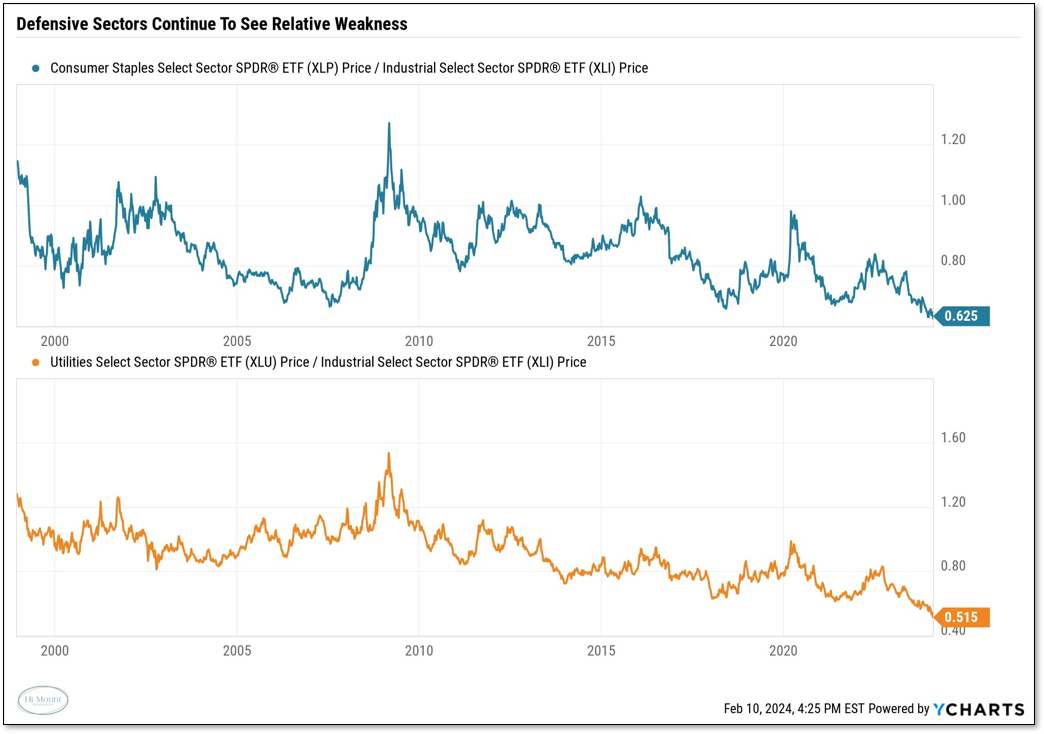

Defensive Downtrends Are Hard To Break

Relative weakness from Staples and Utilities is not just a Tech-related theme and China's struggles mask opportunities elsewhere among Emerging Markets

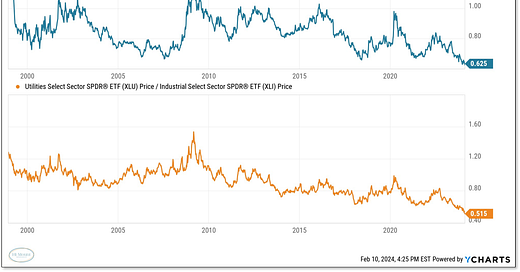

What: Consumer Staples and Utilities are mired near the bottom of our Relative Strength Rankings. Their relative price downtrends versus the rest of the market is not just a function of Tech (and Tech-adjacent) leadership. Both sectors (Utilities and Consumer Staples) made new multi-year lows last week versus Industrials.

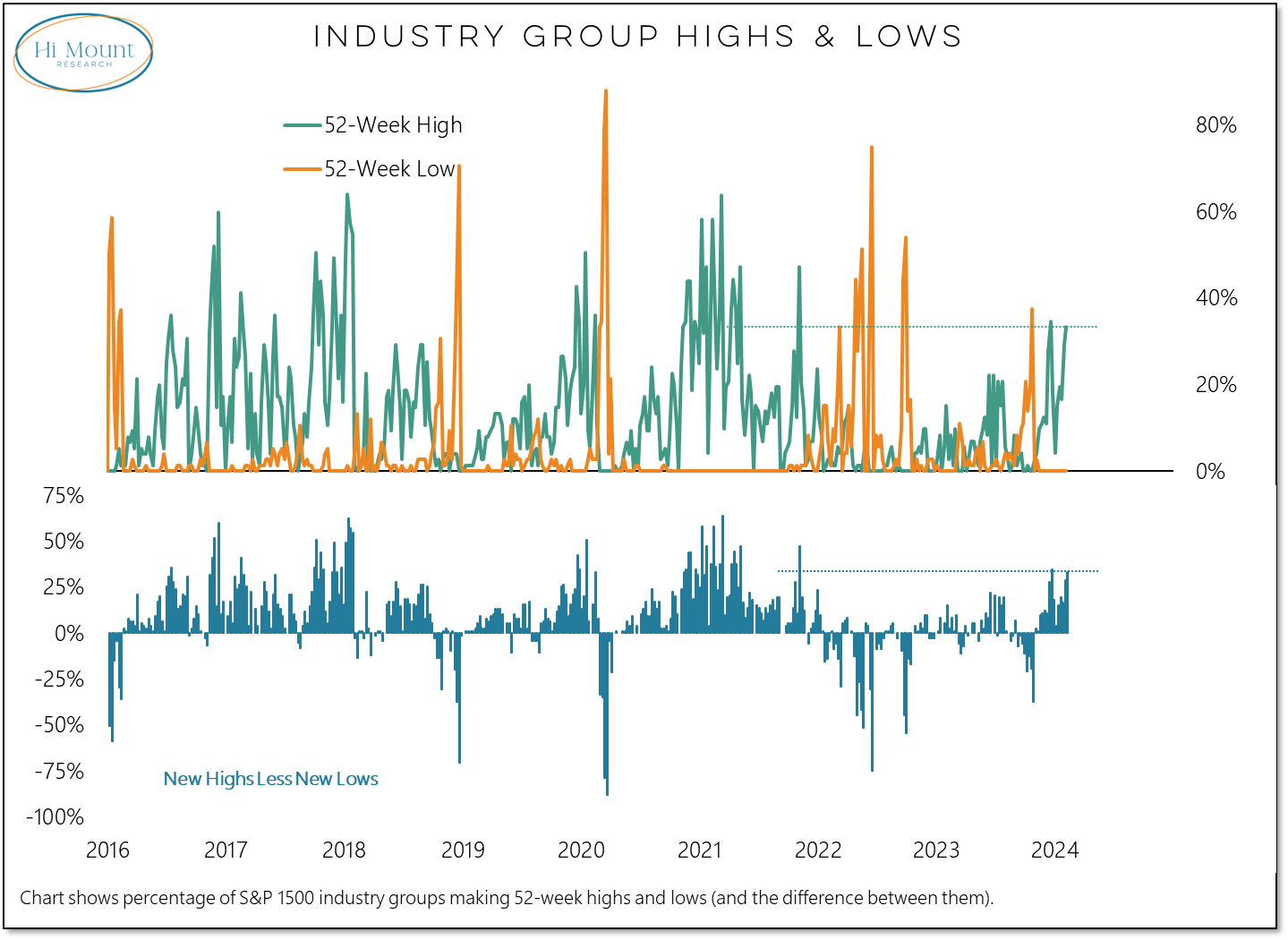

So What: Defensive downtrends persist as the percentage of industry groups making new highs is expanding. As more mid-cap groups make new highs, the overall percentage is approaching the December peak. While the headlines discuss narrow participation, the actual story is one of broad strength beneath the surface.

Now What: While our Global Macro relative strength rankings continue to show US equities (LC Growth and Mid-cap occupy the top two spots), there is plenty of strength being seen around the world.

Don't be fooled by the relatively lackluster ranking of Emerging Markets. China weakness is overwhelming pockets of leadership and strength elsewhere in the EM space.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.