Breadth Thrust Backdrop Guiding Stocks Higher

Weight of the Evidence tilts toward Opportunity despite macro concerns

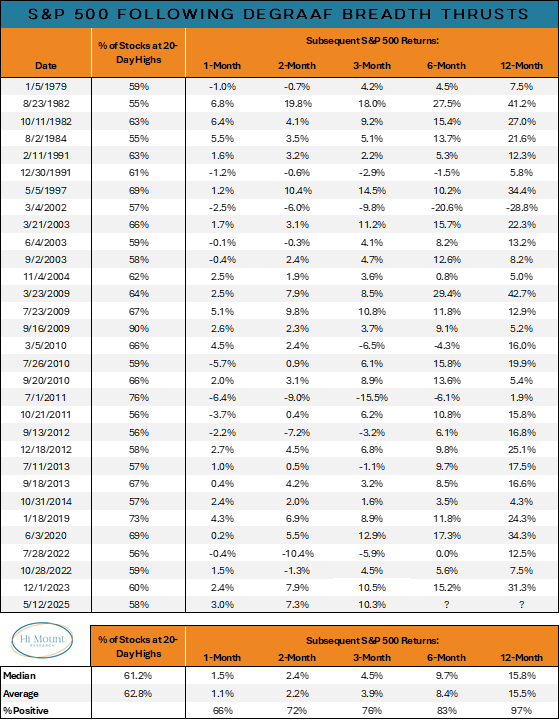

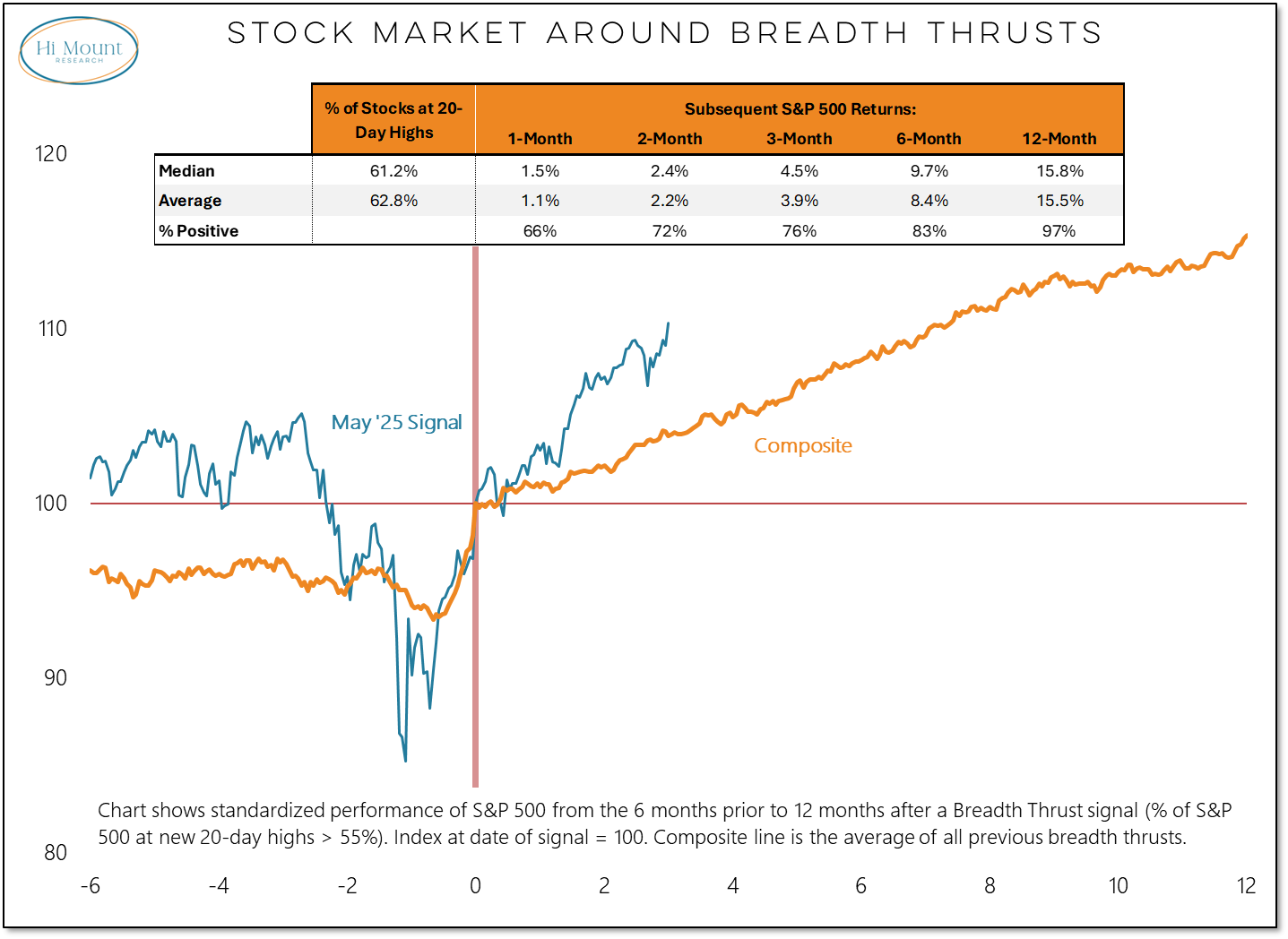

It has been three months since the May spike in the number stocks making new 20-day highs signaled a breadth thrust. Since then, the S&P 500 has rallied over 10%, running well-ahead of the long-term average but roughly matching the experience following the prior breadth thrust in December 2023.

If the historical pattern holds, the S&P 500 is likely to continue to drift up and to the right (with relatively little downside volatility) as we move toward 2026.

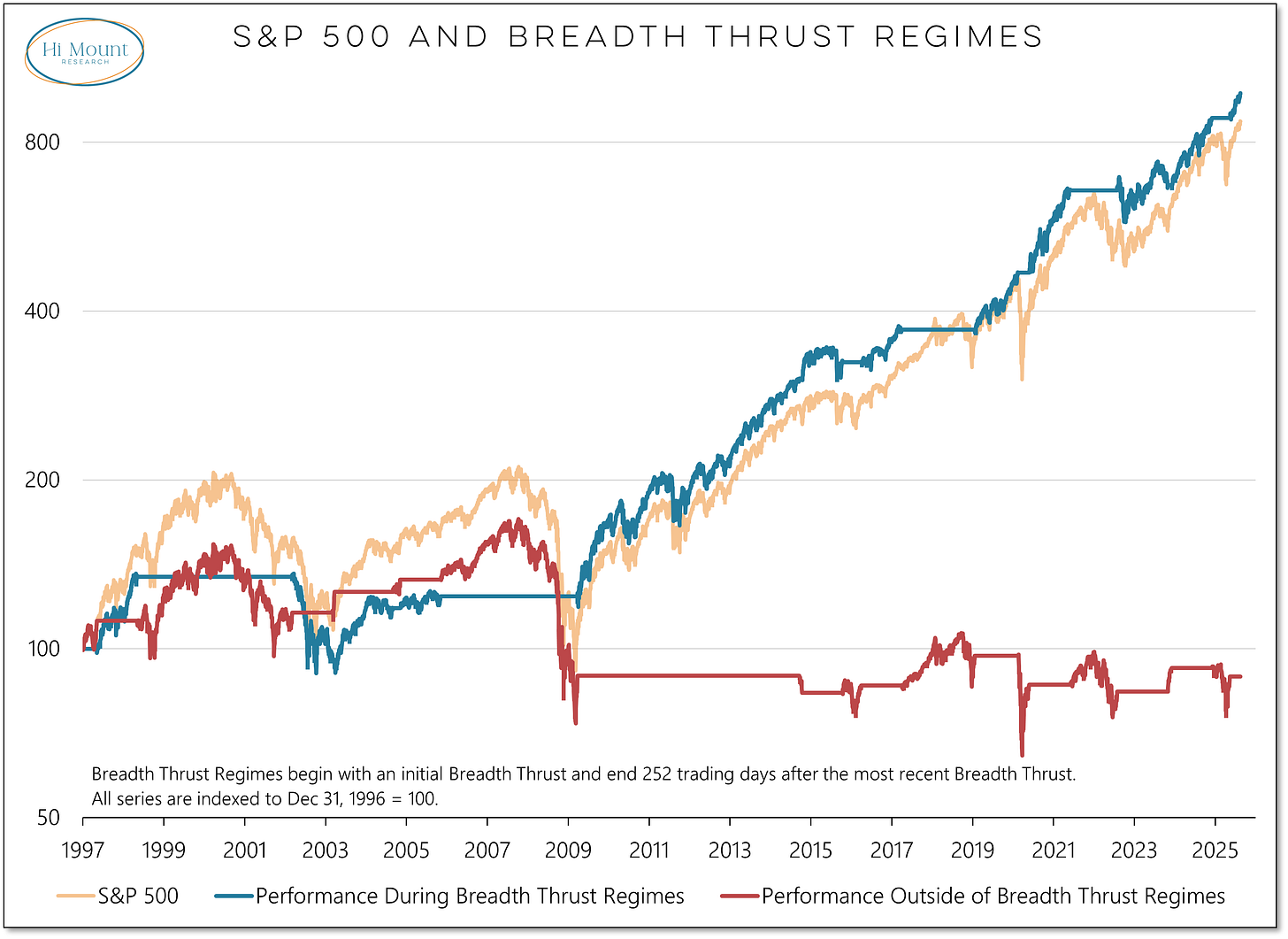

All the net gains for the S&P 500 (and then some) since the late 1990s have come within the year following a breadth thrust.

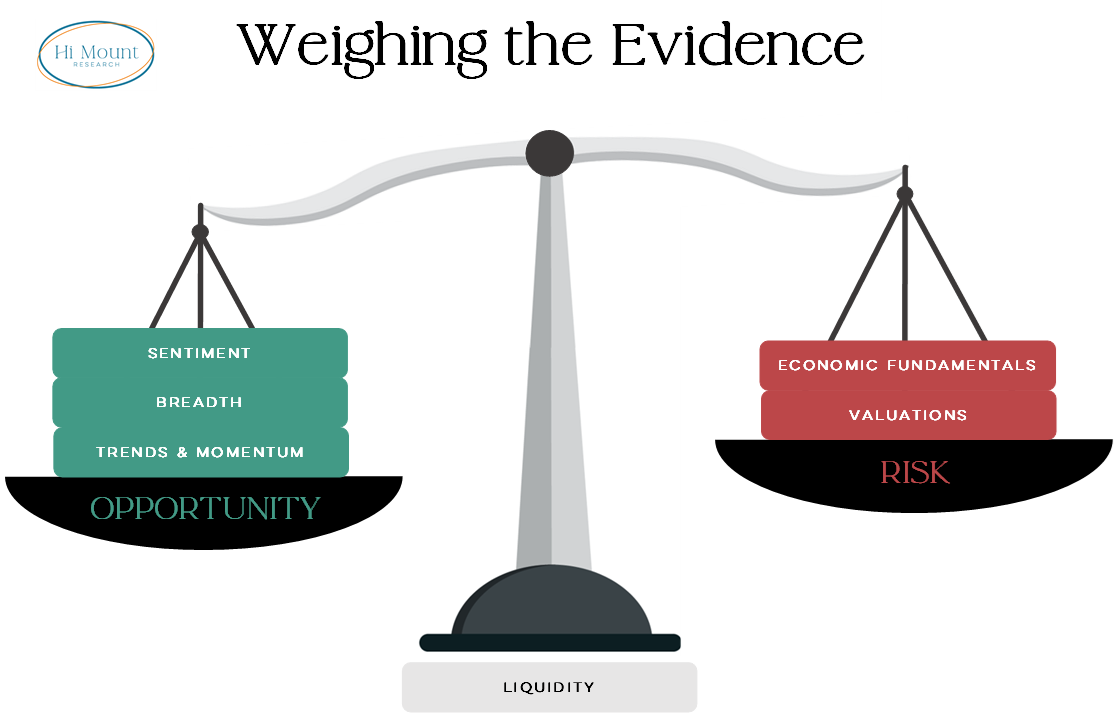

That these breadth thrust regimes provide a bullish backdrop for stocks is unquestioned. But we still want to weigh the current evidence as we consider the balance between Risk and Opportunity.

While the weight of the evidence currently tilts bullish and is in harmony with the historical pattern during breadth thrust regimes, last week’s market action was not without a warning that stocks could be due for a pause before resuming their upward trajectory. We’ll get to that after first taking a closer look at the Weight of the Evidence.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.