Consumers Are Sour, But Investors Like What They See

Sentiment surveys shows optimism is high and rising.

First of All, Thank You: As 2023 winds down and we look forward to the start of a new year, just a note of thanks for your engagement with this endeavor. Whether you are just a casual reader or have taken the next step and become a paid subscriber, I could not do this without your support. I’ll be tweaking a few things as we go forward, but the goal of cutting through the noise & emotion while delivering actionable asset allocation perspectives remains the focus.

As you think about how you are going to spend your investment research time and dollars in 2024, please keep Hi Mount Research in mind. Don’t hesitate to reach out (info@himountresearch.com) for more information.

Again, thank you & please stay in touch. Merry Christmas and a Blessed New Year to you and yours.

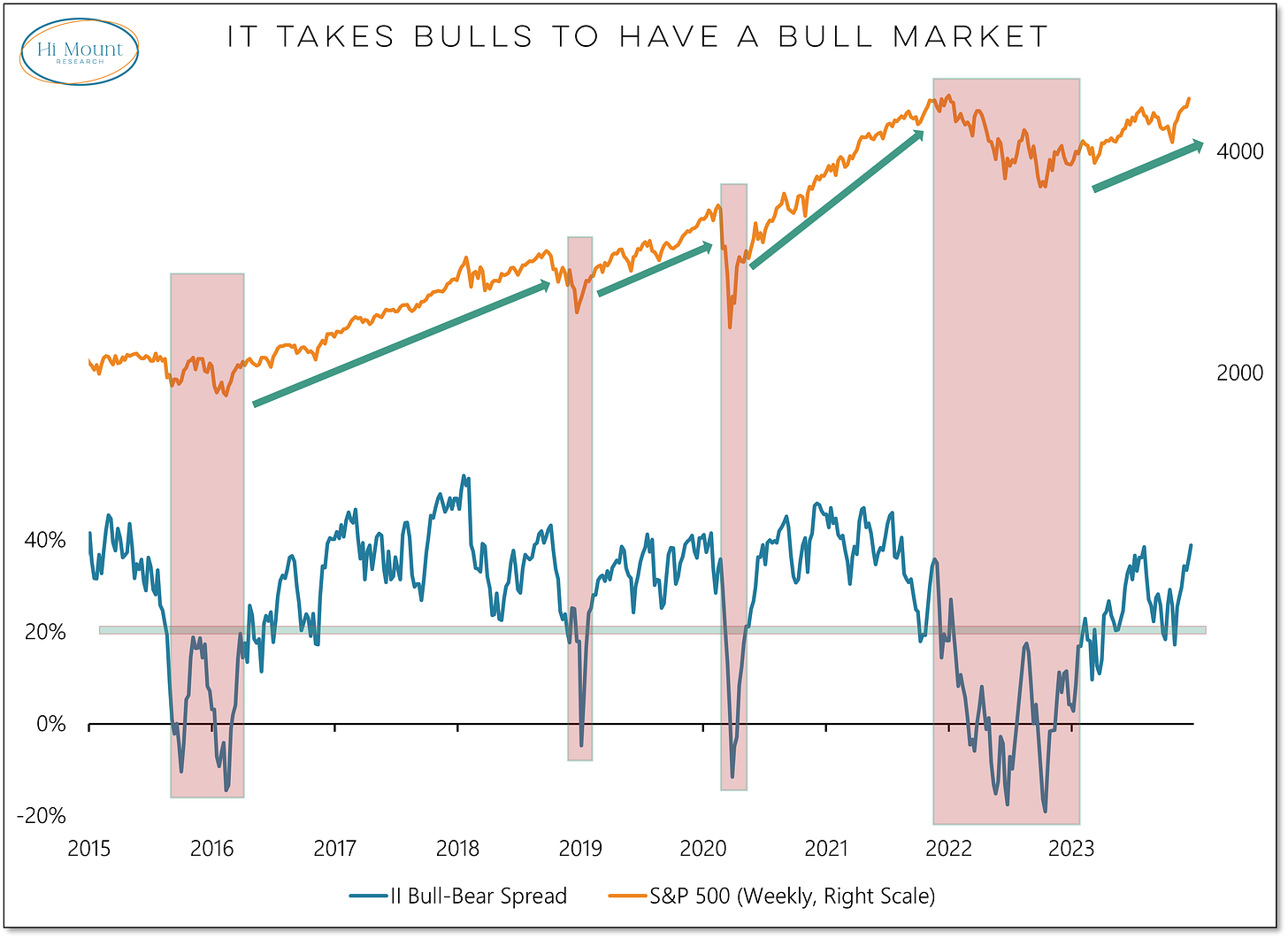

Key Takeaway: While we need bulls to have a bull market, optimism can become a headwind when it reaches euphoric levels. The latest sentiment data suggest that risk is on the rise.

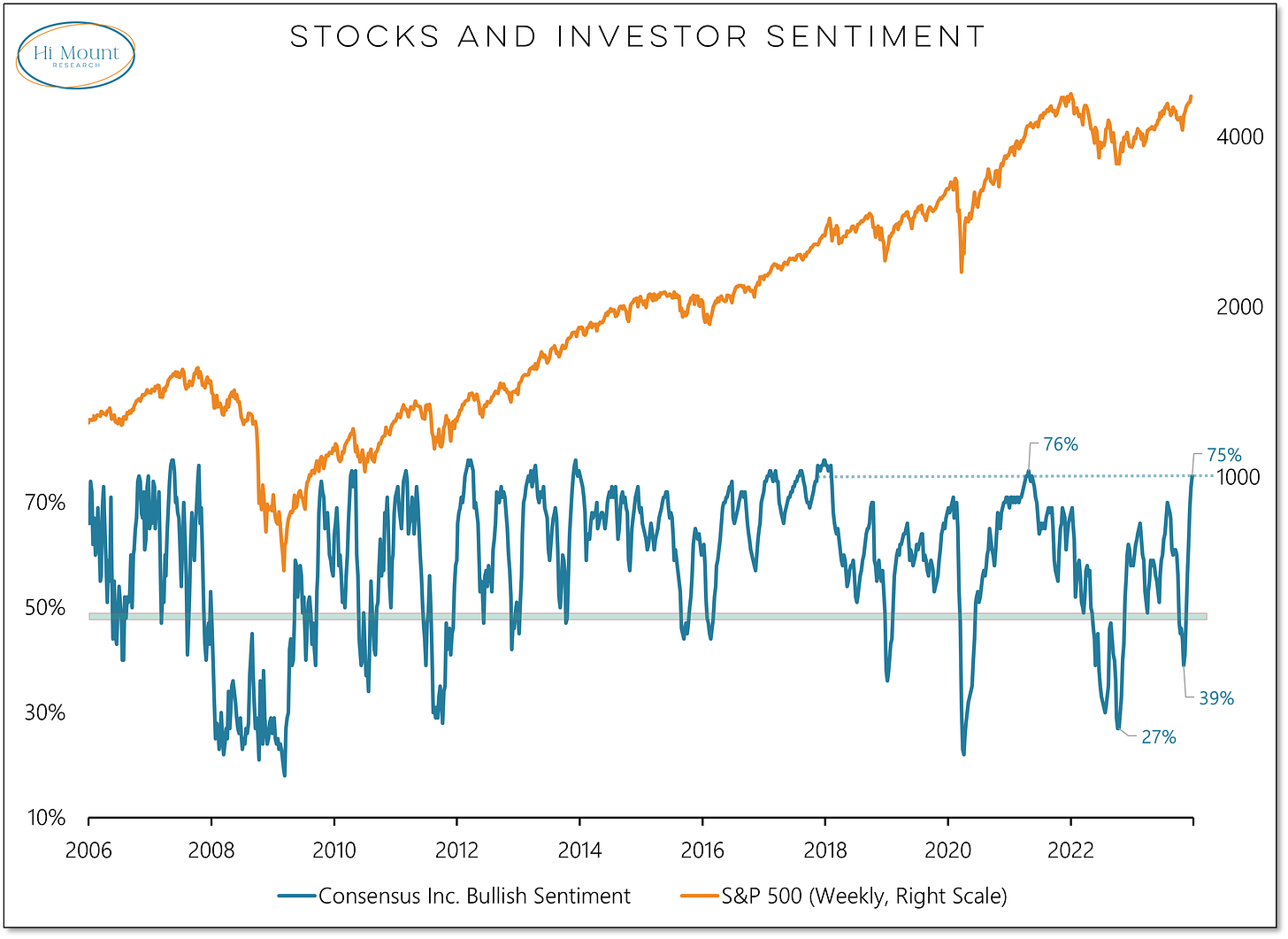

Consensus Bulls have now risen for seven weeks in a row, moving from 39% in early November to 75% this week. This is the second highest level in the past 5+ years (trailing only April 2021).

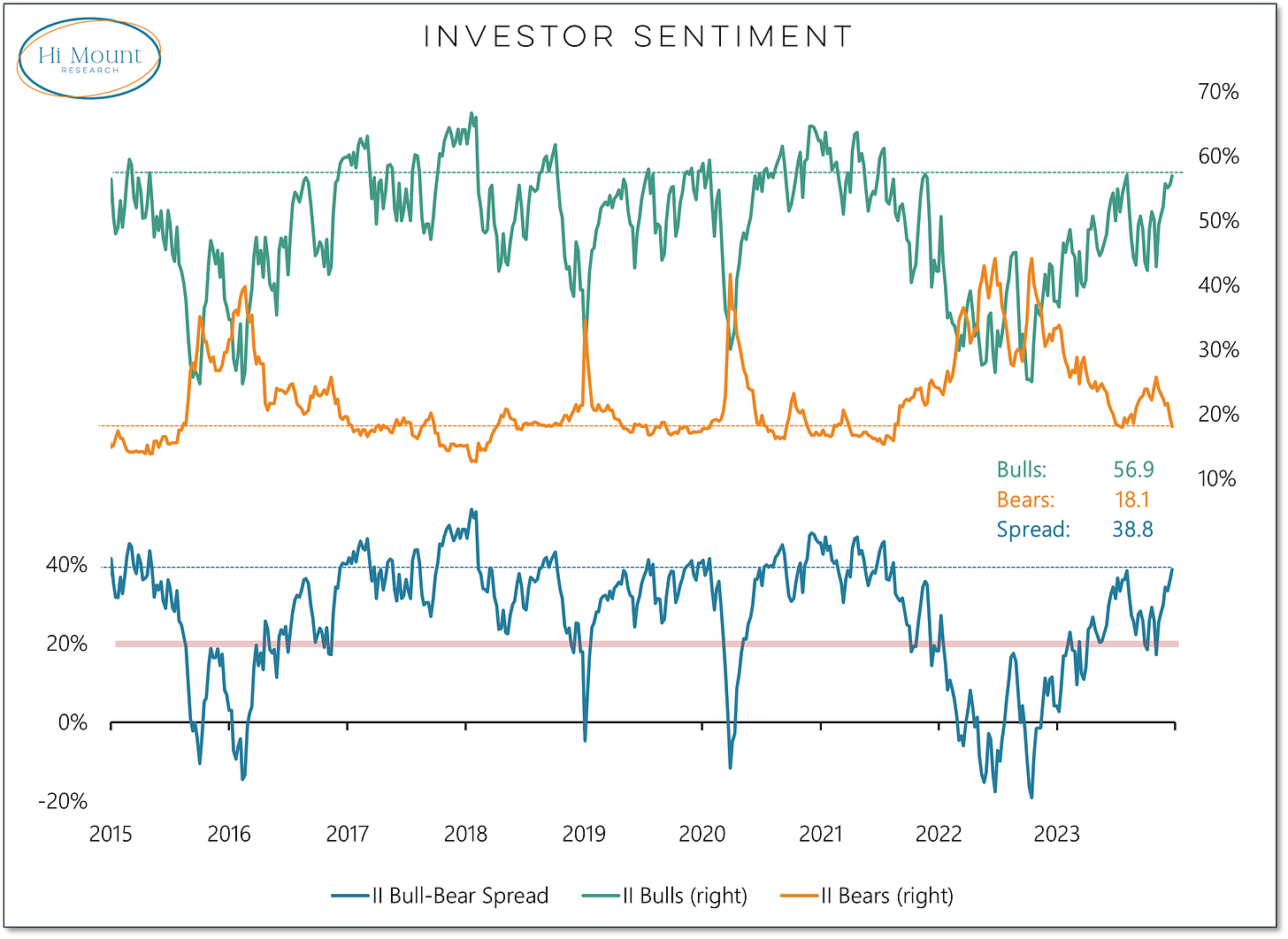

Investors Intelligence bulls this week reached their highest level since August. Bears and the Bull-Bear spread also reached the most extreme levels since August - August 2021 that is.

For the most part, optimism is fuel for rallies. We need bulls to have a bull market and all the net gains for the S&P 500 since 2015 have come when the II Bull-Bear spread has been above 18%. That said, when optimism is as elevated as it is now, it doesn’t take much of a news bump to upset the market. Losing a little froth would be a healthy development at this point.

Finally, much has been made of the sour feelings among consumers and many have been perplexed by the historically low readings from the Michigan sentiment index. What doesn’t get discussed as often is that while bad moods have been pervasive (at least until this month), investors never really abandoned stocks. Even at the S&P 500 low in October 2022, household equity exposure (according to the AAII asset allocation survey) didn’t dip below its long term average.