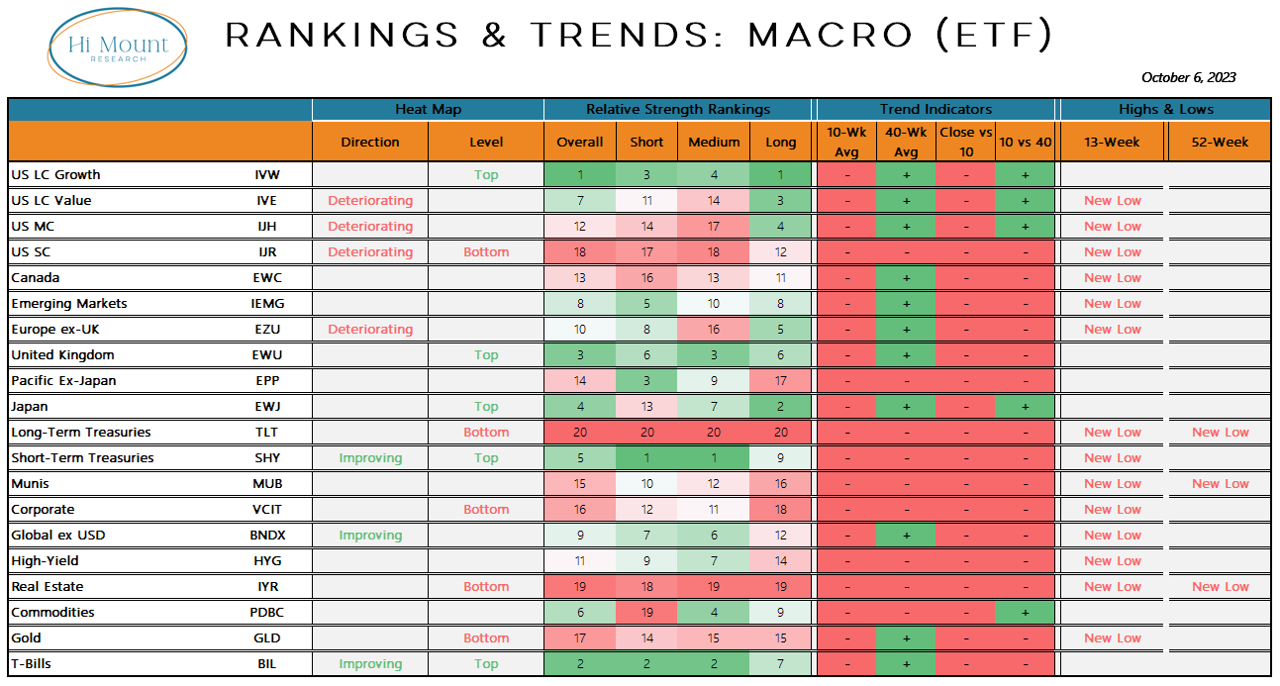

Key Takeaway: T-Bills have claimed the number two spot in our Macro ETF rankings. MINT (which we use as a cash proxy in our ETF portfolio) is seeing improving relative strength and has climbed into the leadership group of our broad universe ETF rankings.

More Context: The impact of the Magnificent Seven Tech and Tech-related stocks is helping Large-cap Growth hold the top the spot in our Macro rankings. But with equity market new lows widespread and new highs scarce, it is the improving strength of cash and cash-related instruments that is catching our attention. As areas of equity market resiliency become few and far between, reducing exposure to stocks and increasing exposure to cash makes more sense from a risk management perspective. That is the message of these relative strength rankings and the latest weight of the evidence.

Subscribers can download the entire Relative Strength Rankings report to see what areas are showing relative leadership as absolute trends deteriorate.

In case you missed it: Last week I checked in again with Oliver Renick on the Schwab Network to discuss the market. You can catch a replay of that conversation here.