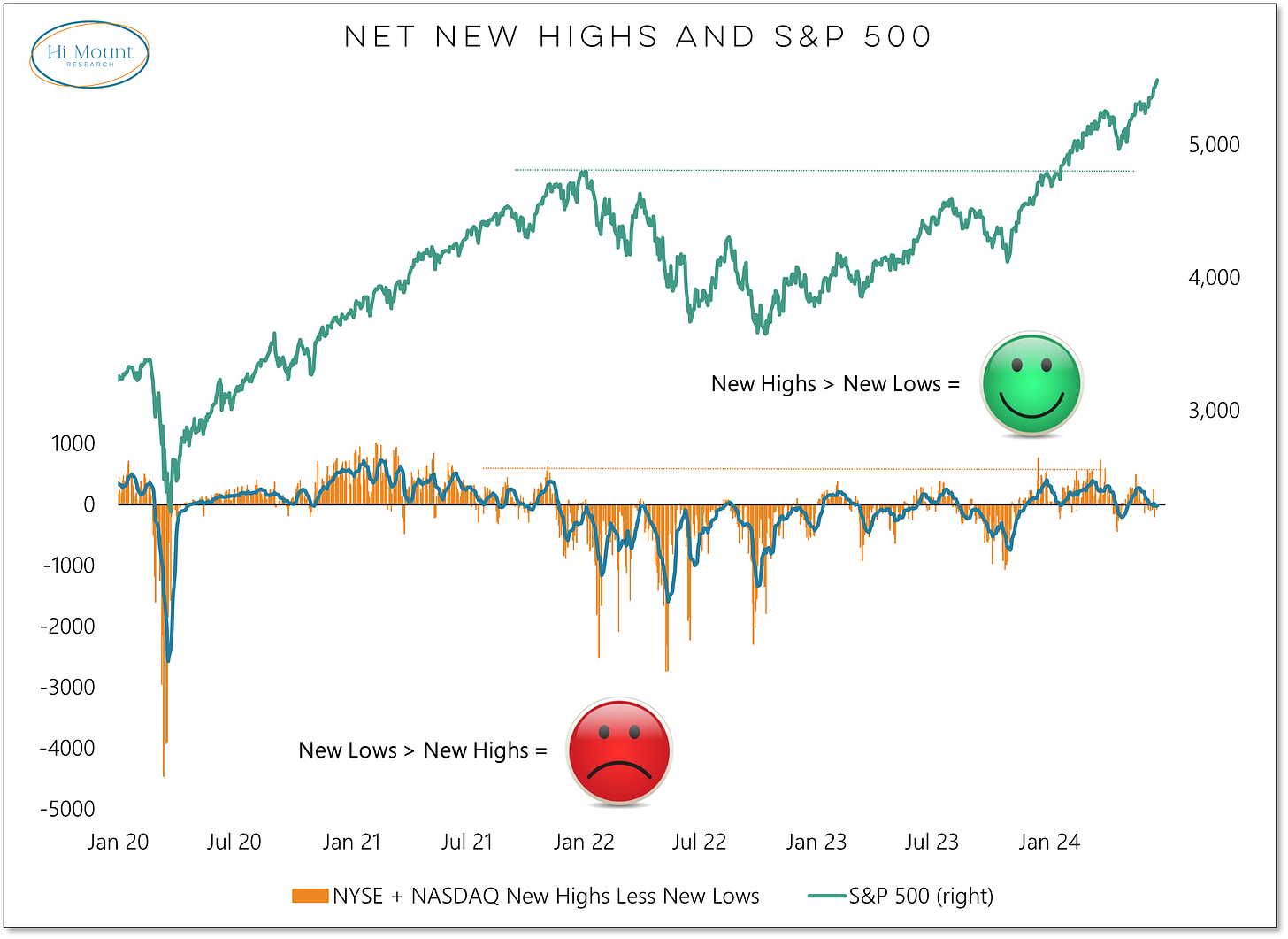

Broad Market Strength Evaporates

Index-level up trends are intact, but history suggests that aggregate upside is limited (and volatility increases) when new lows persistently outnumber new highs.

Portfolio Applications Update: We have made the following changes to our Dynamic Tactical Opportunity Portfolio: sold EZU (Eurozone), added to SOXX (Semiconductors) and reduced exposure to PDBC (Commodities). Subscribers can read about the rationale and see the current portfolio weightings here.

Key Takeaway: Mega-caps have powered the S&P 500 to new highs, but beneath the surface our Fear or Strength model has turned negative.

The S&P 500 has closed at a new all-time high seven times so far in June. In all but one of those instance new highs for the index were accompanied by more stocks (on the NYSE+NASDAQ) making new lows than new highs. That is a sharp contrast from the new all-time highs that emerged in Q1 and does not put a smile on our face.

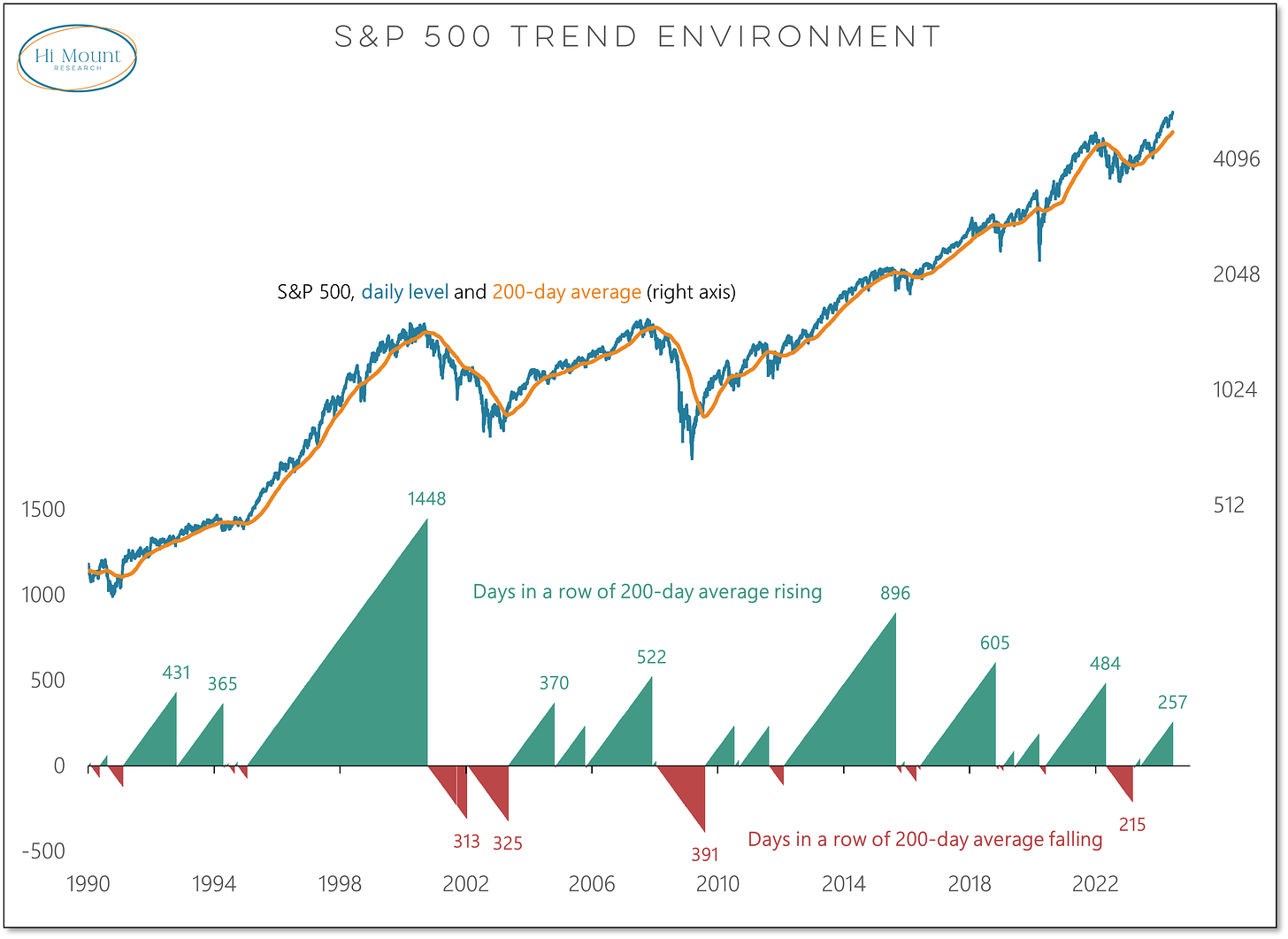

While breadth has broken down, the cyclical price trend remains bullish. The 200-day average for the S&P 500 has been rising continuously for more than a year.

History suggests that aggregate upside is limited and volatility increases when new lows persistently outnumber new highs.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.