Chart for the Weekend: Another Pivot

Folks want the Fed to follow the market, but the market doesn’t seem to know if it is coming or going

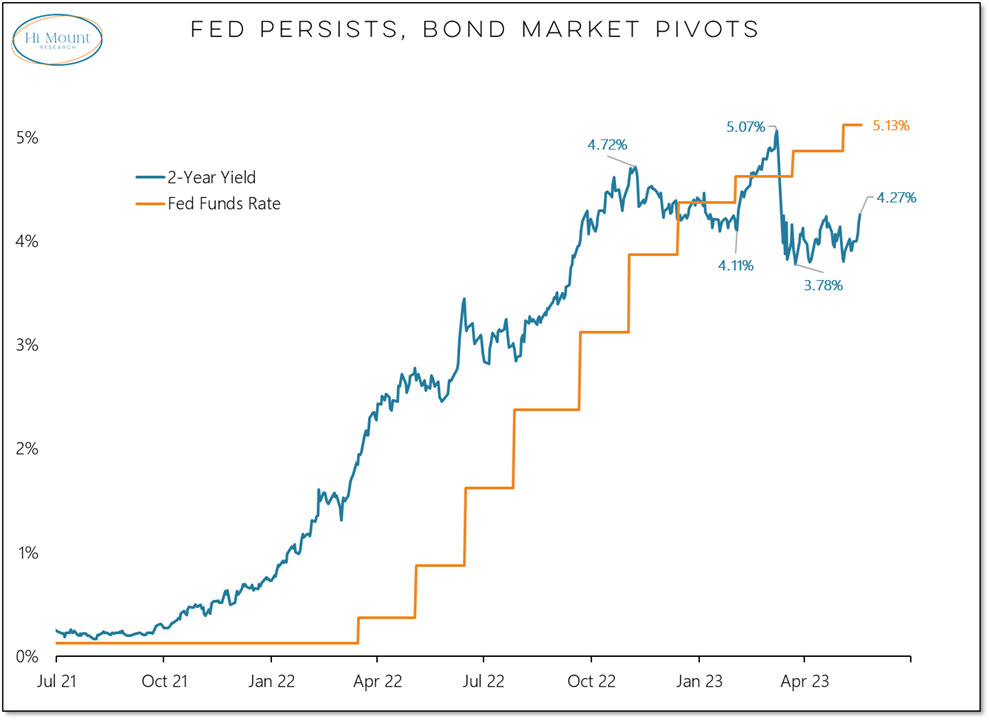

The 2-year T-Note yield is a proxy for where the market thinks the Fed needs to head. It rose this week to its highest level since regional bank issues emerged in March.

More Context: The noise is that the Fed takes its cues from the bond market and will be aggressively cutting rates later this year. The news is that while the Fed has persisted with its tightening regime, the bond market is now working on its fourth pivot in the past six months.

After the 2-year yield peaked at 4.7% in November it fell to 4.1% in January only to rise above 5% (and the fed funds rate) in March. Later that month it had fallen to a new six-month low. It is rising again as inflation has proven sticky, inflation expectations are on the rise, and Fed officials have discussed the need for additional rate hikes.

Our weekly chart pack has been emailed to subscribers of our premium Portfolio Applications service. Reach out for more information.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.