Breadth Is An Anchor, But Not The Only Thing Weighing On Stocks

The lack of fear and downturn in earnings revisions add to the headwinds for equities

Key Takeaway: The median stock in the S&P 500 is making new YTD lows. The absence of fear and the earnings revision trend rolling over are likely to keep downward pressure on stocks even as many hang their hopes on better seasonal trends.

The S&P 500’s YTD return is well off its summer highs but is still above its early year peak. The YTD return for the median stock, however, is hitting a new low.

The VIX is off its lows and has made some forays above 20 but fear is still conspicuous by its absence. Over the past two-plus years, the S&P 500 has rallied 20% when the VIX has been above 28.5 and has fallen 20% when it has been below that level.

Rallies are sown in fear and while bull markets are fertilized with optimism and increasingly broad participation. Right now the market looks like fallow ground. Don’t be shy about being patient and waiting for the situation to improve.

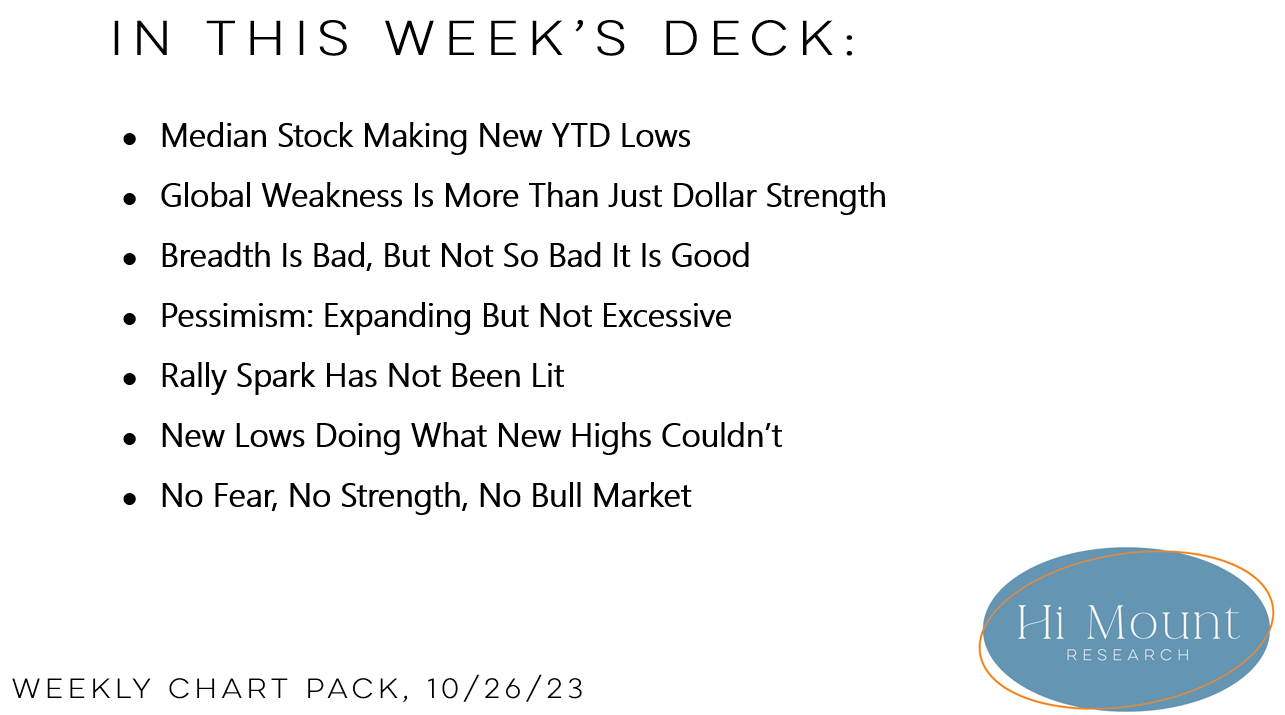

We dig into the latest developments and continuing themes in this week’s chart pack.

Paid subscribers can download the charts/commentary.