Decision Time For Fed As Employment Weakens and Inflation Persists

Distinguishing between talking points and decision points reveal the trends that matter most

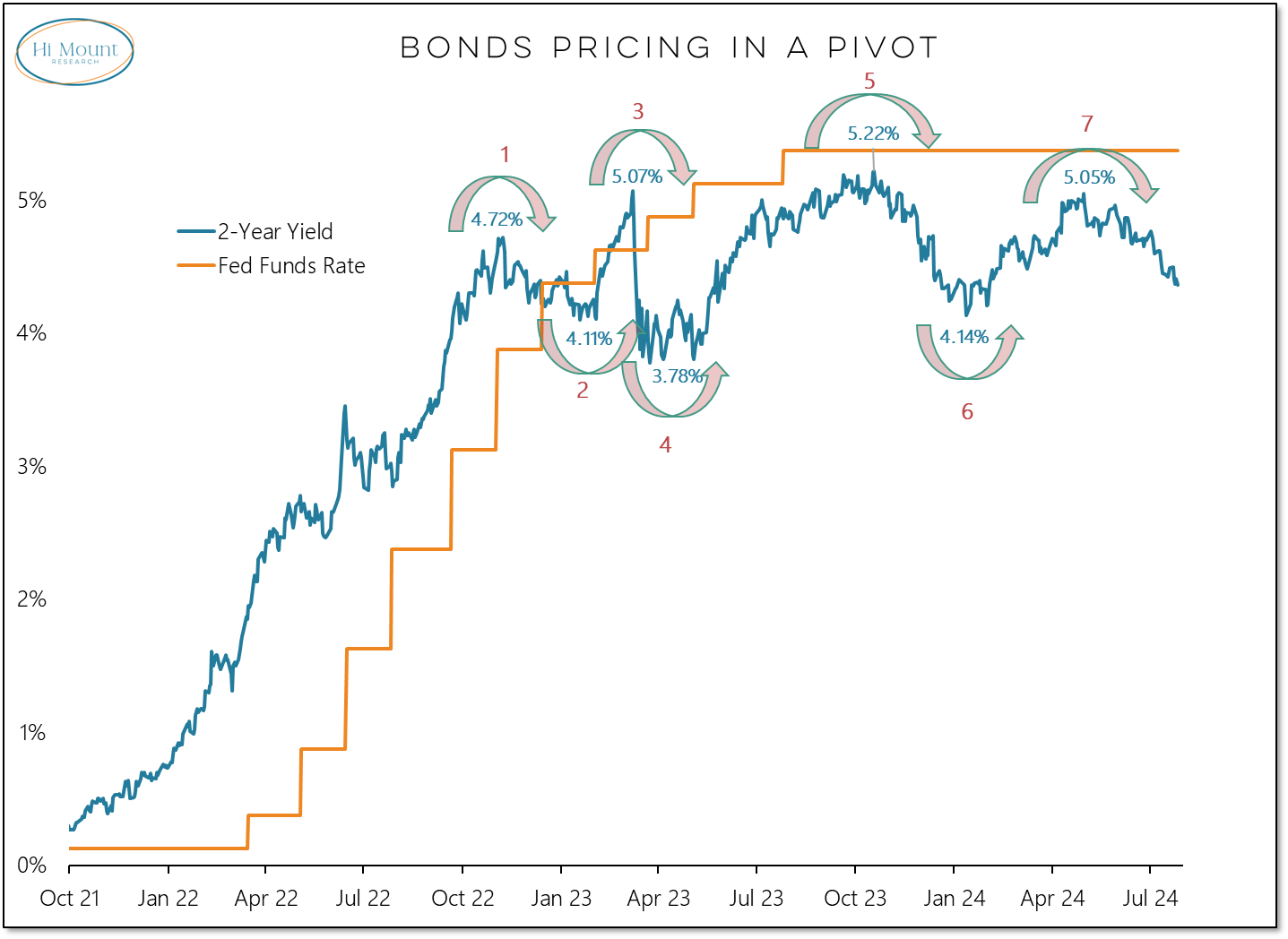

The Fed this week is expected to signal that a much anticipated pivot could come as soon as the September FOMC meeting. The market expects the Fed to move sooner rather than later and Powell & Co. don’t like to disappoint or otherwise surprise the consensus. The economic case for moving is mixed and reflects the box in which the Fed finds itself.

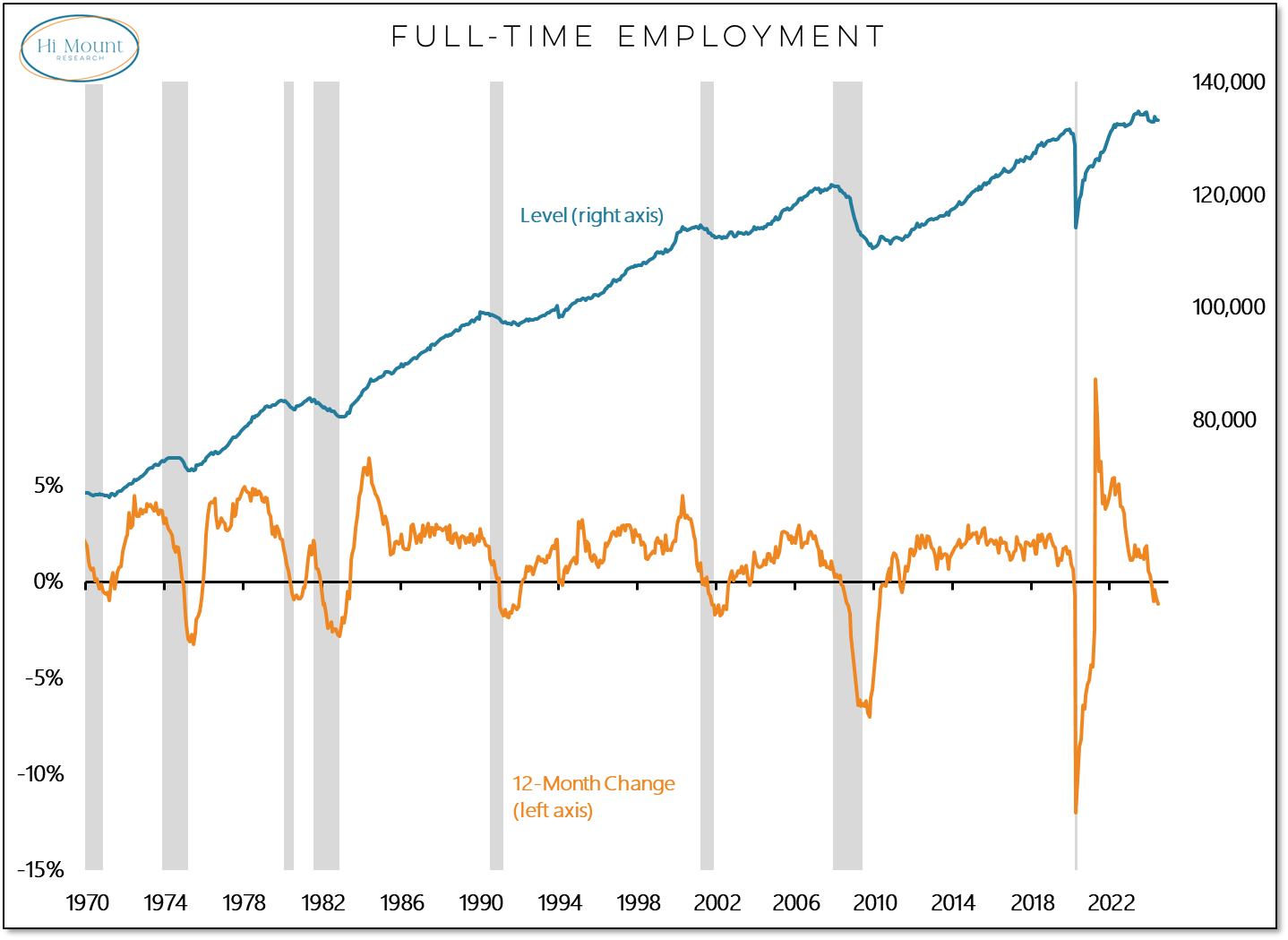

Full-time employment peaked in November and has been in negative territory on a year-over-year basis for five months in a row. Going back over the past 50 years, every time yearly growth in full-time employment has been below zero, the economy has been in recession. From this perspective, the Fed is already late.

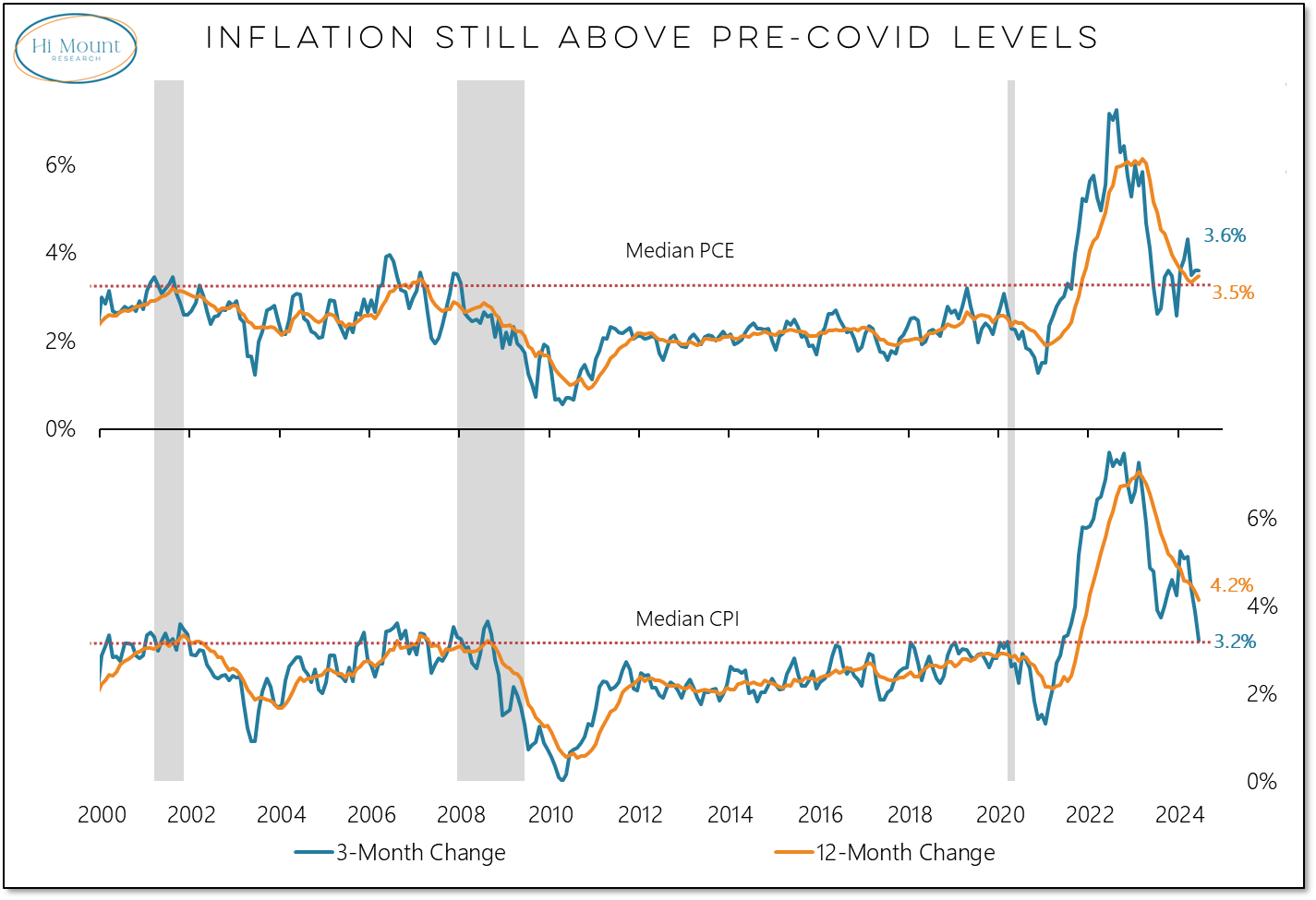

But the Fed needs to balance employment with price stability and while inflation data has improved on balance, price pressures linger and inflation rates have held above pre-COVID levels. The Fed talks about CPI in public but from a policy perspective, it focuses on the PCE data. The yearly change in the median PCE price index has turned higher at a still-elevated level.

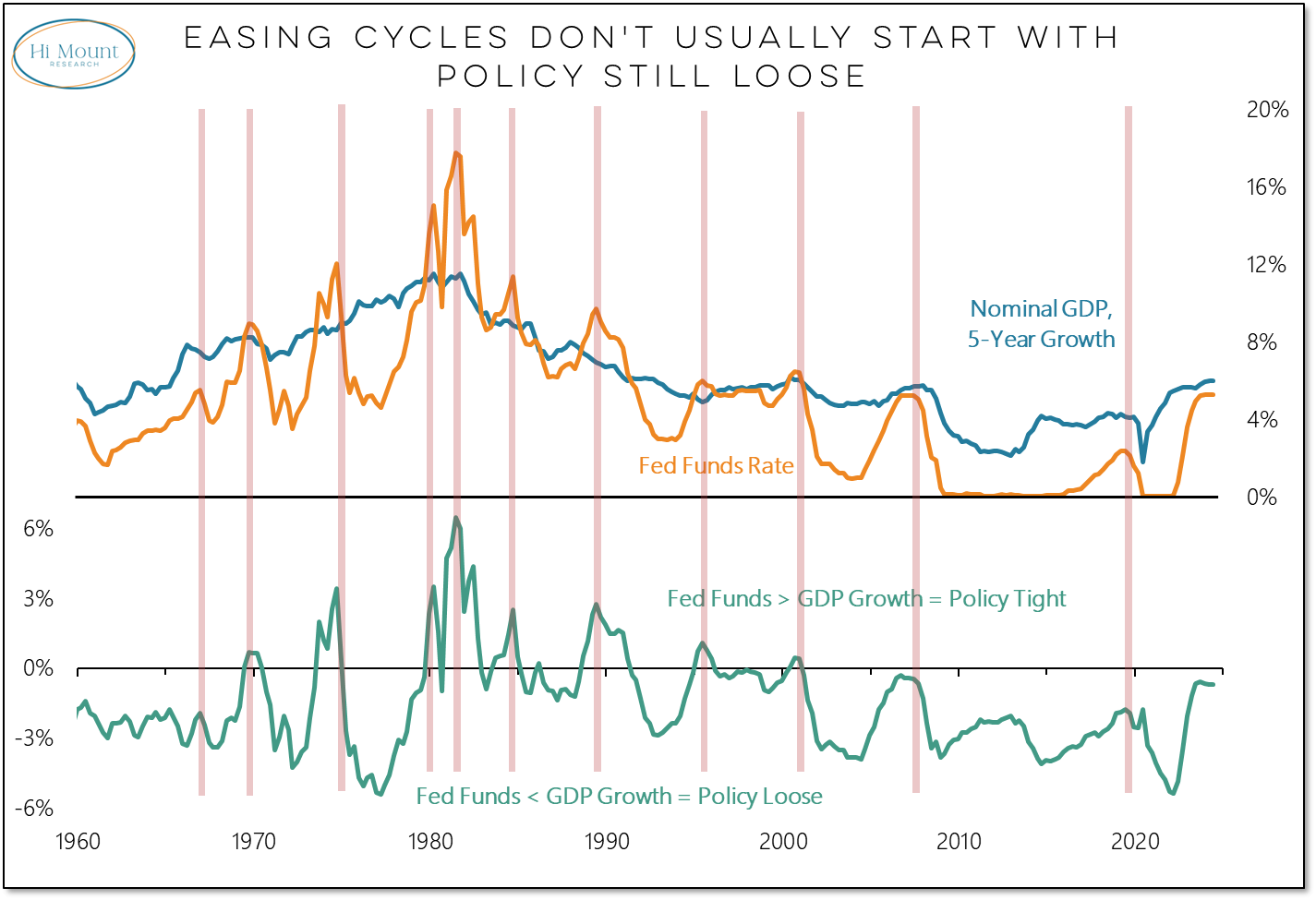

When we compare the trend in nominal growth (i.e. real activity plus inflation) to the current level of interest rates, policy remains relative loose and the Fed doesn’t usually begin easing cycles until after policy is tight. The exception to that was 2019 and in many ways that policy error helped fuel the inflation fire that the Fed has been trying to put out.

This brings us back to navigating market expectations. This is not the first time this cycle that the market has been anticipating a sharp pivot from the Fed. The Fed’s job this week (in both its written statement and Powell’s press conference) its to be as clear as possible on the expected timing and degree of any potential easing. The market wants to believe that the pre-COVID rate regime is likely to return. Plenty of data argues that is not going to be the case.

Before looking at the latest relative strength rankings, a few comments on streaks that matter and distinguishing between talking points and decision points:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.