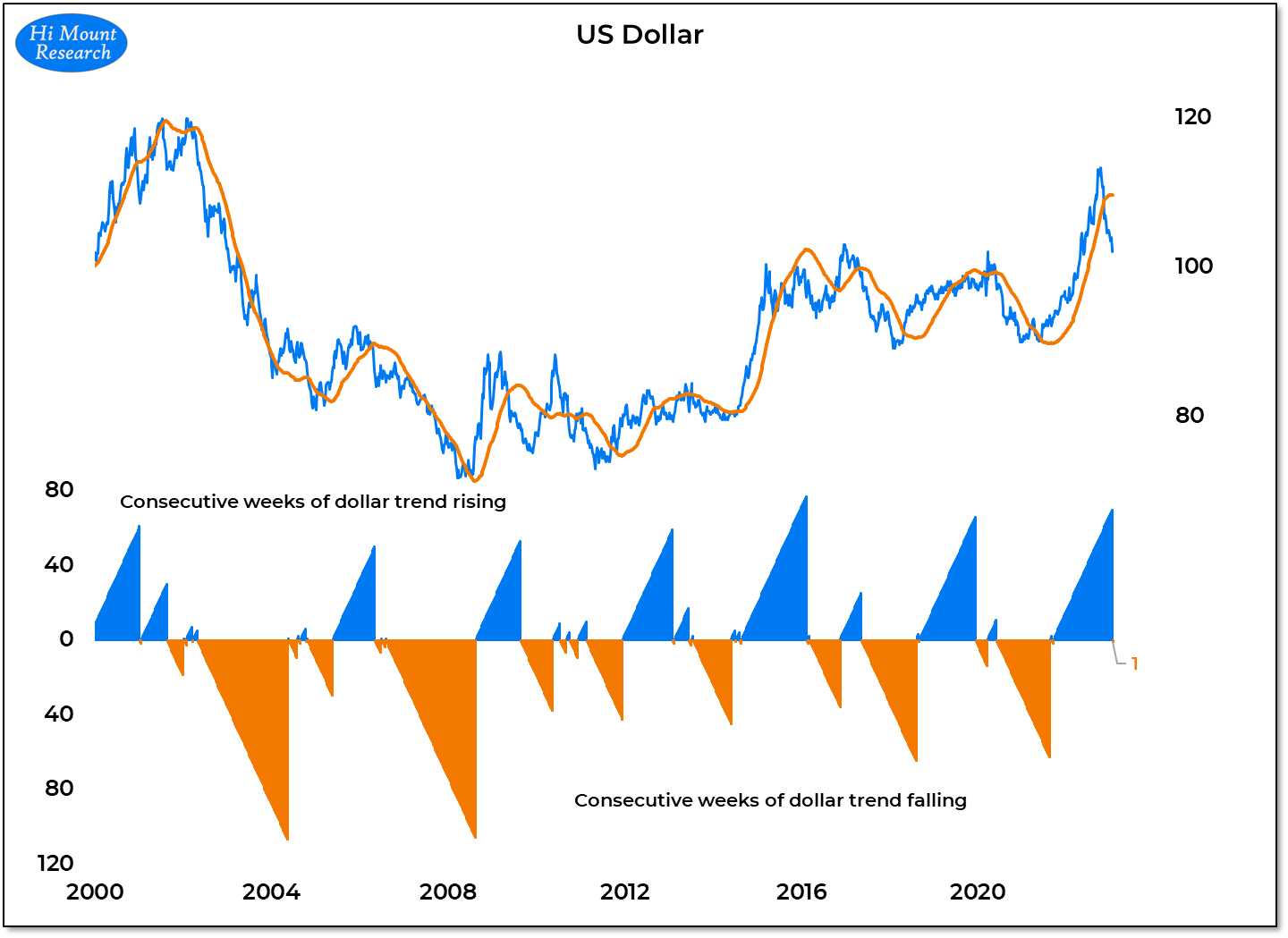

Chart of the Day: Dollar Downturn

With the trend rolling over, opportunities are emerging overseas

After one of the longest periods of sustained strength in the past two decades, our trend indicator for the US dollar turned lower this week.

Why It Matters: Since the dollar peaked, the percentage of global markets in up-trends has surged. Now more than 80% of ACWI markets are above their 200-day averages, the most since early 2021. Relative global equity leadership has moved overseas and this is now being accompanied trend strength on an absolute basis. The trend in the EAFE has turned higher for the first time in 50 weeks and Mexico today was trading at its highest level since 2015. In the US, dollar weakness has tended to be associated with strength rather than weakness for the S&P 500. The caveat for US investors: the secular bear market in the 2000s was accompanied by persistent weakness in the Greenback.