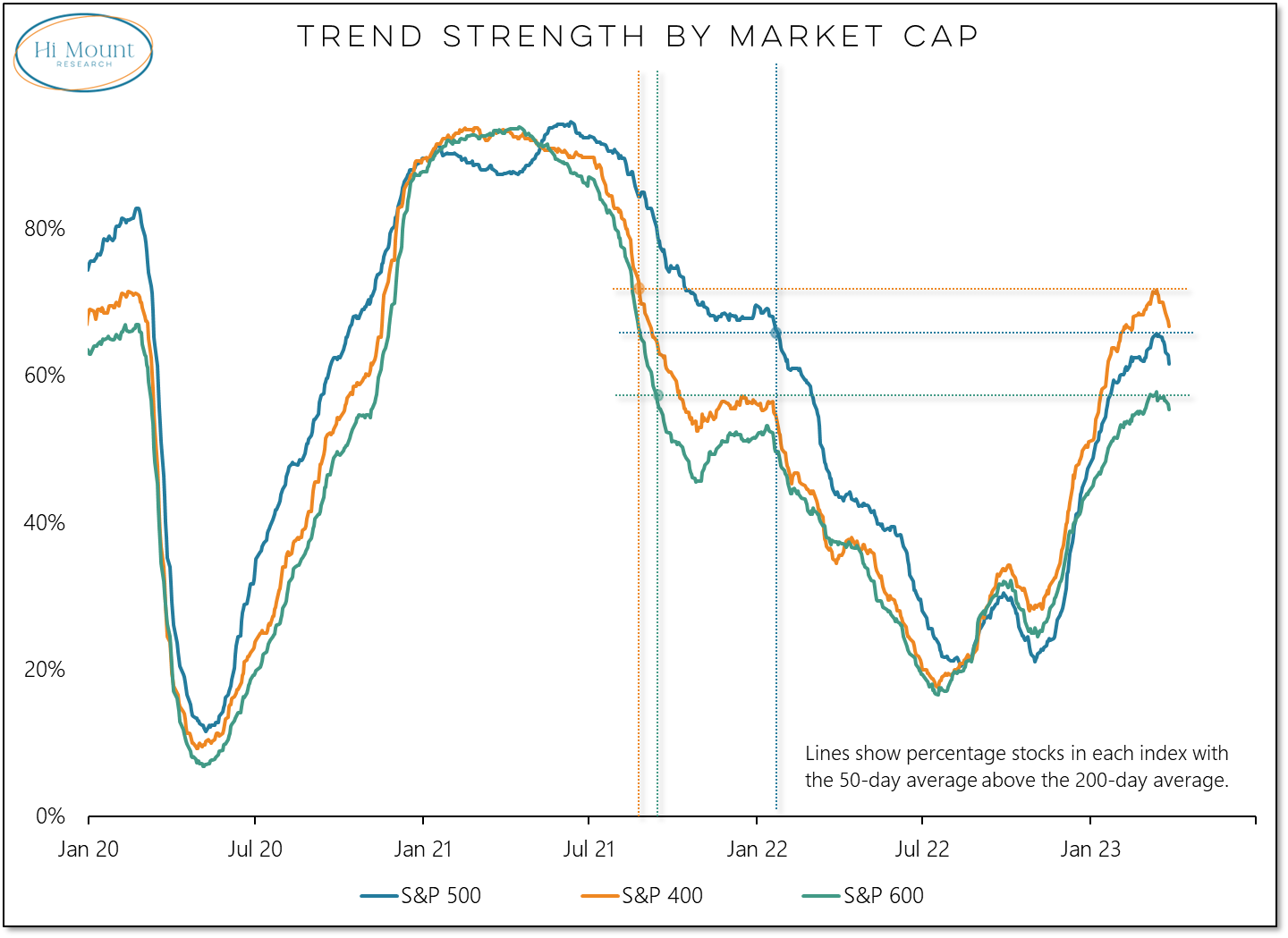

The percentage of stocks experiencing trend strength expanded in late 2022. By early March, the percentage of S&P 500 stocks with 50-day averages above their 200-day averages had climbed to the highest level since January 2022. For the mid-cap S&P 400 and small-cap S&P 600, it was the highest since Q3 2021. In recent weeks trend strength has started to roll over.

Why it matters: Trend strength beneath the surface of the indexes was deteriorating when the indexes were peaking in Q4 2021 and it was improving when the indexes were bottoming in Q4 2022 (notice the higher low in Q4 vs Q3). This may just be consolidation after a healthy run higher. But if these trends continue to move lower it will be difficult for the indexes to remain range-bound, let alone break higher.

Think of a stock market index as a ship: Breadth is the rudder and the steering happens beneath the surface. Not always immediately, but eventually.