Breadth Struggles As Yields Continue To Surge

Poor participation and deteriorating liquidity have risks outweighing opportunity as 2025 kicks into high gear.

Key Takeaway: The percentage of stocks in up-trends continues to contract as bond yields break higher. While investors remain optimistic overall, the weight of the evidence now argues for caution.

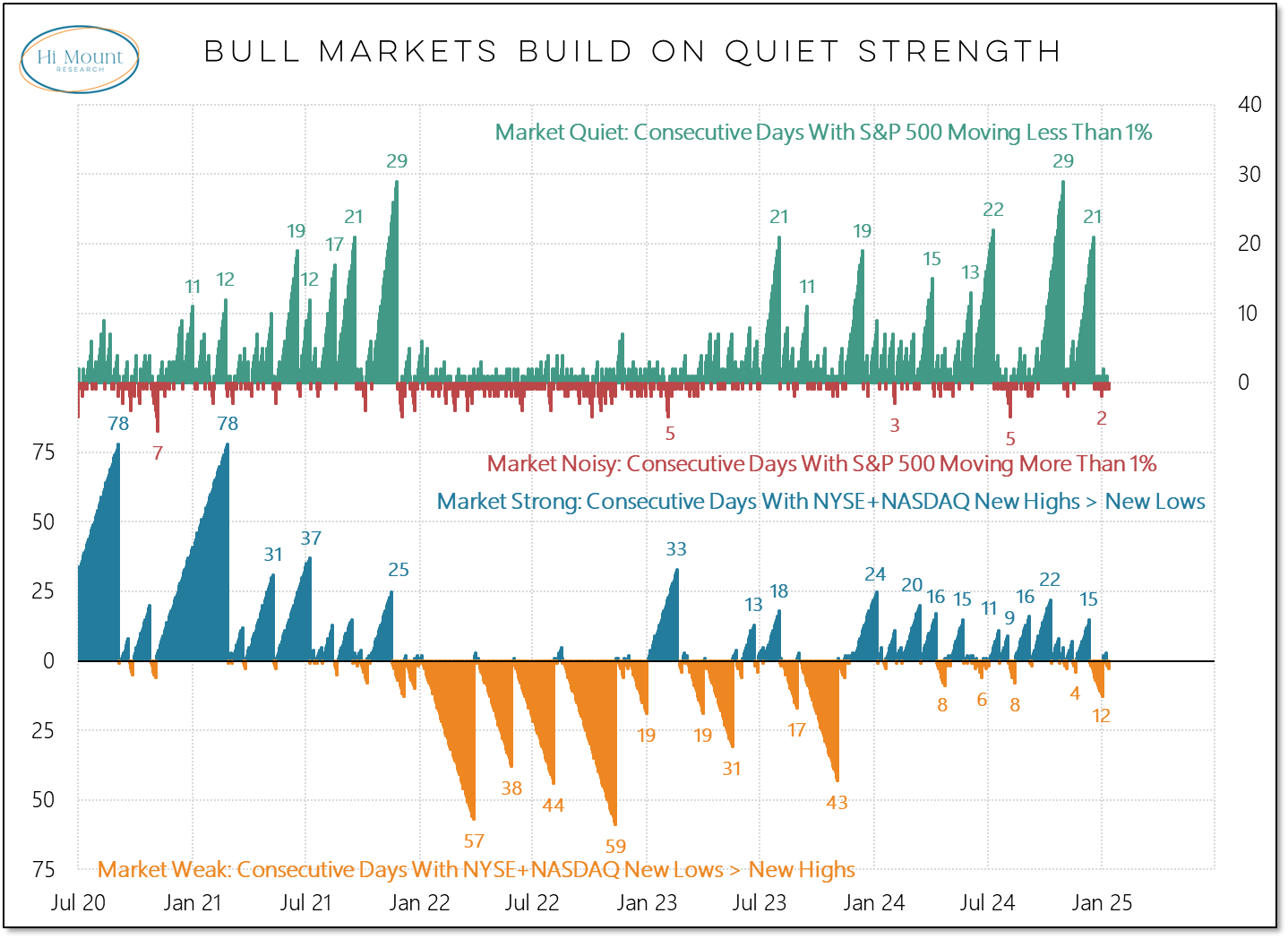

The first half of December was marked by a historic run of days with more stocks down than up, and since then market action has been characterized by noisy weakness.

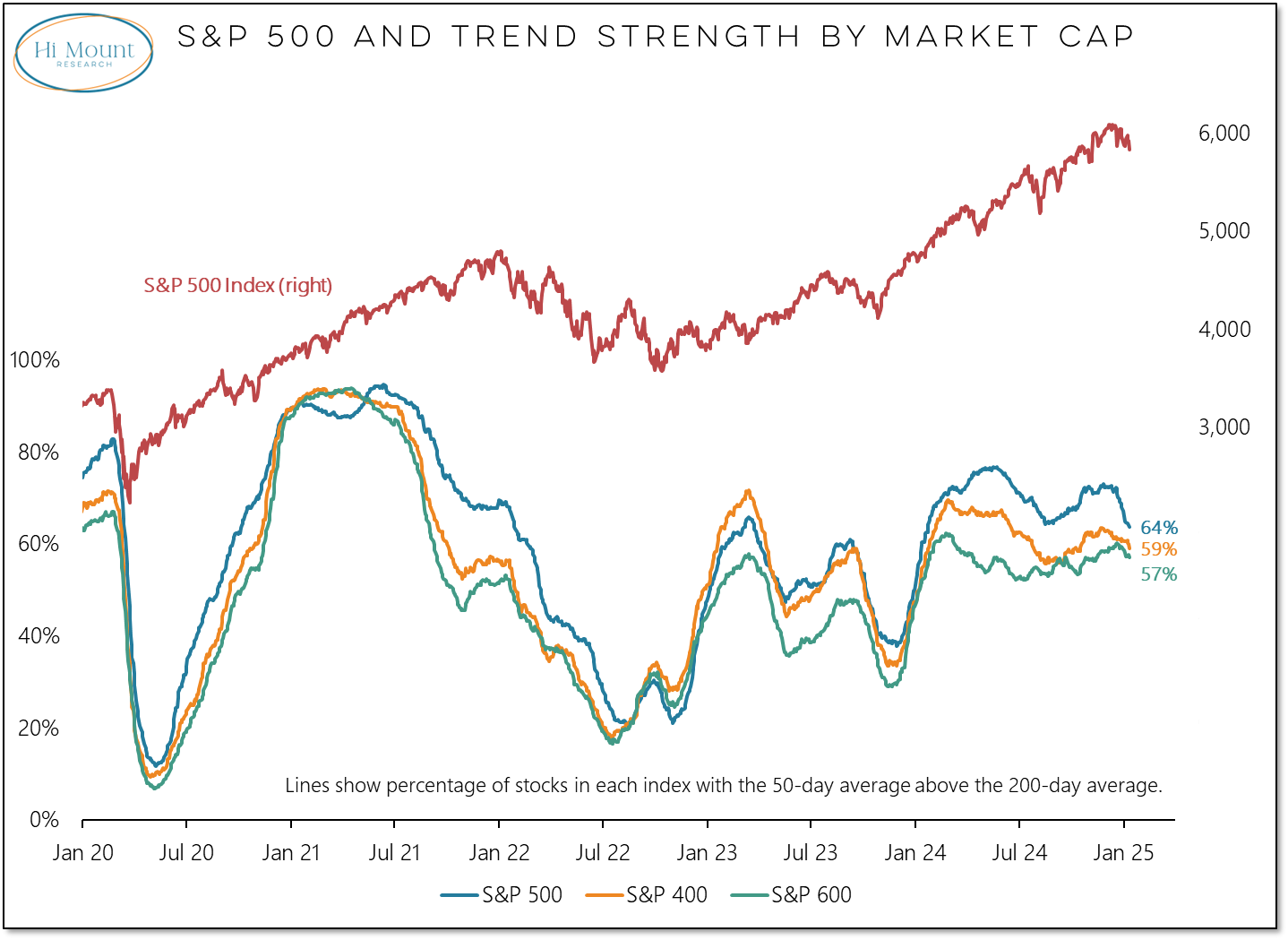

The quiet strength that was prevalent for much of 2024 is now a footnote of history. As 2025 gets in gear, the percentage of stocks still in uptrends is shrinking and the median stock in the S&P 500 is rapidly retreating from its 2024 peak.

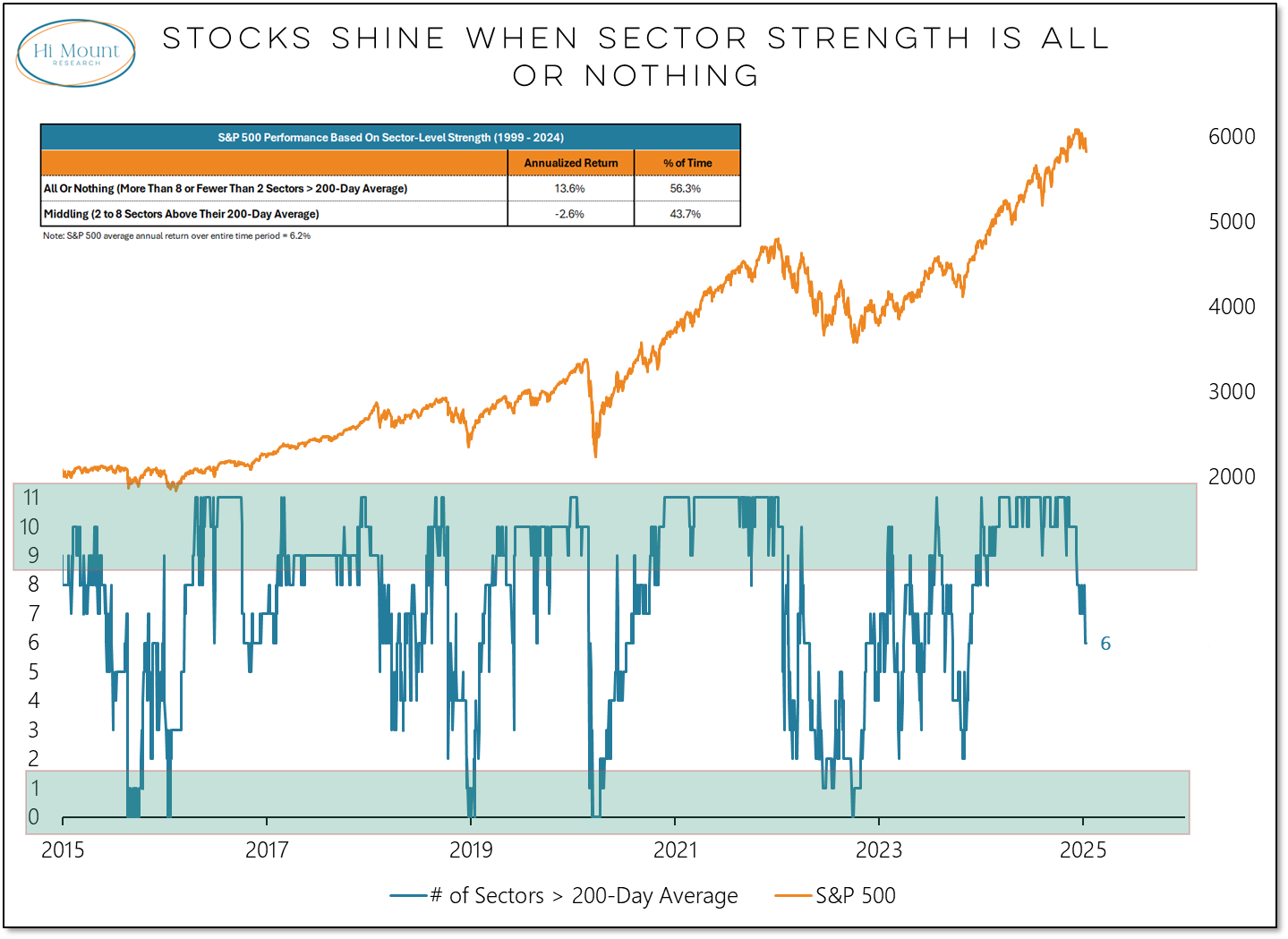

Weakness at the stock level is rising up to the industry group and sector level. The percentage of industry groups making new 13-week lows is surging and the percentage of groups that are above their 10-week averages has collapsed. The net effect is that the drop in the number of sectors still above their 200-day averages is consistent with an overall index that struggles just to tread water.

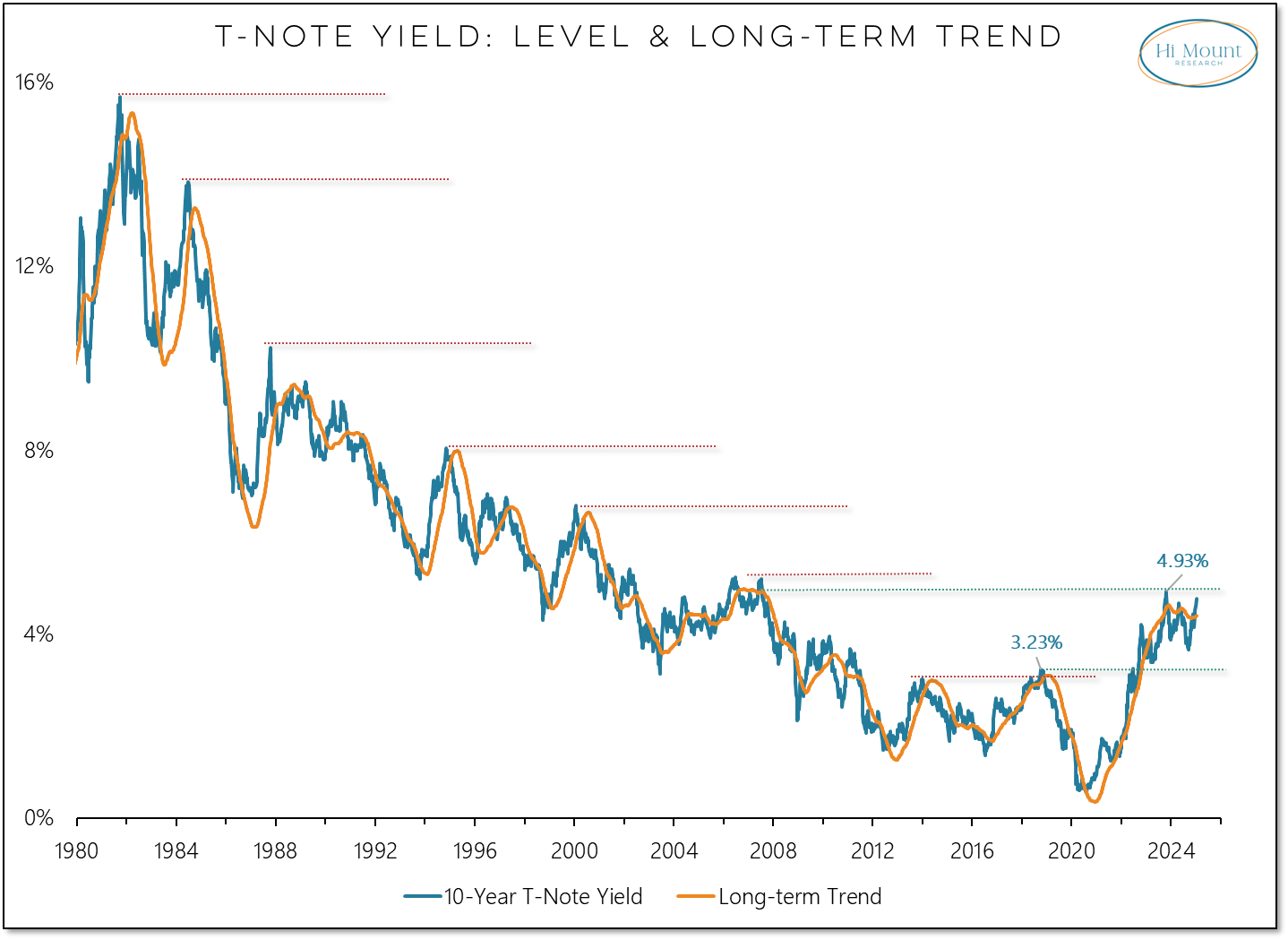

While breadth is breaking down, bond yields are breaking out. The path of least resistance for bond yields is higher and the 10-year T-Note yields is moving toward 5%. There is is part of a decisive change in character in the bond market in recent years (where higher highs have replaced lower lows).

We break down breadth, liquidity and more our January Weight of the Evidence update.

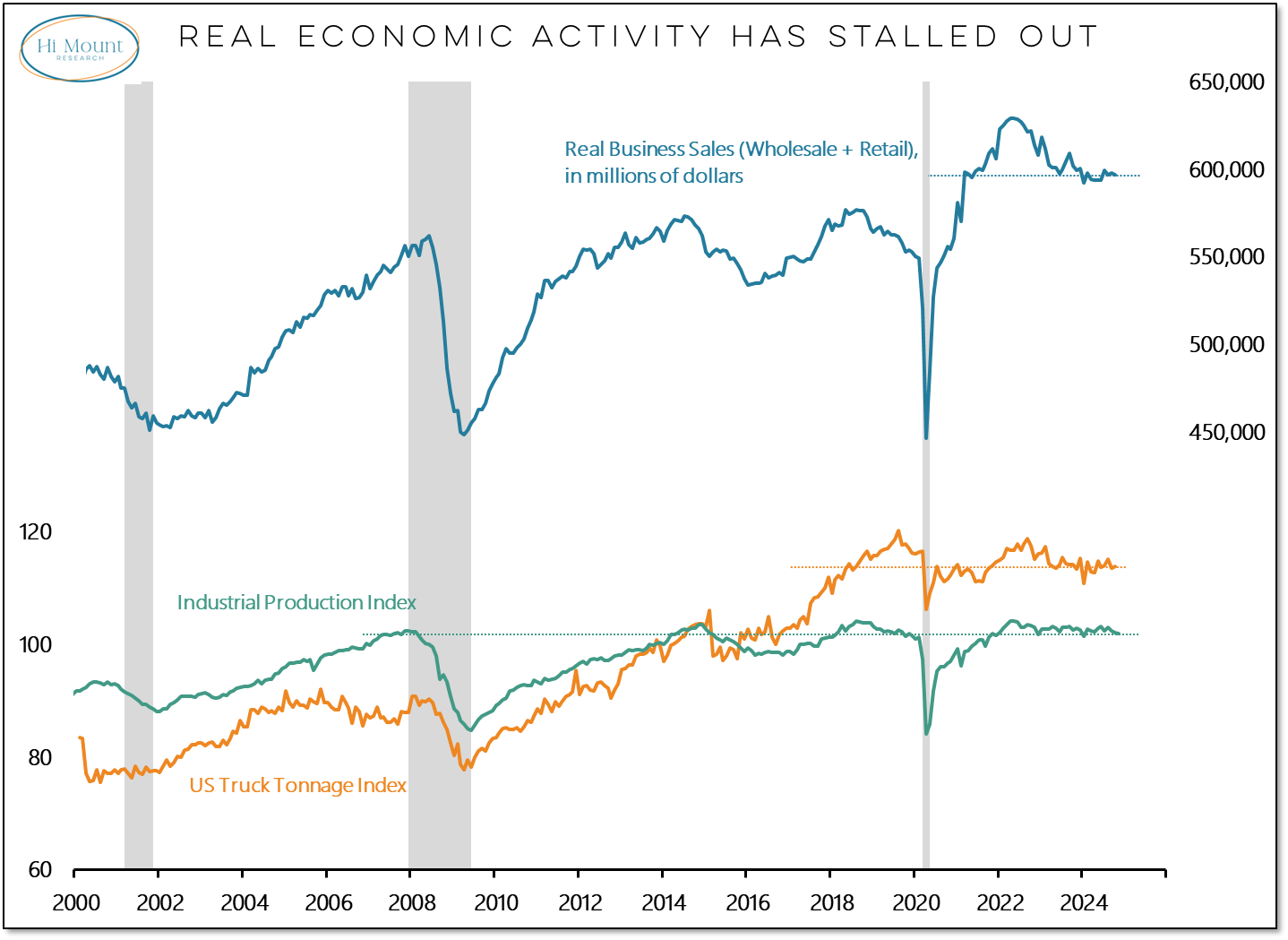

Economic Fundamentals note: Over the past 18 months, the economy has shed 1.3 million full-time workers (and yet somehow created 3.5 million new jobs). Real business activity is struggling to make progress. Business sales have are no higher than they were three years ago, while truck shipments are at pre-COVID levels and industrial production is no higher than it was prior to the 2008-09 Financial Crisis.

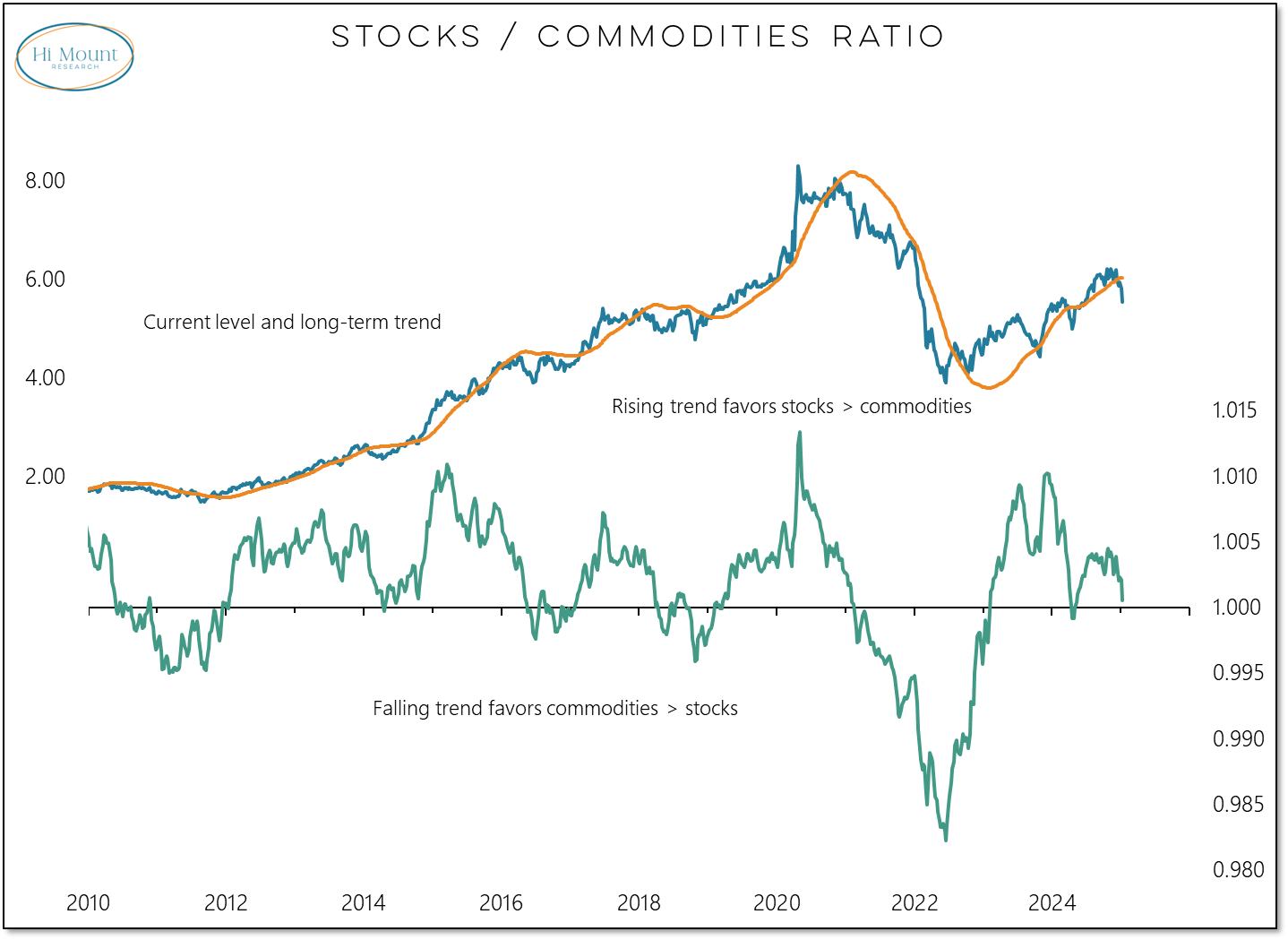

Asset Allocation note:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.