Chart of the Day: Fed Fighting Persistent Inflation

After being late to acknowledge labor market imbalances, Fed may be slow to pivot

The growth in total compensation costs cooled in the second half of 2022, but still finished the year above 5%. While this may provide some passing comfort, it may not be the enduring evidence of moderating inflation that the market hopes the Fed will find.

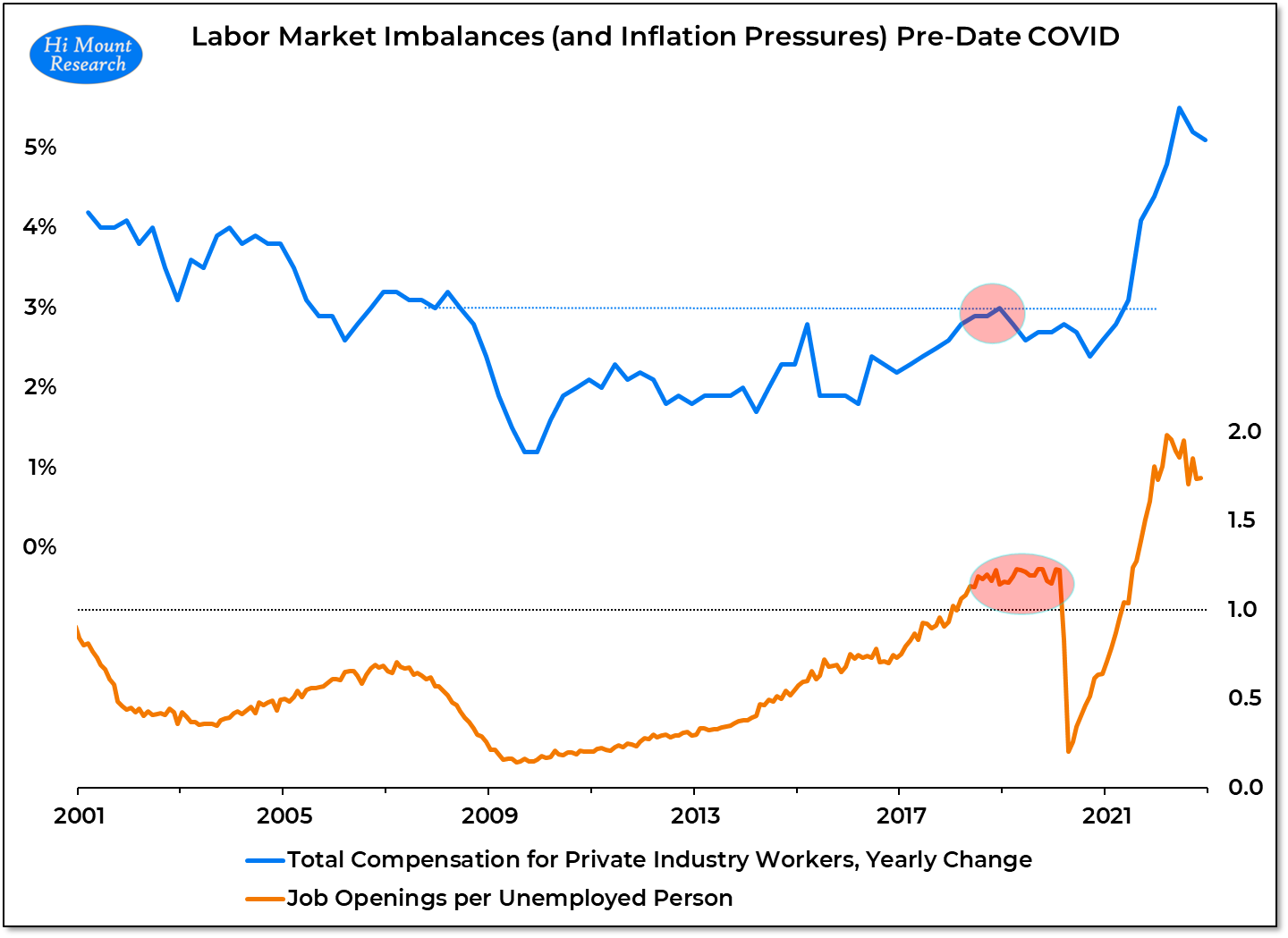

Why it matters: This compensation data (and the employment cost index from which it is derived) seems to be everyone's favorite economic indicator. Too bad it wasn't more on the radar in 2018-2019. Back then the labor market was already tight (with more job openings than unemployed persons) and total compensation costs were rising at their fastest pace in a decade. In fact, the post-COVID acceleration higher was a continuation of a pattern of higher lows and higher highs. Yet the Fed ignored this when it cut rates in 2019. If the Fed hadn't bowed to political pressure back then, maybe we could have avoided some of our current inflation woes.

The Fed can now see the embedded inflationary pressure that it missed pre-COVID. The December Summary Economic Projections showed upward revisions to the inflation outlook for 2023 and 2024 as well as projections for a year-end 2023 Fed Funds Rate above 5%. The market's view has shifted over the past six weeks, I doubt that the Fed has meaningfully changed its expectations.