Broad Strength Consistent With Ongoing Bull Market

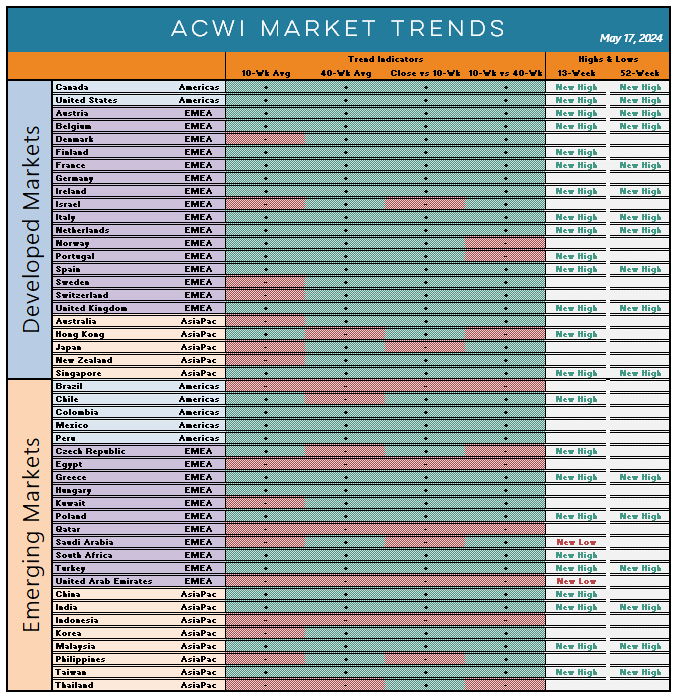

Global equity market leadership is moving away from the US

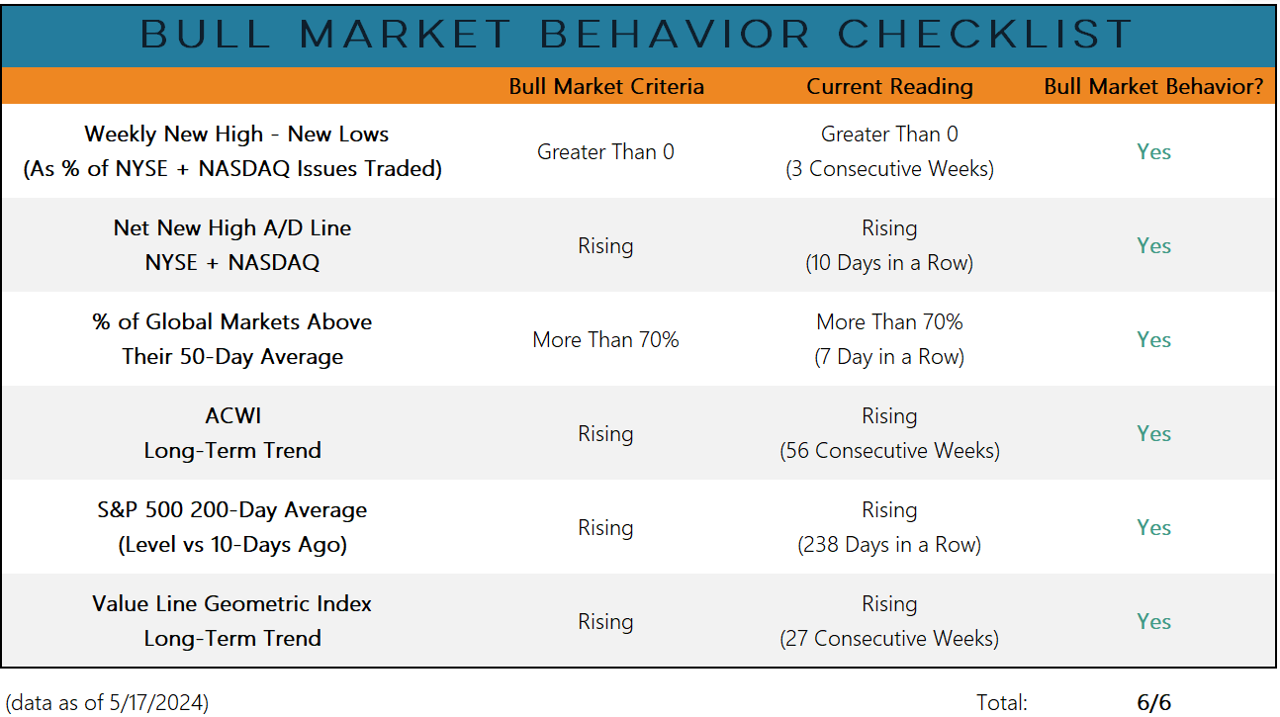

Key Takeaway: New highs are expanding around the world as the May rally has brought back quiet strength and bull market behavior.

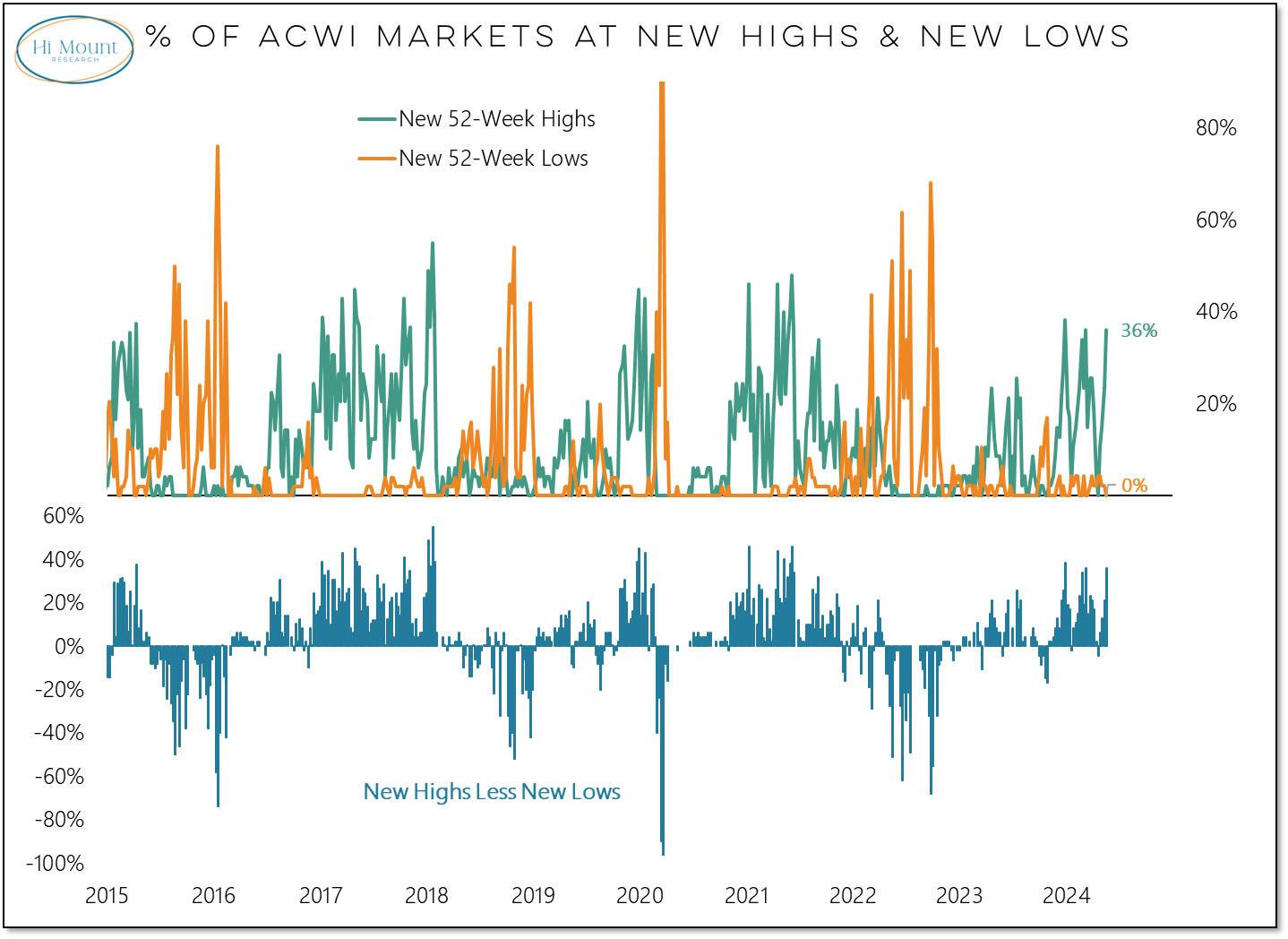

A month ago, more country-level indexes were making new lows than new highs. Now, the global new high list is about as high as it has been since mid-2021.

New highs can be found in almost every corner of the world.

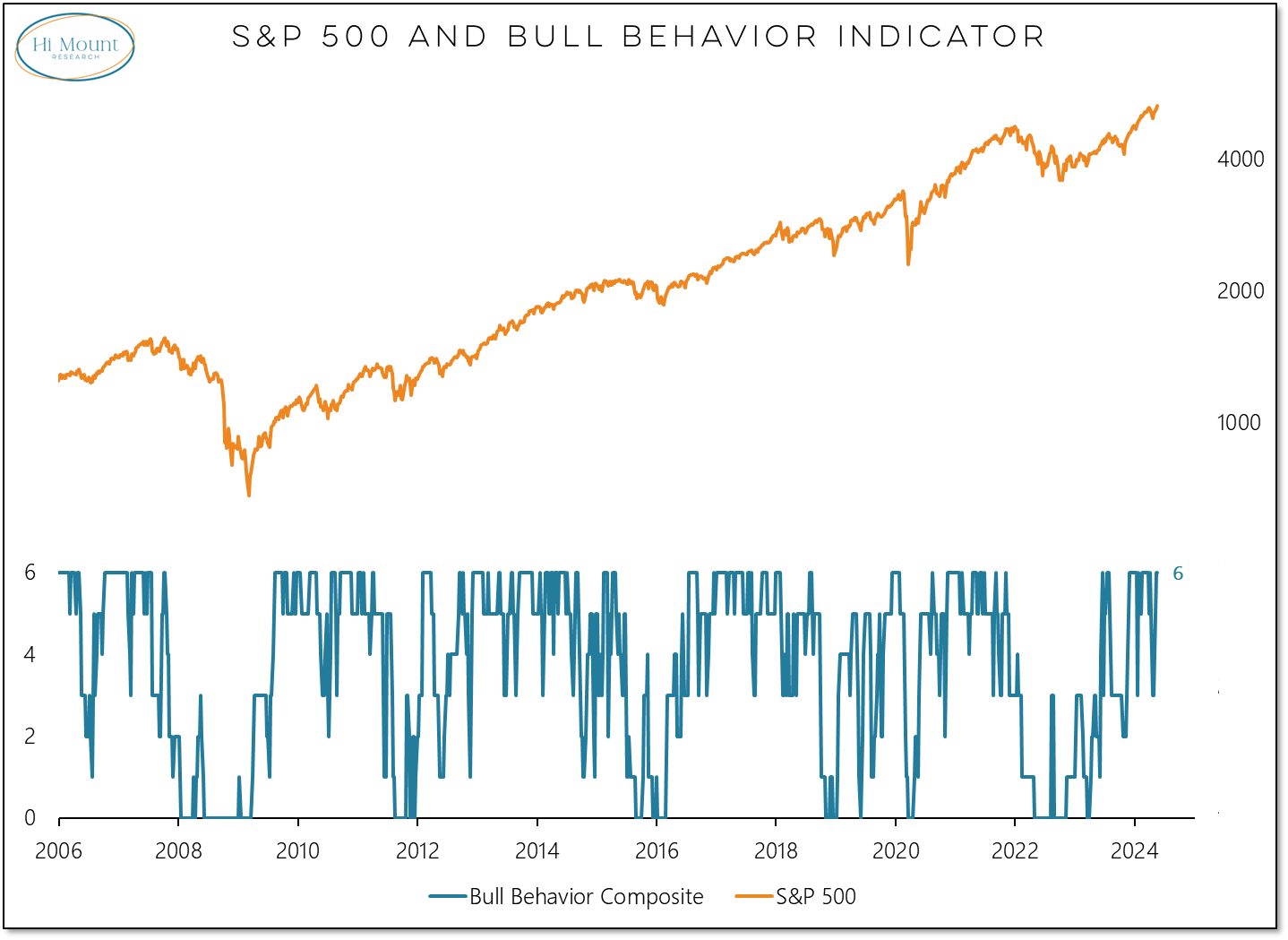

Our global relative strength rankings show that US leadership is slipping, but this is a function of global strength, not US weakness. Our Bull Market Behavior Checklist (which includes both US and global indicators) is back to 6 out of 6.

While selling in April dented the breadth components, it failed to turn the price trend components. It is difficult to hurt a bull market when the bull behavior composite does not breakdown.

One fly in the ointment is that while price and breadth move to new highs, the trend in earnings revisions continues to roll over. It would be easier to sustain price strength if sell-side analysts were having raise their estimates to catch up to reality:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.