Bulls Not Bothered By Macro-Related Concerns

Market factors favor continued strength from stocks as rally turns doubters into believers

The news environment is noisy - the market environment is not. In fact stocks are as quiet (measured by the number of days since the last 1% swing on the S&P 500) and as strong (measured by the number of days in a row with more new highs than new lows) as they have been all year. Quiet strength is characteristic is bull markets. So are new highs - and that was what we are seeing from the S&P 500.

We are now two months removed from the mid-May Breadth Thrust and stocks are doing what they typically do during breadth thrust regimes. They are moving up and to the right with relatively little overall volatility.

Strong price action and broad rally participation is turning skeptics into believers. More on that below when we discuss Sentiment in the context of the Weight of the Evidence, but remember: it takes bulls to have a bull market. An expansion in optimism at this point is a healthy development and one that supports continued strength in stocks.

While it would be nice to see an expansion in the overall number of stocks making new highs, as long as they don’t contract from here and we don’t see a marked expansion in the number of stocks making new lows, its good enough to keep a smile on our face and keep our “Fear or Strength” tactical model in bullish territory.

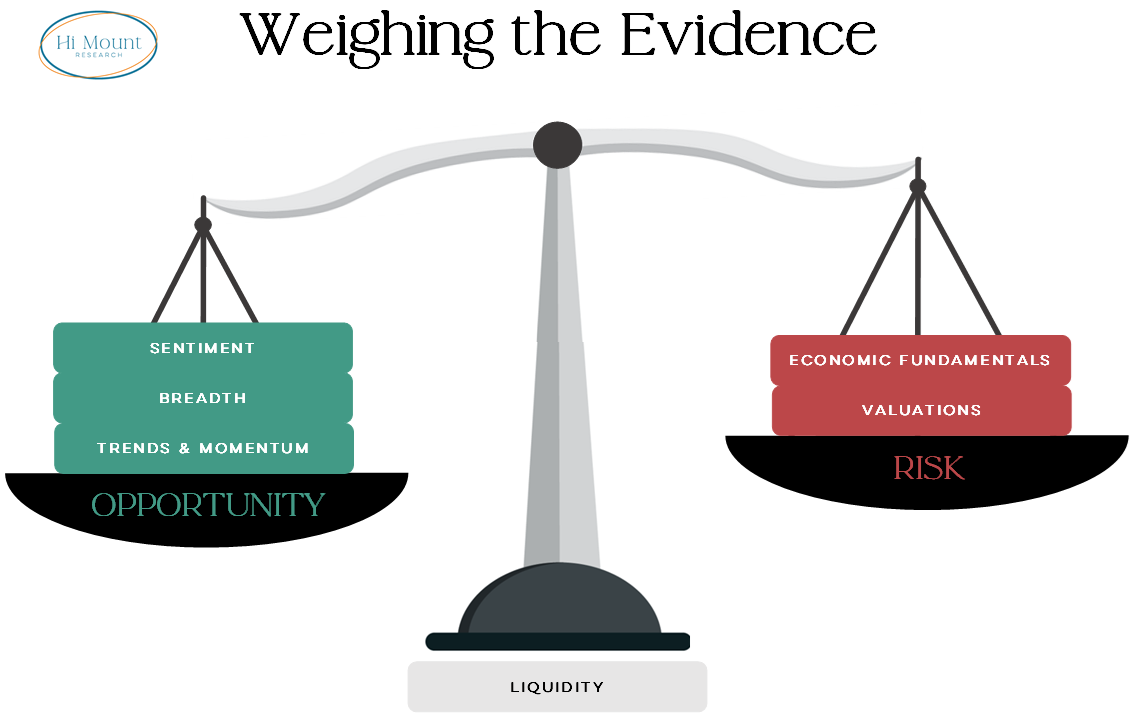

Weight of the Evidence update: with Sentiment improving, all of the Market Factors are on the Opportunity side of the scale and the overall Weight of the Evidence tilts positive:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.