Can Bulls Build On Their Big Bounce?

There is still little evidence of bull market behavior coming from US equities while the impetus for the bounce has faded

Stocks bounced last week, with the S&P 500 gaining 4.6% on the week. In fact, for the second time in three weeks, the S&P 500 posted a weekly gain in excess of 4%. The historical record of such big gains in close proximity to each other is mixed. About half of the time, it is represents the beginning of a strong move and sustained move off cyclical lows (e.g. April 2020, March 2009). The other half of the time, it reflects a counter-trend move within an intact cyclical bear market (e.g. April 2008, April 2001).

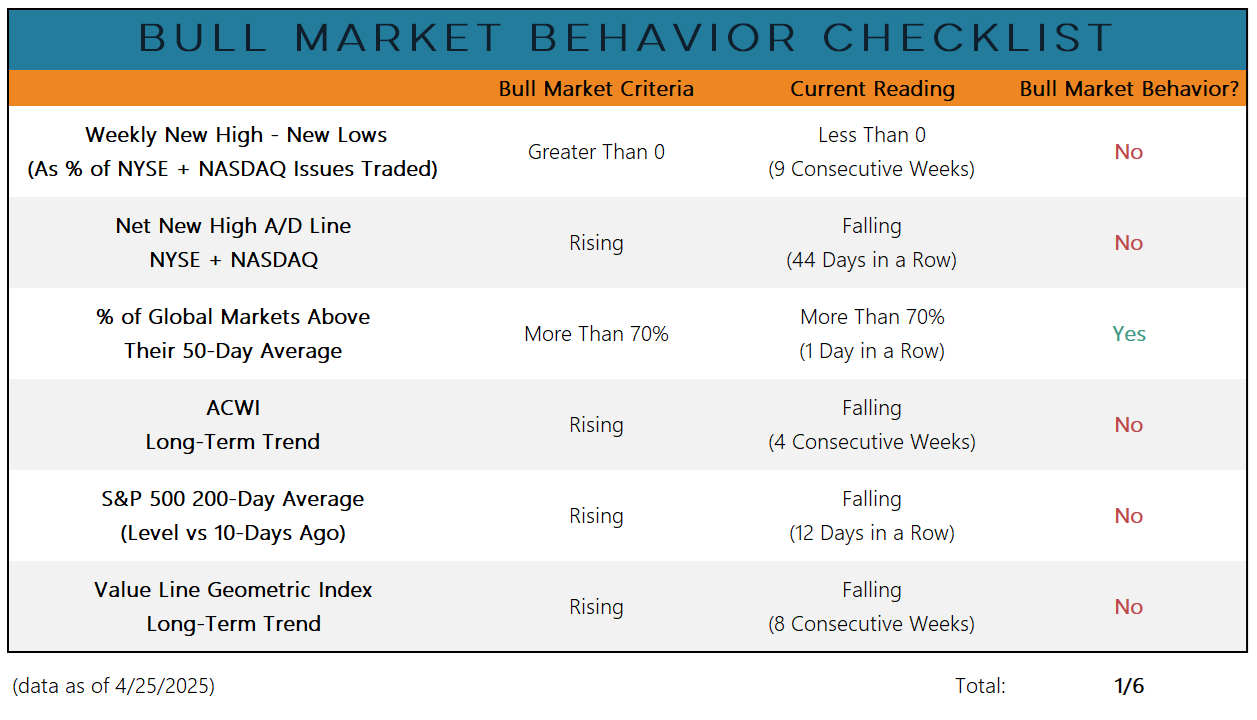

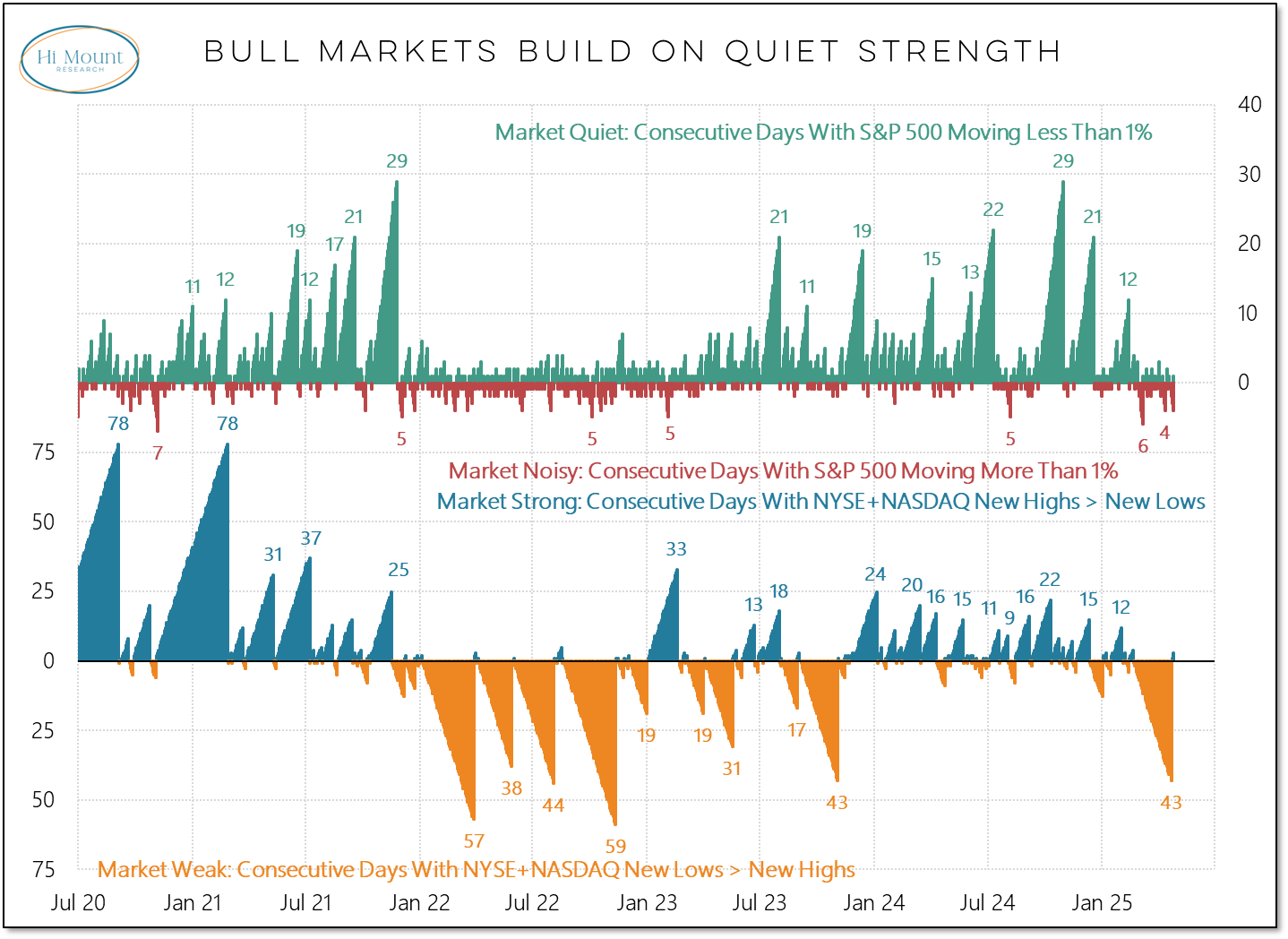

What we do know is that big moves in either direction tend to be symptoms of an unhealthy market environment and with the trend evidence for US stocks remaining unfavorable (the 200-day average for the S&P 500 is still falling and the 50-day average remains below the 200-day average), the burden of proof is on the bulls to build on the recent bounce. In other words, we need more evidence of bull market behavior.

An important step in the healing process would be to have quiet replace noise and strength replace weakness. While it is not yet enough to lean into, last week saw a few days with the number of stocks making new highs exceeding the number making new lows for the first time in over two months.

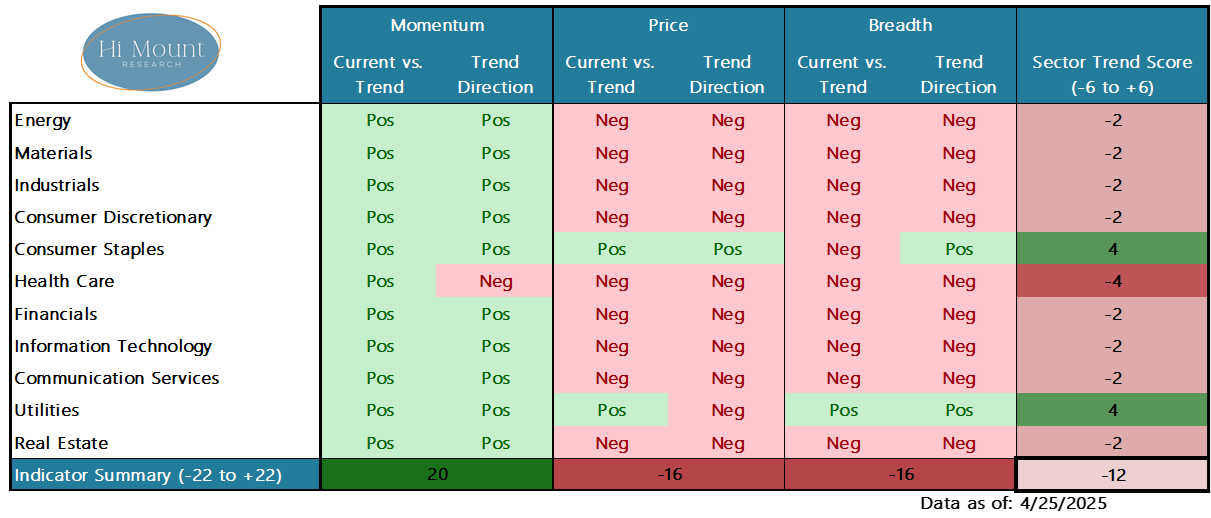

Our summary of short-term momentum, price and breadth trends at the sector level tells the story well. We have seen widespread improvement in momentum, but it has not (yet) translated into a meaningful improvement in trend or breadth strength.

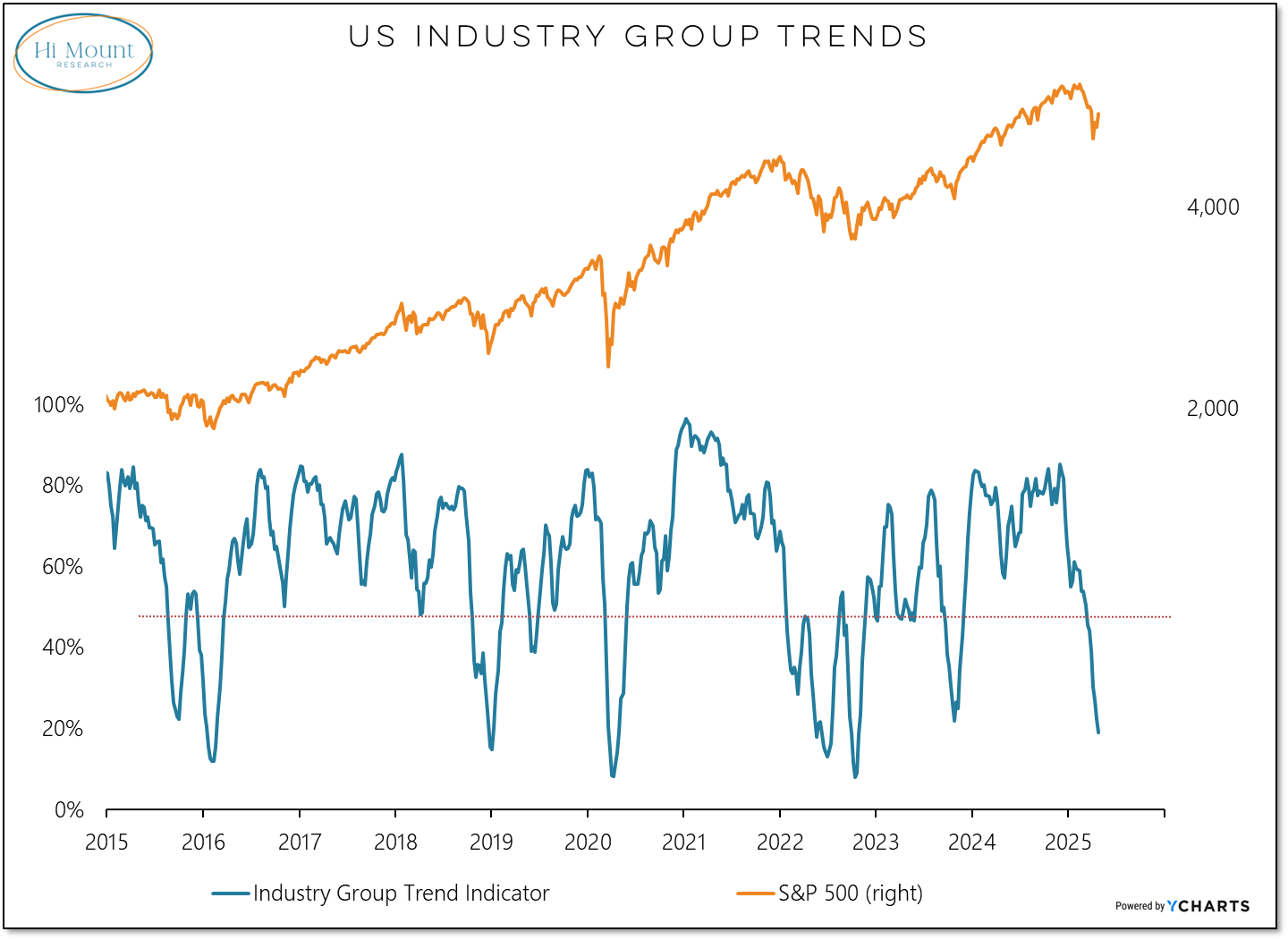

Our longer-term industry group breadth trend indicator continues to fall. It has dropped below its late-2023 trough and its behavior is consistent with a bear market environment.

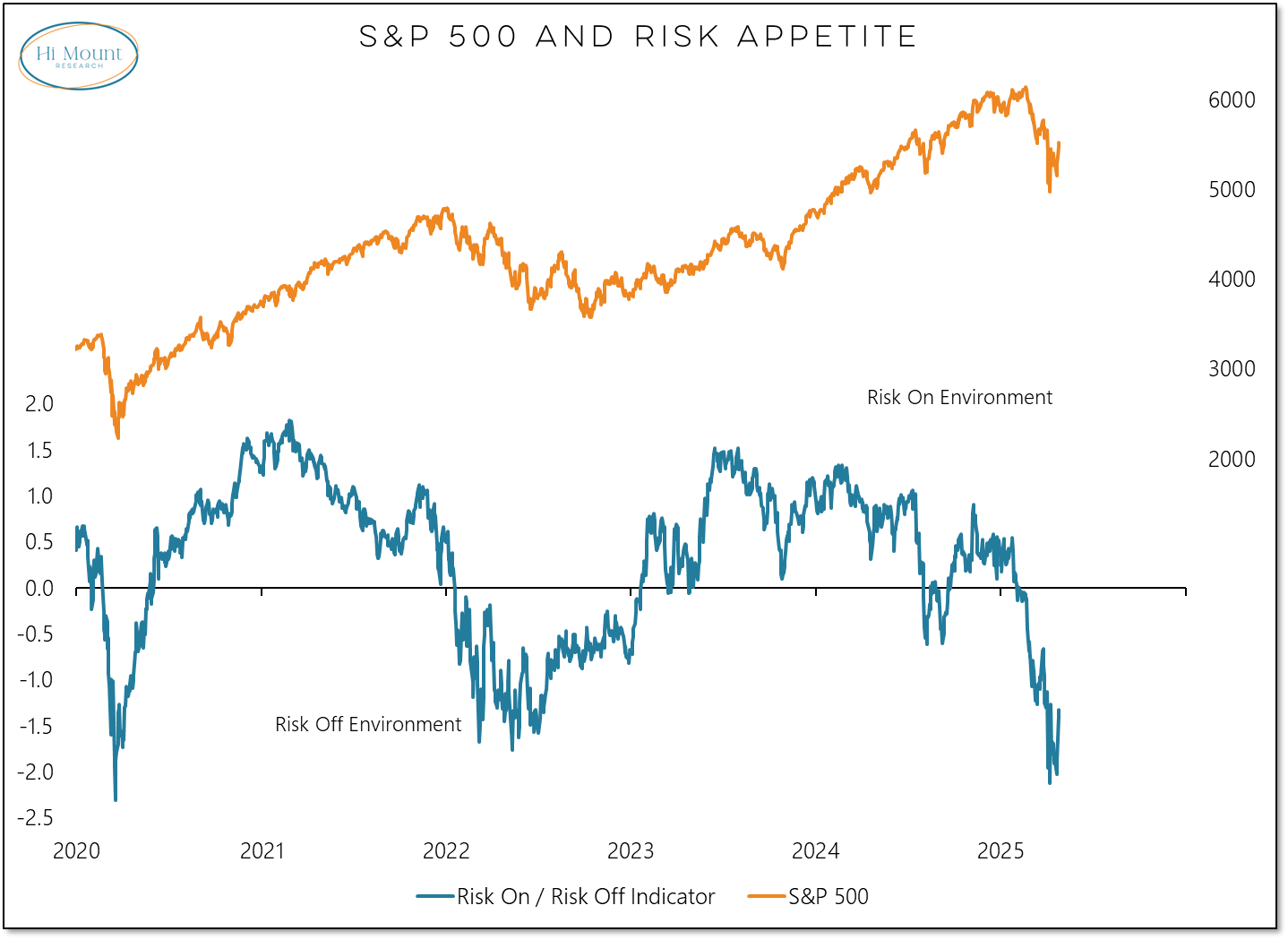

Simply put, despite the big bounce in the S&P 500, the longer-term Risk Off Environment remains intact.

In the wake of last week’s gains, two tactical indicators that we highlighted as supportive of a bounce three weeks ago are now offering a more cautious message.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.