Celebration Stalls

US stocks are hitting new highs versus the rest of the world despite less than robust behavior of their own

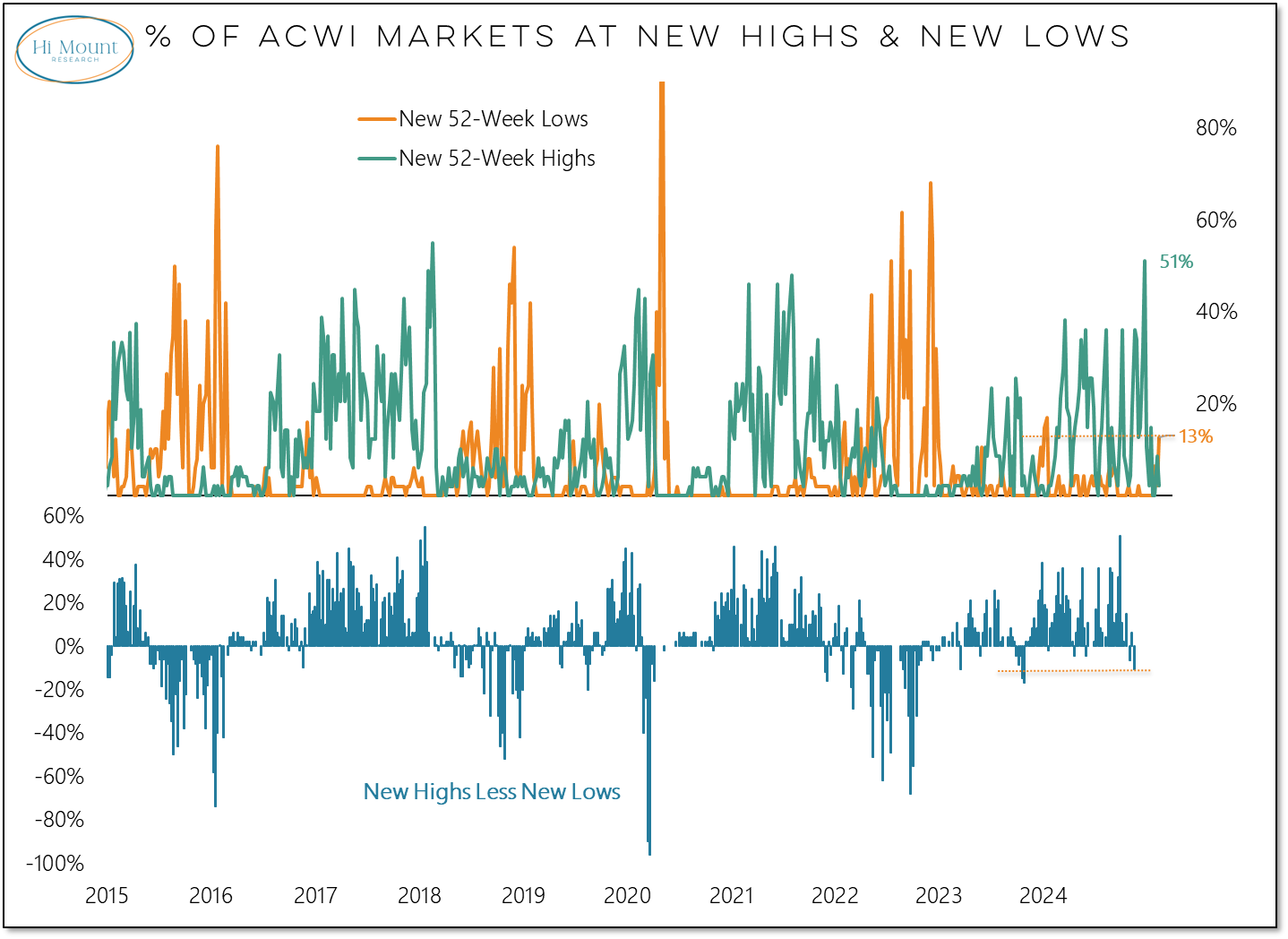

Key takeaway: New lists expanded as stocks sobered up following a post-election celebration. US equities have been more resilient than their global counterparts, cyclical strength could be tested in the weeks ahead.

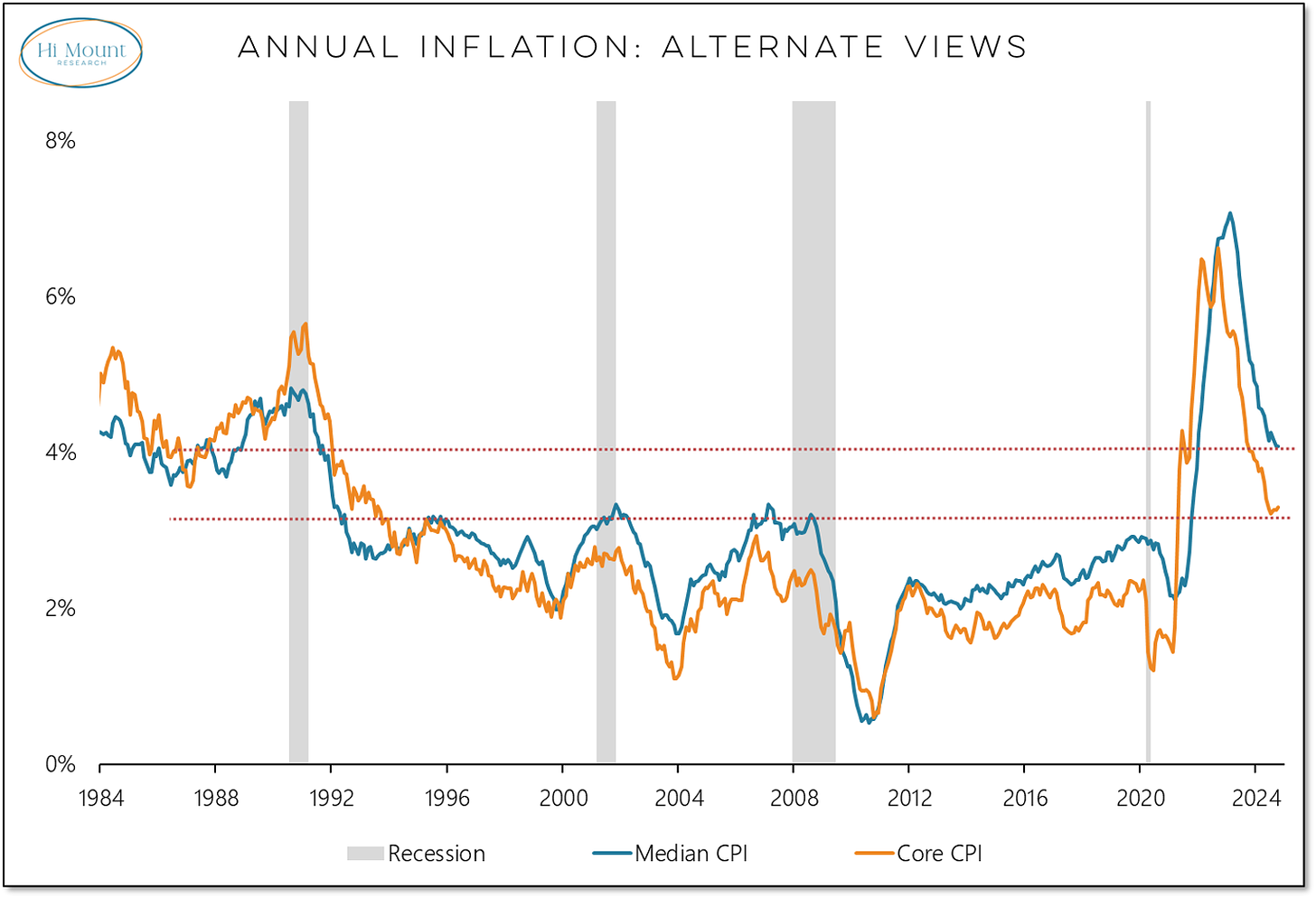

Stocks have been reacting to bonds and bonds have been reacting to inflation. The October CPI data shows that inflation remains a persistent threat. Despite all the hopeful talk about price pressure subsiding, both core and median CPI continue to rise at a faster pace than what was experienced in the decades prior to COVID.

The bond market has caught on to the inflation dilemma. While the Fed is cutting rates, bond yields at the long-end of the curve have been rising. The changing long-term trend dynamic suggests that a break in the 10-year yield above 5% is more likely than a break below 3.25%, especially if the Fed remains in easing mode.

The number of markets hitting new lows reached its highest level of the year. The late-September spike (when half the world was making new highs) seems like a distant memory at this point. As it stands now, fewer than one-fifth of markets are above their 50-day average and less than half are still above their 200-day average.

Global weakness last week helped confirm one of the most durable trends over the past decade as the US hit a new high versus the rest of the world (again).

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.