Downtrends Persist

Week-to-week volatility is rising, but price trends across asset classes are not

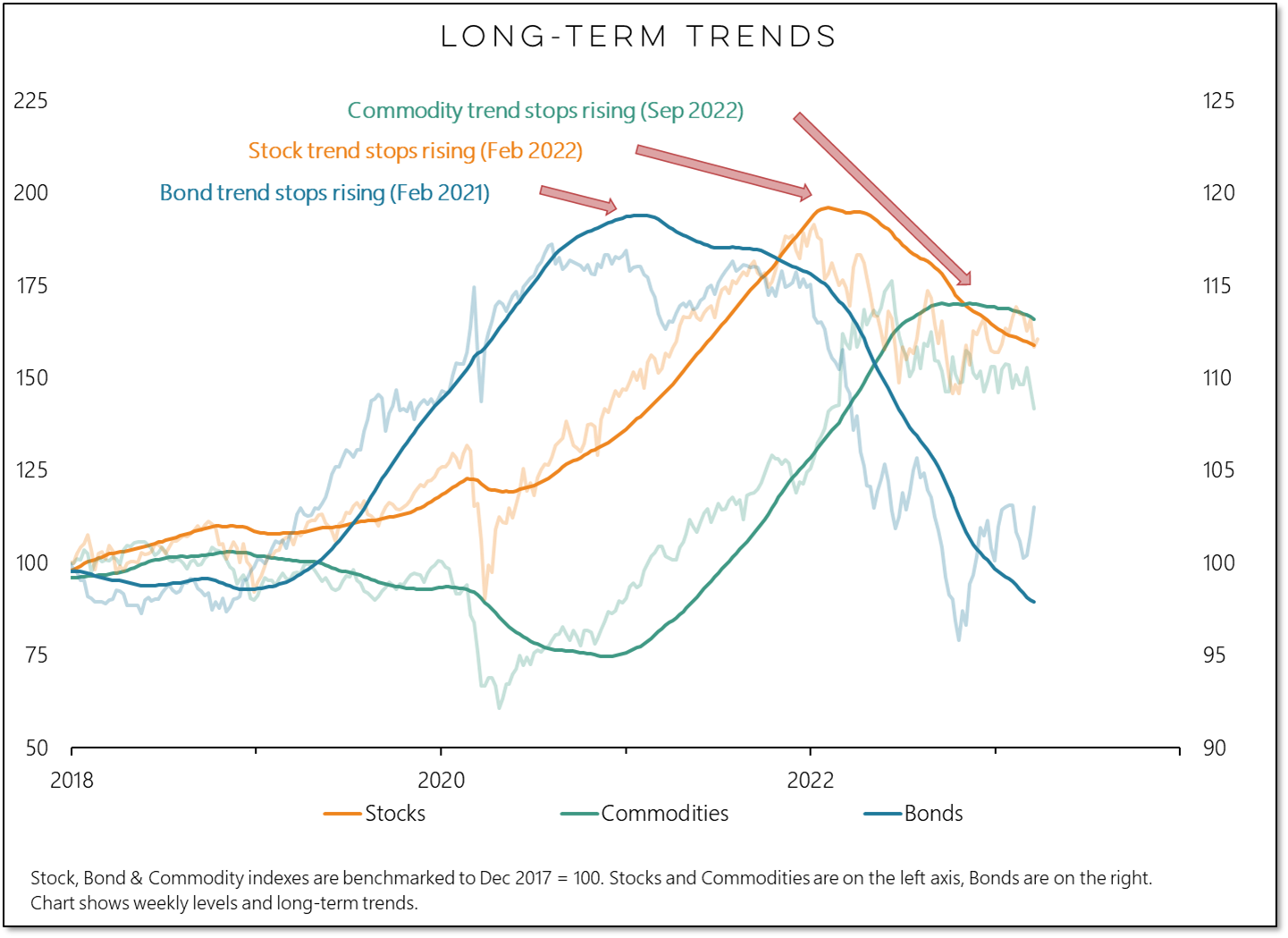

Commodities finished last week at new 52-week lows and the downtrend that emerged for that asset class in September 2022 remains intact. More surprising, and presenting more of a challenge for many investors, is that the downtrends in Bonds and Stocks also remain intact.

More Context: The technical conditions were in place for a new equity bull market earlier this year, but the ensuing behavior has not been consistent with sustained strength in stocks. Bonds appear close to breaking out, but at this point it is more about a partial unwind of the historic rise in yields over the past year than a turn in the longer-term trend. Short-term swings in the bond market appear overdone and there could be upward pressure on yields if the Fed pushes against market expectations for rate cuts in the second half of the year.

In our Market Notes we look more closely at equity market trends, how the Fed may approach this week’s FOMC meeting and where our indicators see relative strength across asset classes.

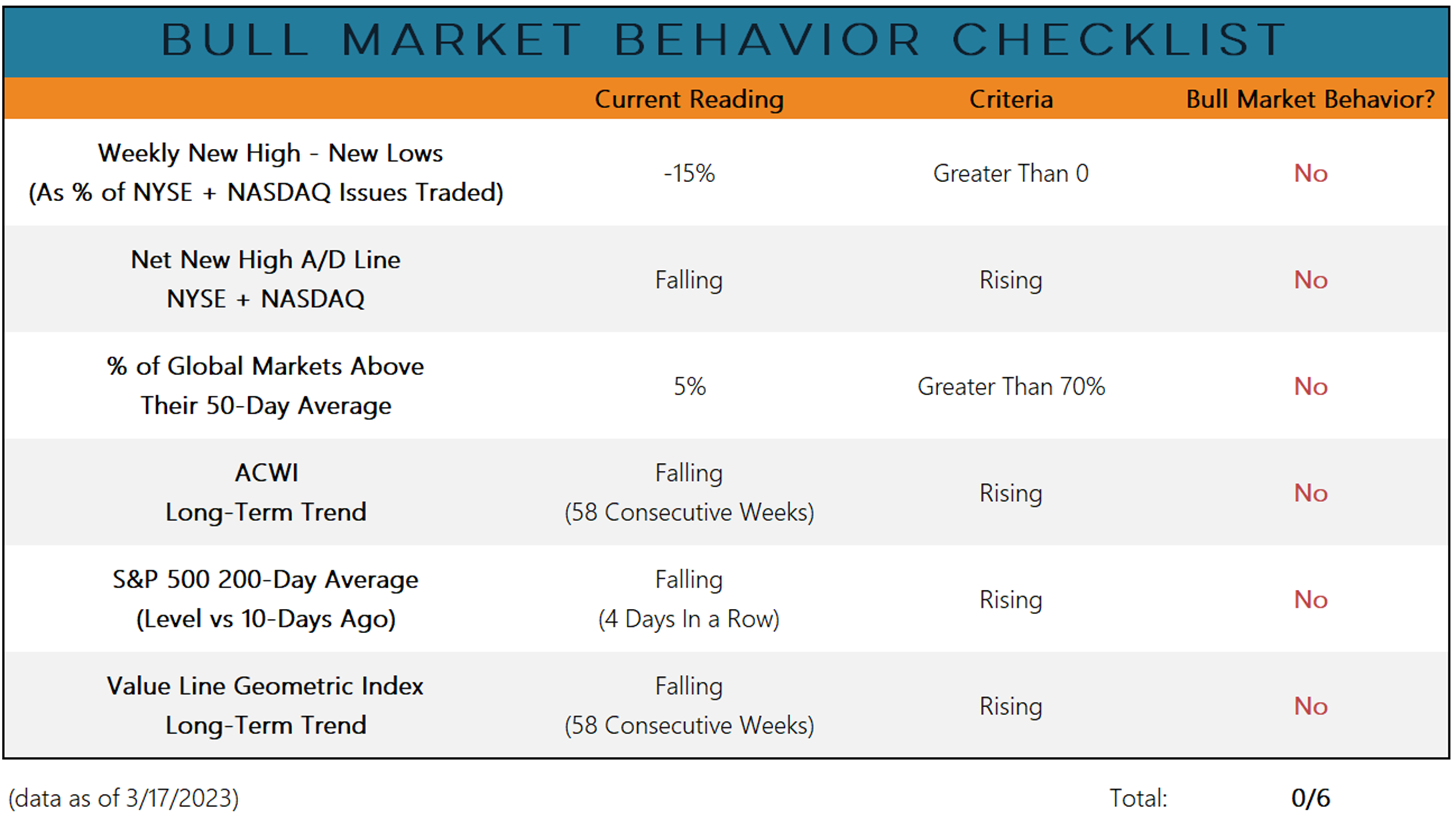

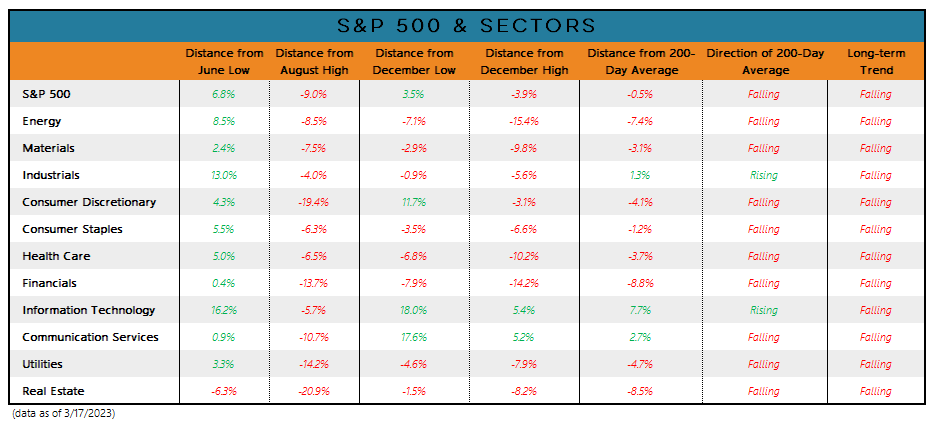

The 200-day average for the S&P 500 has renewed its decline as global breadth continues to deteriorate. In the US and around the world, long-term equity market trends are mostly lower. We are not seeing bull market behavior.

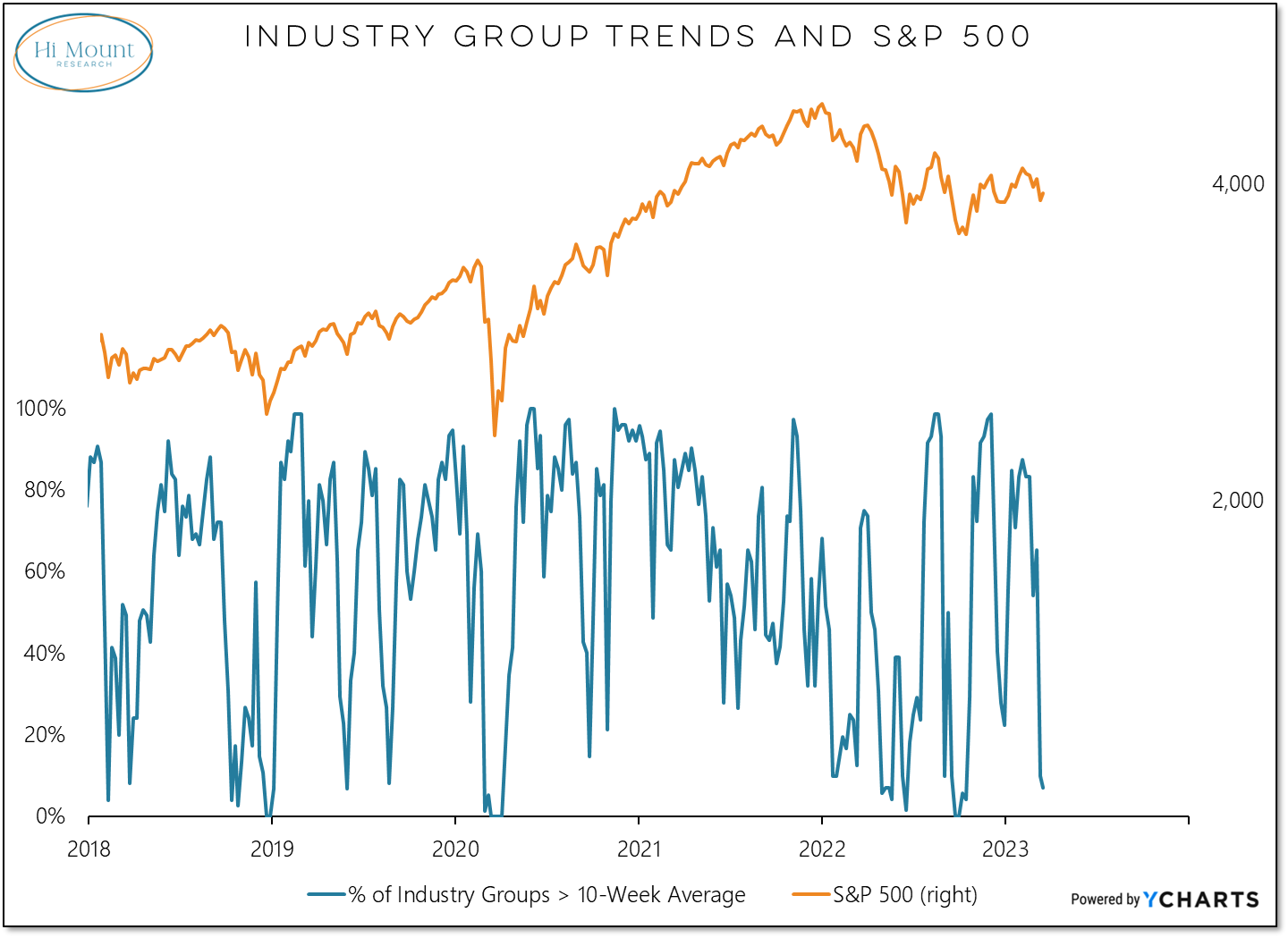

In the US, the rally off of the Q4 lows was fueled by improving conditions beneath the surface. That has now reversed. The percentage of industry groups above their 10-week average has made a lower high and a lower low and this week dropped to its lowest level since October.

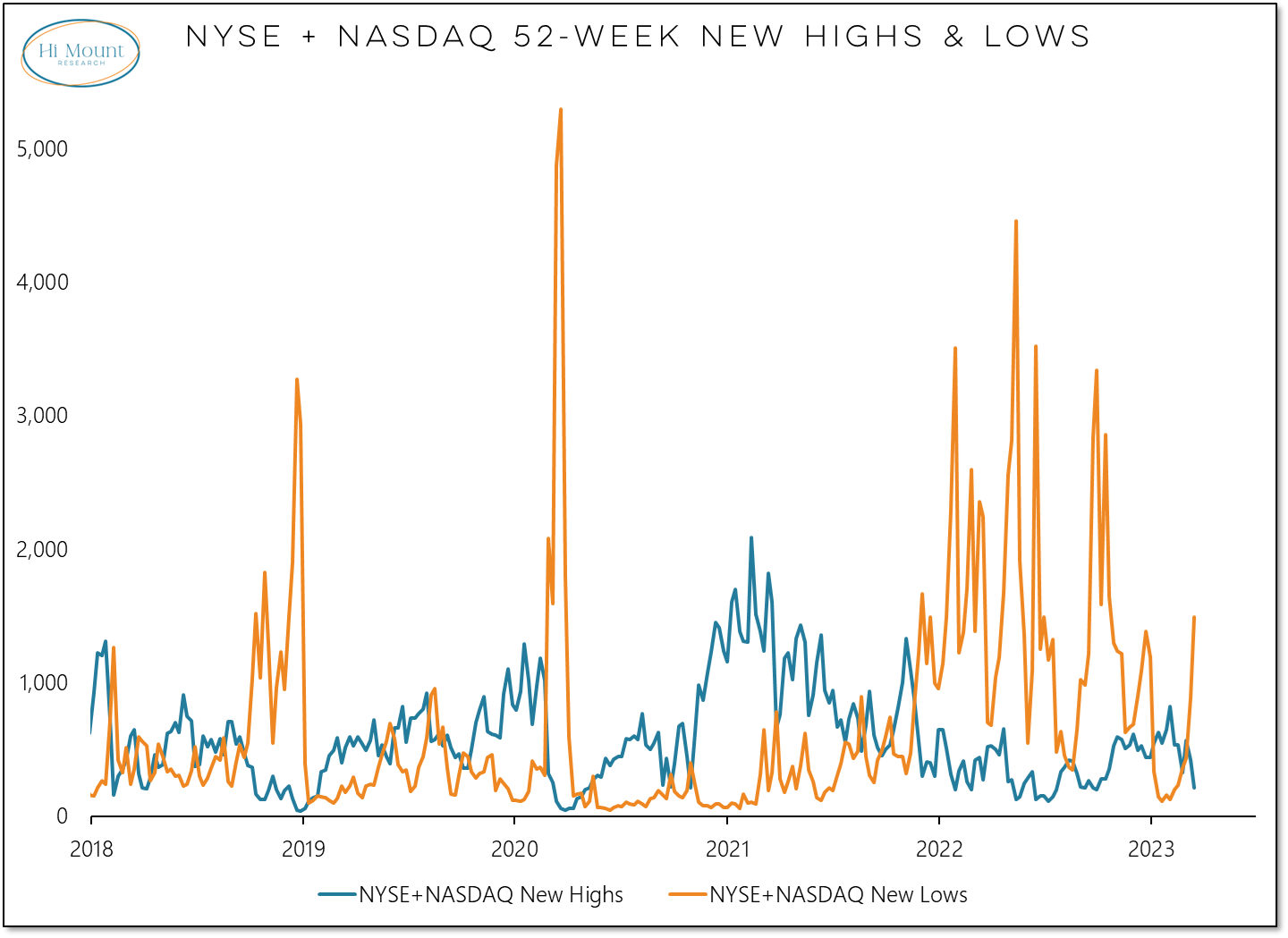

Bear markets end when new lows collapse and new highs expand. We saw new lows collapse earlier this year, but new highs never did take off. Now we see highs collapsing and lows surging.

Prior to February, it had been a long time since the Fed raised rates when the 2-year Treasury yield was below the Fed Funds rate. The market briefly embraced a continuation of the tightening cycle, but after the events of the past two weeks, it’s message to the Fed is to stop raising rates.

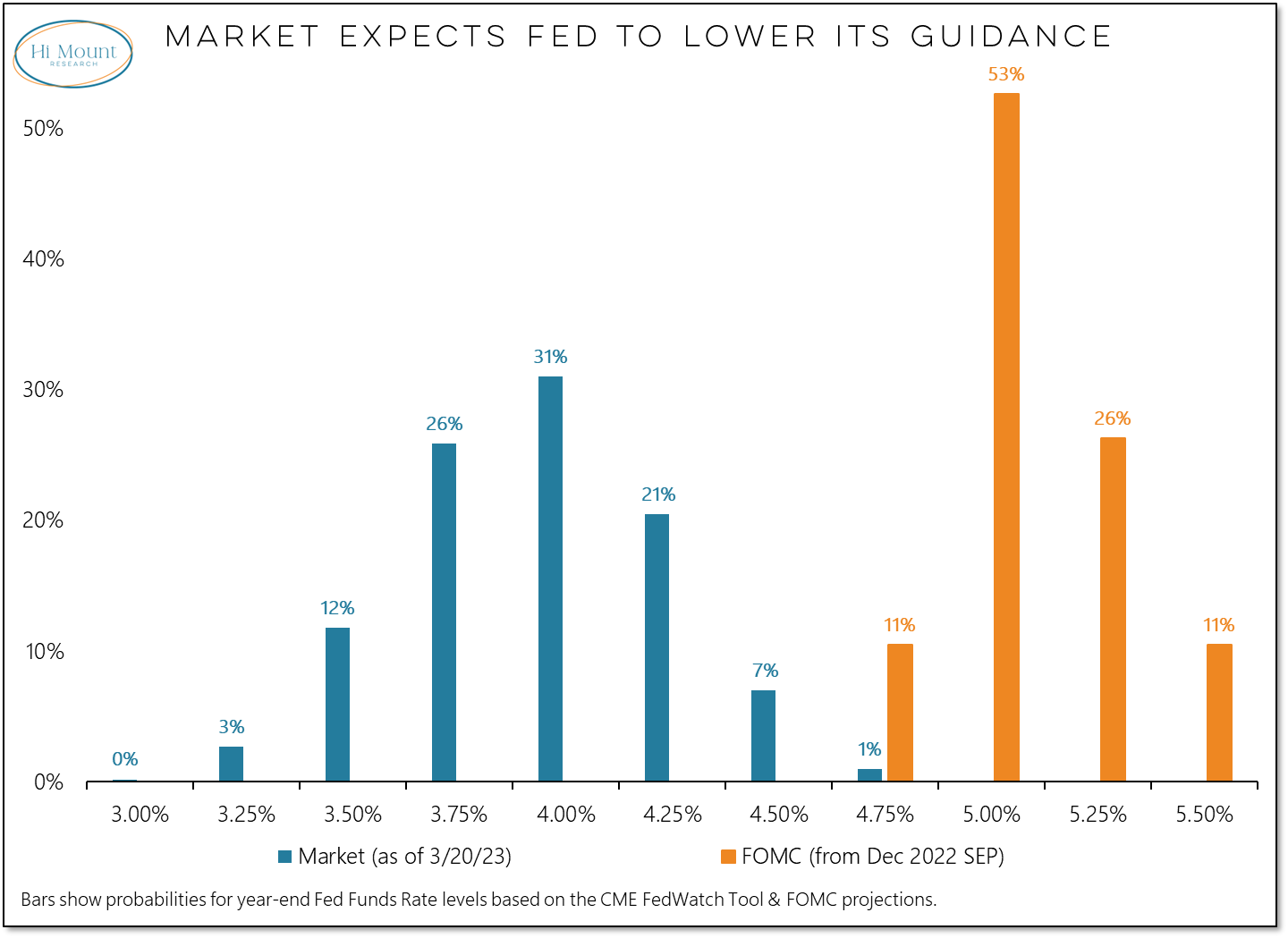

I expect the Fed will go ahead with a 25 basis point rate hike this week, but the more interesting (and impactful) news may be what the updated projections suggest about the path of rates going forward. As of December, a majority of FOMC members expected the Fed Funds Rate to be at 5% by the end of the year. The market is currently pricing in a 4% year-end fed funds rate.

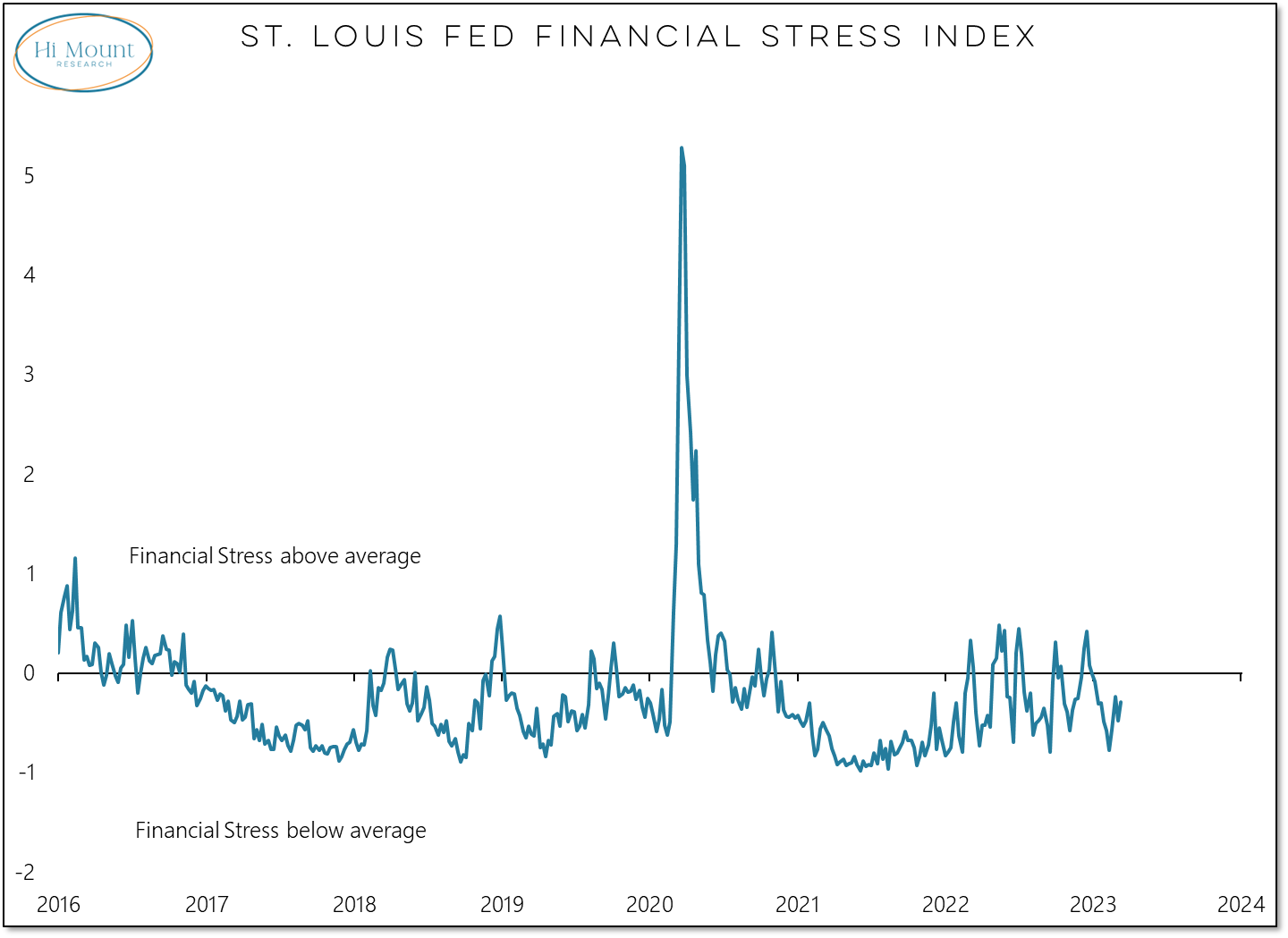

Pockets of financial stress have emerged, but overall there is little evidence of broader stress. That may lead the Fed to believe that it can (and should) continue to push a hawkish message on rates.

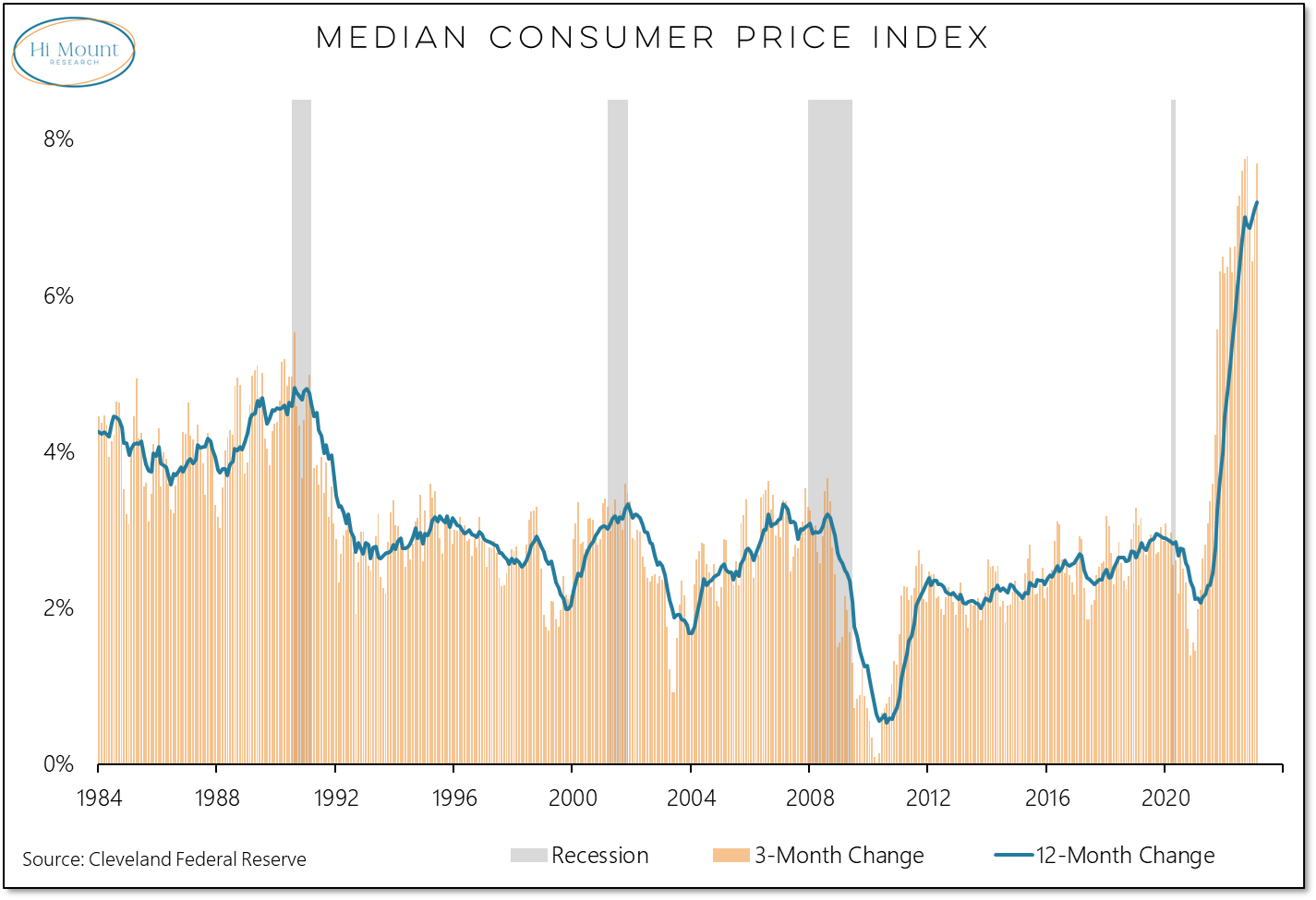

The inflation data suggests that further rate hikes are warranted. The yearly change in the median CPI just hit a new high and there is evidence that price pressures are re-accelerating.

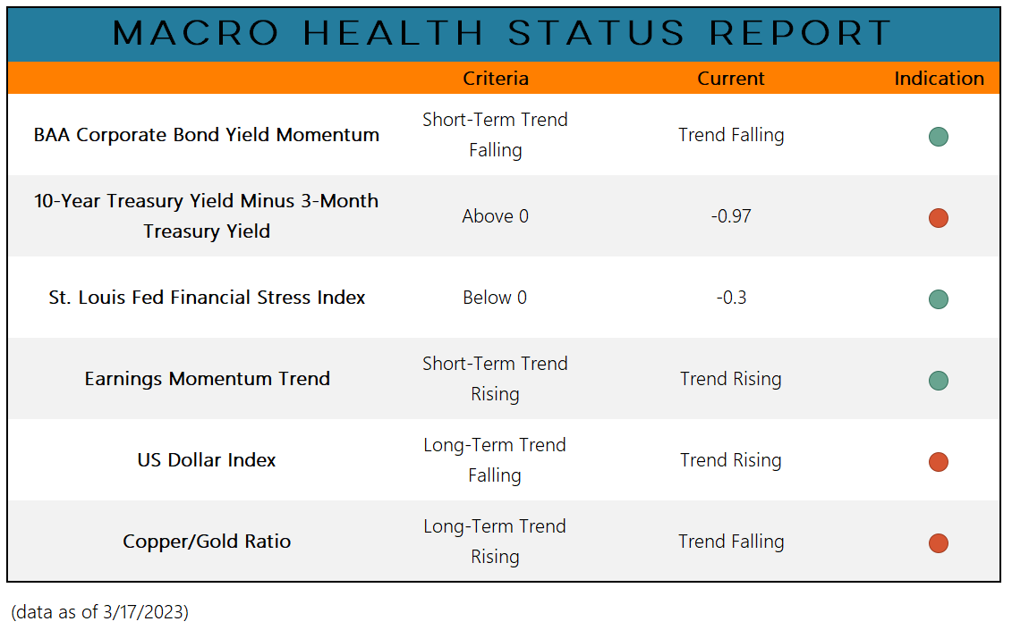

If the Fed sees the macro issues of the past two weeks as either isolated or contained, it is unlikely to pivot in terms of action or message. Our macro health status report remains mixed but does not show a broad deterioration in conditions. The Fed may be wise to buy some time, but changing its heading may be premature.

Challenges persist for US equities. Neither the S&P 500 nor any of the sectors have long-term trends that are rising. Only three sectors have managed to hold above their December lows. That the S&P 500 has done so is a mild encouragement.

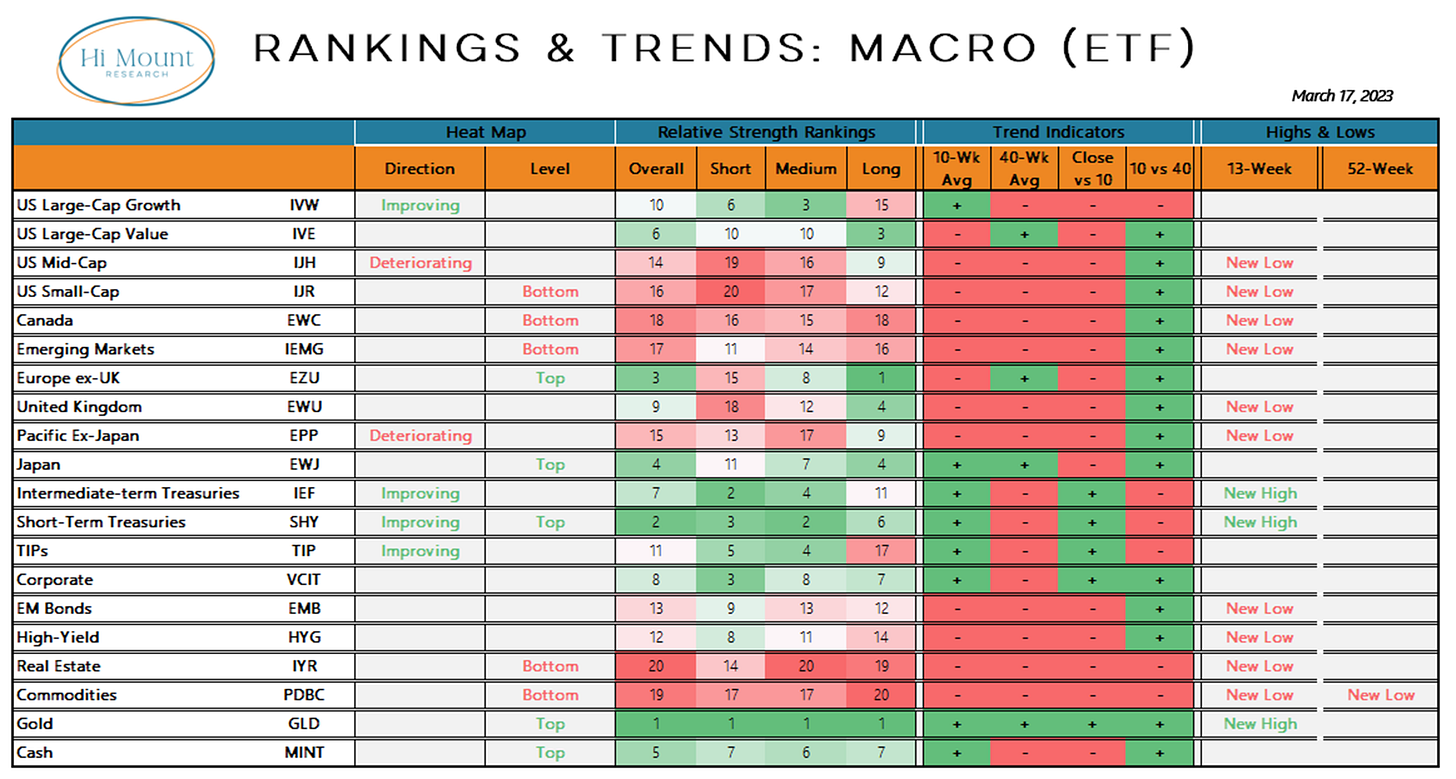

The global macro relative strength rankings show leadership from European and Japanese equities, short-term bonds, cash and gold. The current environment is more about maintaining flexibility and preserving capital than it is about embracing risk.

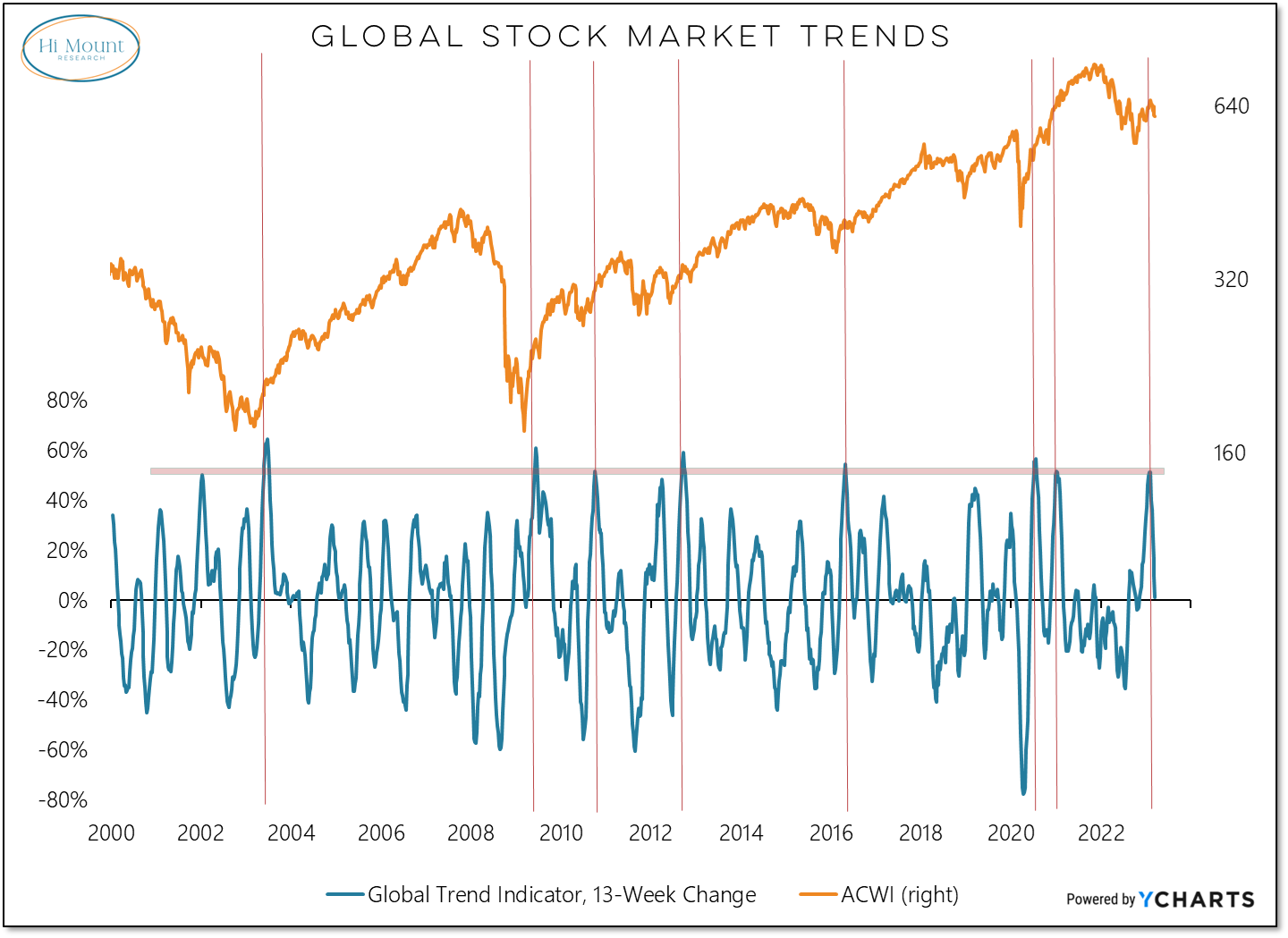

From a longer-term perspective, we are seeing consolidation in the global trend strength that emerged last year. This is consistent with the pattern that was seen coming off of the 2016, 2018 and 2020 lows. Zooming out, the degree of improvement (13-week change > 50%) was consistent with other periods in which consolidation ultimately resolved higher.