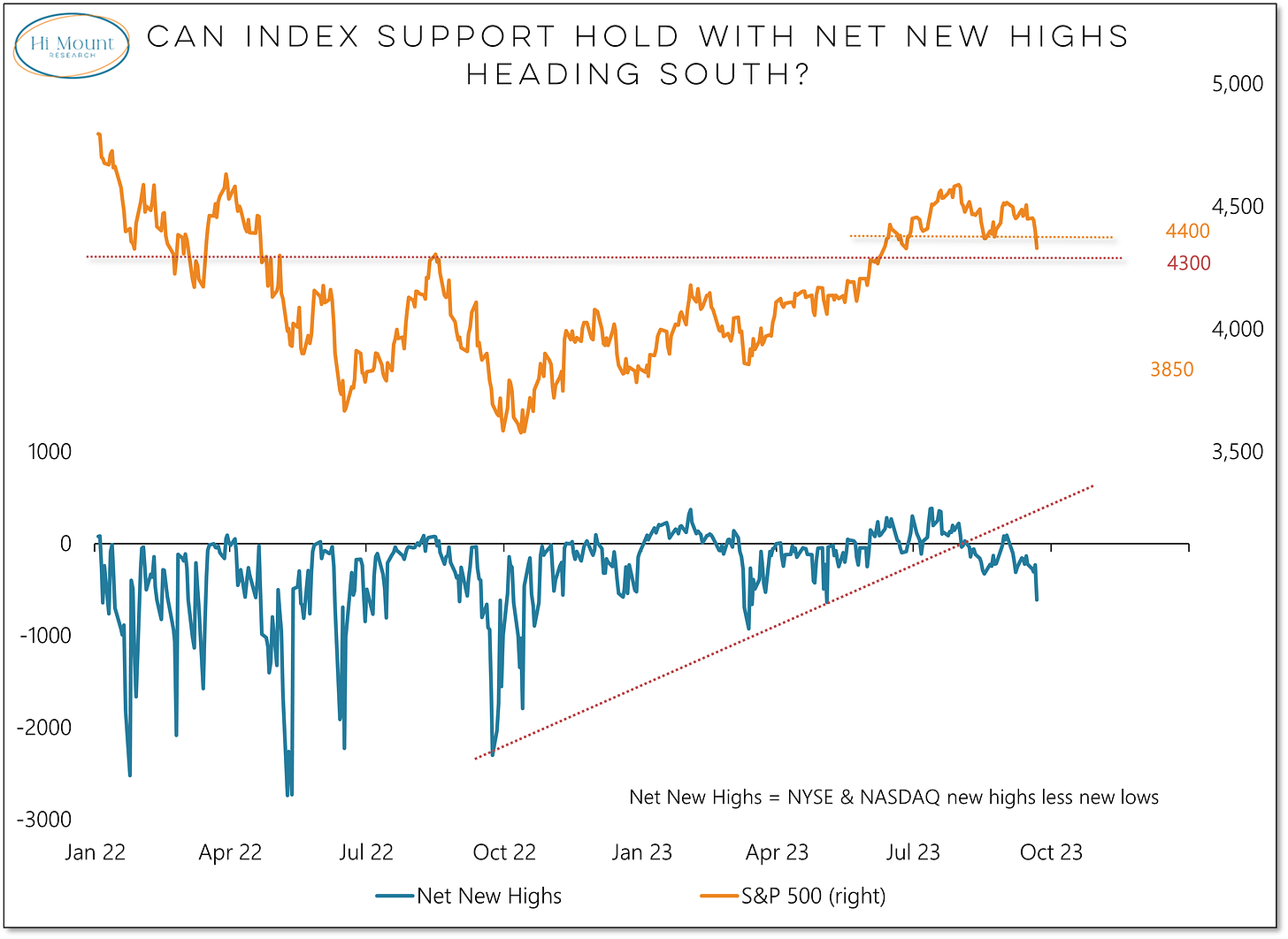

Key Takeaway: New lows are expanding as key indexes have moved to and through support. The mirage of a new bull market has been unable to persist next the reality of shifting secular trend environment for both stocks and bonds.

More Context: Small-caps have never been this weak at the beginning of a new bull market. Micro-caps ($IWC) have gone nowhere over the past three years and are the cusp of their lowest weekly close since 2020. The Value Line Geometric Index closed below the 500 level today for the 67th time in the past 5+ years. Even with the recent weakness, the S&P 500 still clings to a double-digit YTD gain. The median stock in the index, however, is now up less than 1% for the year. The weight of the evidence argues for caution and in the absence of both fear and strength it is not unusual for stock to struggle. In fact, it would be surprising if they didn't.

I had the privilege earlier this week of speaking to the Sheboygan Economic Club, discussing these (and other) recent market developments in the context of a secular trend environment that has shifted for both stocks and bonds. Successful navigation requires adaptability and an awareness of this environment, not a regurgitation of recent narratives.

I recorded a reprise of that presentation for Hi Mount Research subscribers (links to the recording and slide deck are available on the other side of the paywall and can also be accessed via our website).

This is what I covered:

These were the summary takeaways from that talk and the current message from a cyclical and tactical perspective:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.