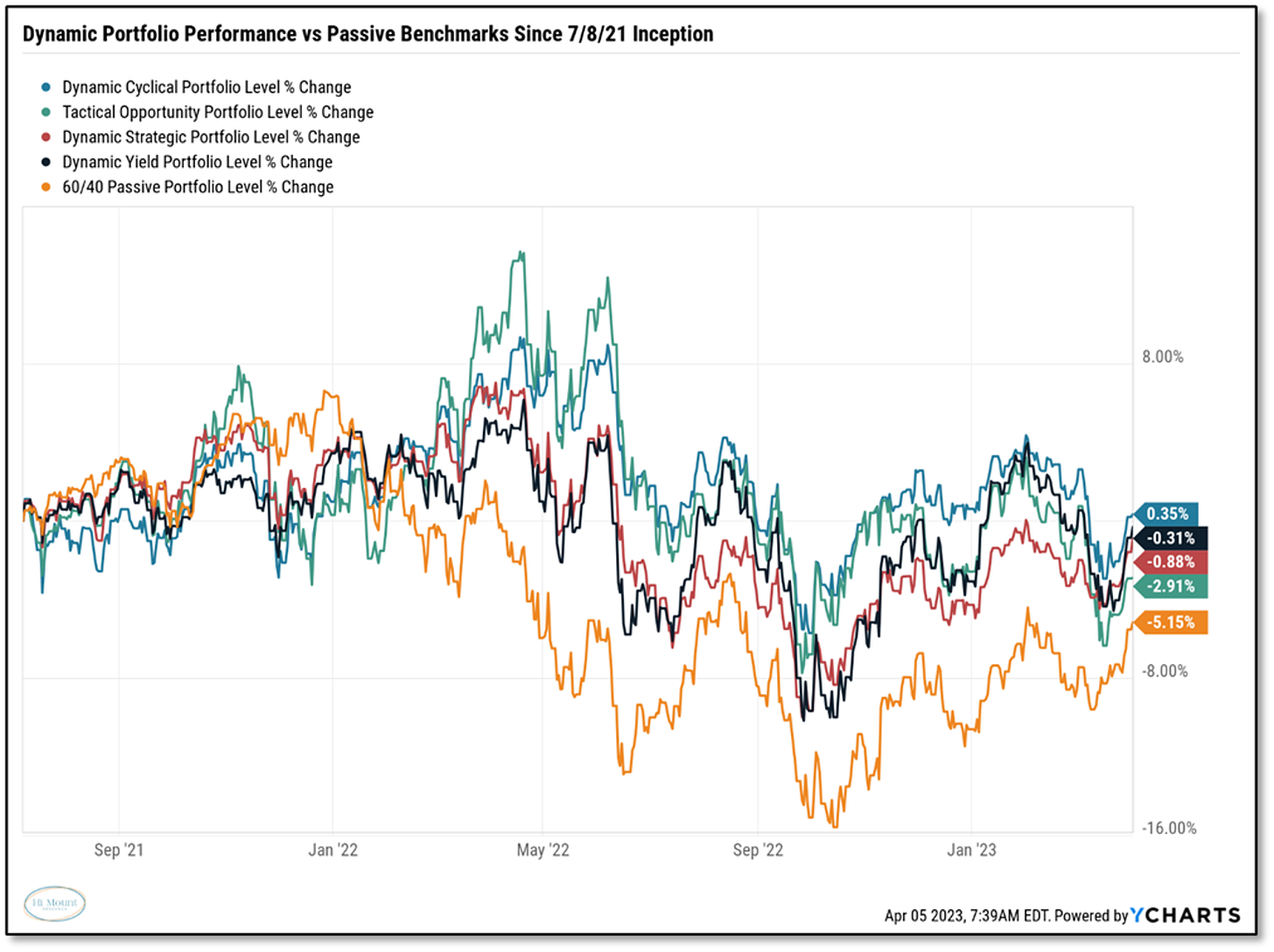

A few takeaways:

Dynamic Strategic - Overall equity exposure is unchanged, but is moving toward large-cap value in the US and toward Europe from a global perspective.

Dynamic Cyclical – Reducing equity exposure overall (consistent with a more cautious message from the weight of the evidence) and also tilting away from the US and toward the rest of the world.

Tactical Opportunity – Not putting cash to work but narrowing our focus and concentrating on areas that have been making higher highs (gold and semiconductors).

Dynamic Yield – Getting out of Real Estate and buying short-term Treasuries.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.