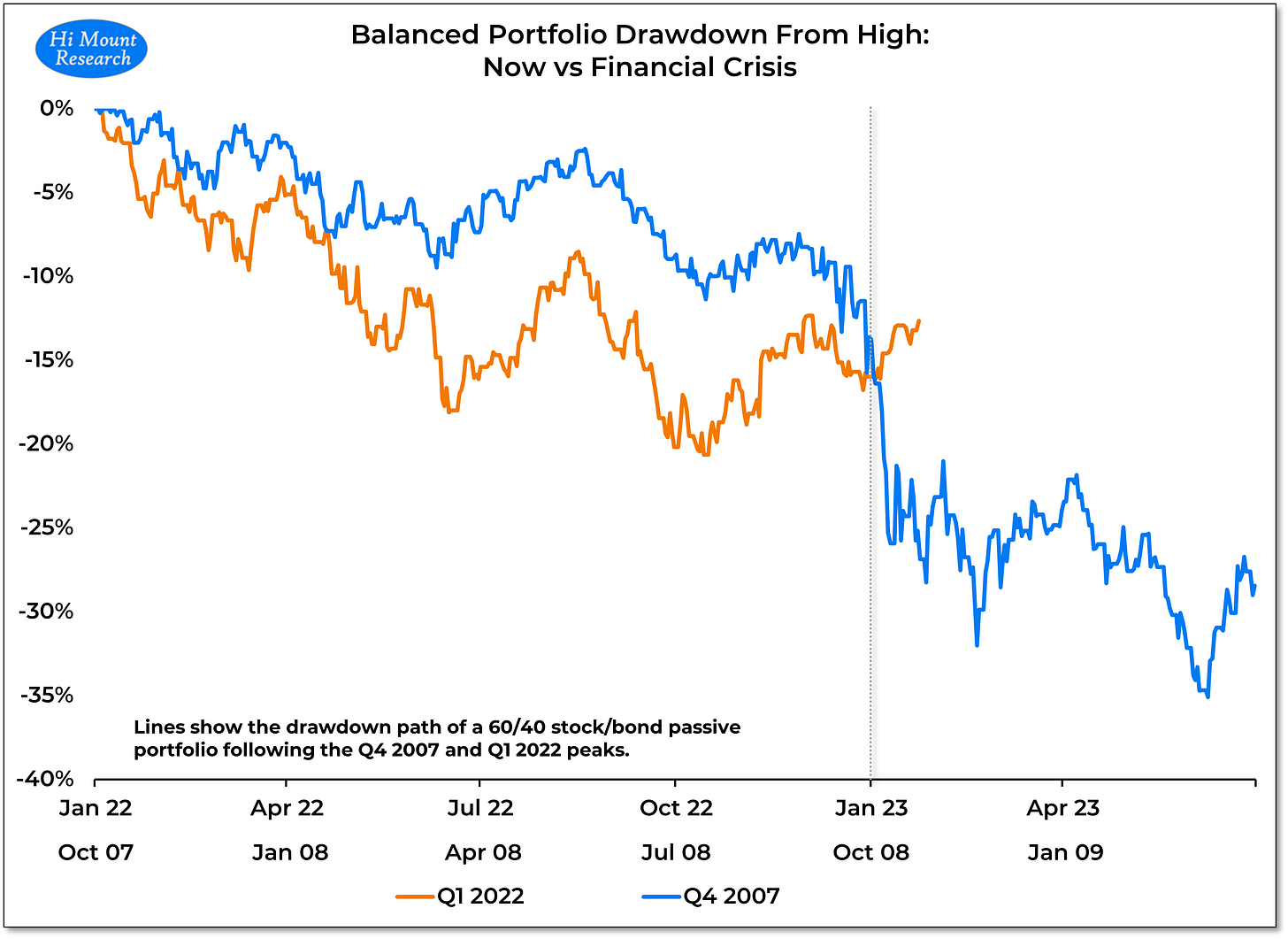

Chart of the Day: Two Paths Diverge

Market & Fed playing chicken as investors shake off echoes of the Financial Crisis

The ebbs and flows in the benchmark 60/40 portfolio last year (more ebbs than flows if we are being honest) echoed the drawdown seen off of the October 2007 peak. But that pattern is being tested as 2023 gets underway.

Why it Matters: The Fed talking about the need for further rate hikes and rates staying high for some time while stocks and bonds have been in rally mode in the hopes of fewer remaining hikes and rate cuts by the end of this year. If the Fed blinks first in this game of chicken, the similarity between the financial crisis and the current environment will continue to wane. If it’s the market that blinks then both stocks and bonds could face additional pressure. In that case, the pattern the emerged last year could be renewed.