Broad Support Provides A Boost As Leaders Stumble

New leaders are waiting in the wings as former higher fliers stall

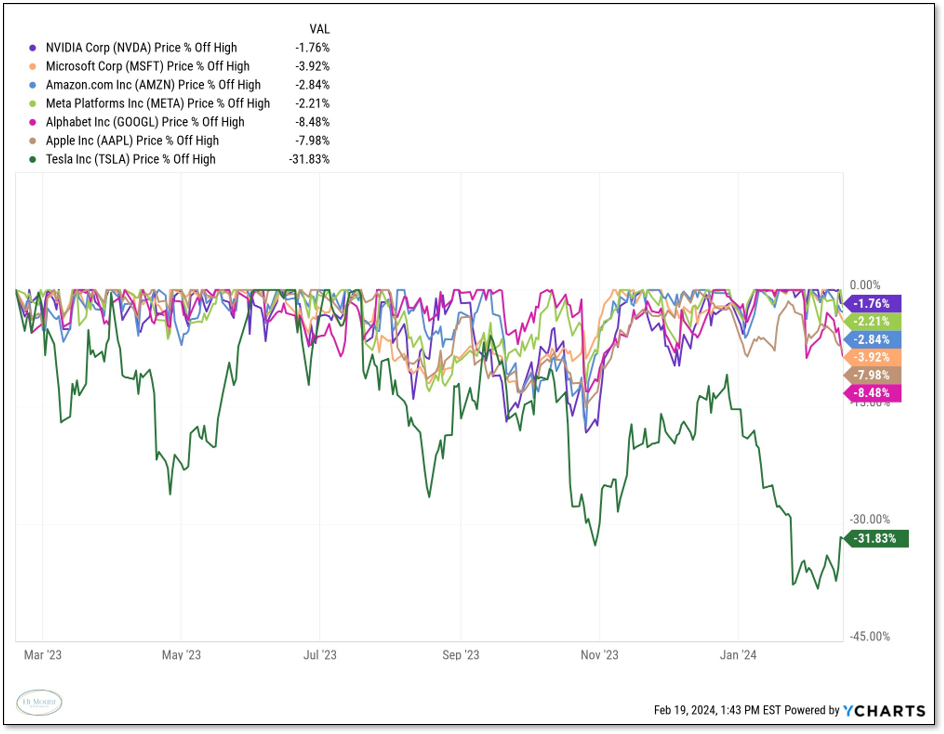

What: The Magnificent Seven are coming under pressure. One ($TSLA) has already come under significant pressure and two more ($AAPL and $GOOGL) are approaching double-digit drawdowns. If breadth were weak, this would be a serious problem for the market. Fortunately, that is not the case.

So What: While former higher fliers are struggling, the rest of the market is not stumbling. Last week produced breakouts in the equal-weight S&P 500, the Broker/Dealer Index and the German DAX. When all three of these areas are making new highs, the S&P 500 is probably not headed for trouble.

Now What: Given the rotation away from mega-cap leadership (and their impact on cap-weighted rankings), looking at relative strength ranking from an equal weight basis makes more sense. Industrials, Health Care and Financials (all of which made new highs last week) stand out as opportunities from a sector perspective

Portfolio Applications subscribers can click through to download the latest Relative Strength Rankings (and also see the asset allocation implications of the long-term trend in the Bonds/Commodities ratio turning toward Commodities).

Finally, while volatility tried to return last week, it was short lived - the VIX moving from 13 to 16 is hardly more than a blip on chart. Strength persists and our Fear or Strength model remains positive.