Chart for the Weekend: Participation Matters

Look beneath the surface for distinctions between bear market rallies and new bull markets

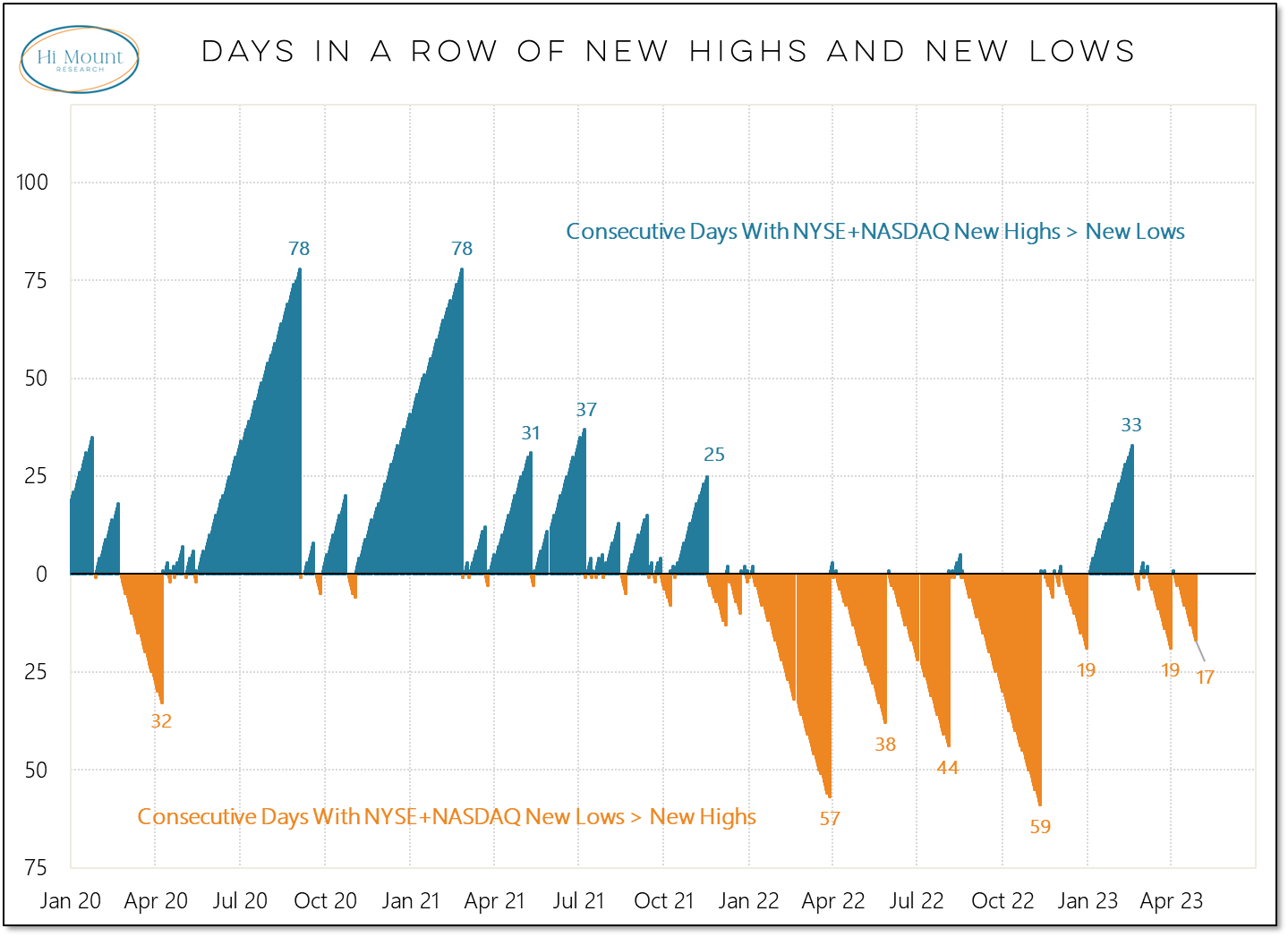

From April 2020 through November 2021, the number of stocks making new highs on the NYSE + NASDAQ consistently and persistently outnumbered the number of stocks making new lows. Since November 2021, and with the exception of the first month-and-a-half of this year, the number of stocks making new lows has consistently and persistently overwhelmed the number making new highs.

More Context: Notably absent from much of the debate over whether it’s a new bull market vs just a bear market rally is a working notion (rooted in the data) of what distinguishes bull markets and bear markets. Sure, facts are cited, and anecdotes are referenced, but all the while, terms remain ill-defined.

From where I sit, bull markets are best defined as periods in which the new high list is persistently longer than the new low lists. Bear markets are the opposite, periods in which the new low lists is persistently longer than the new high list.

We’ve seen shifts in leadership and even some pockets of sustainable strength. But when it comes to US equities overall, and from the perspective of participation, the current environment looks more like a bear market rally than the early stages of a sustainable move higher.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.