Breadth Building A Bullish Case

The weight of the evidence is back in balance as market technicals improve but macro challenges persist

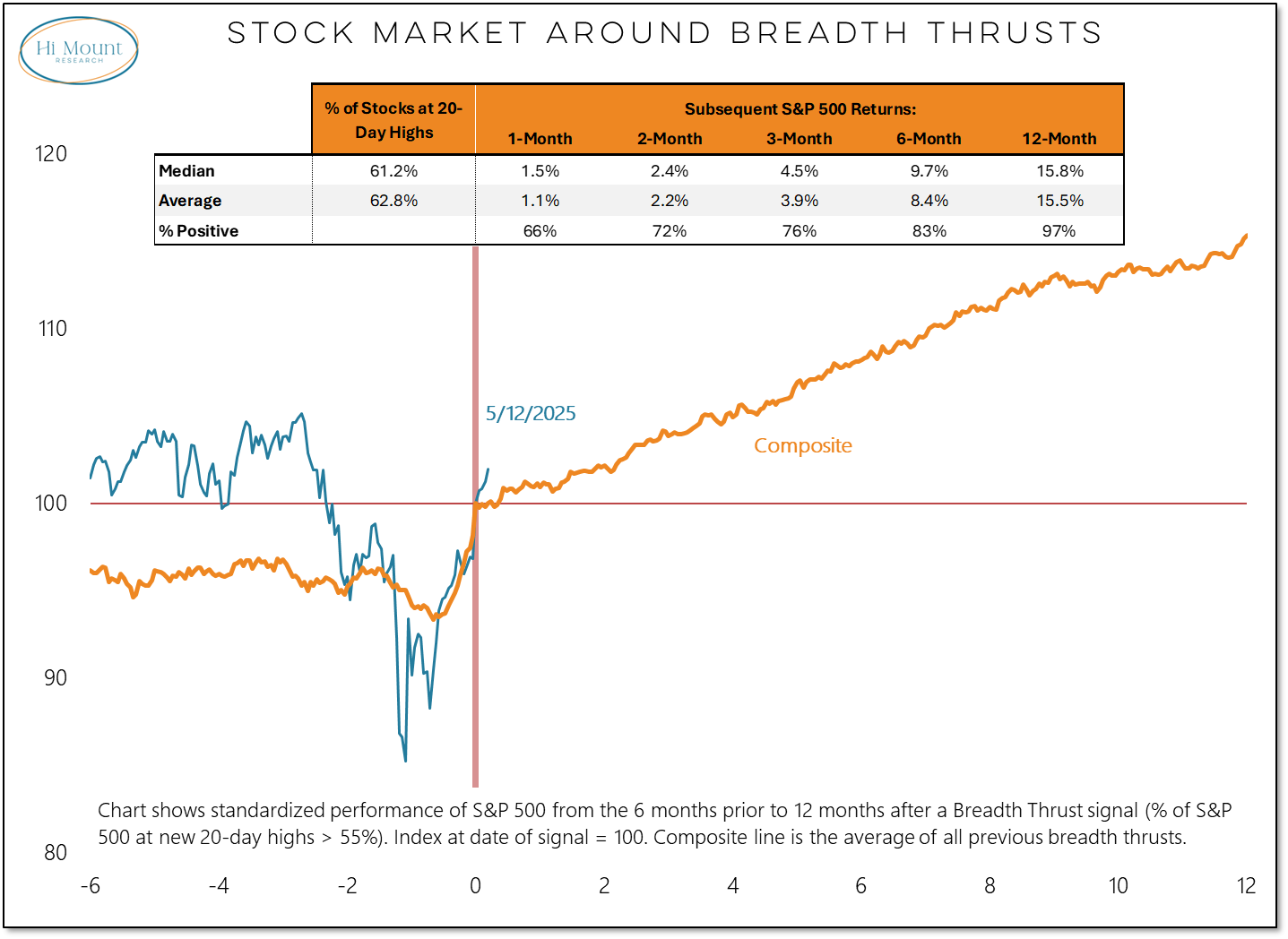

Last week began with breadth thrust and ended with a US debt downgrade. These bookends perfectly encapsulate the current dynamics in the financial markets. The technical backdrop for equities has improved substantially over the past month while macro conditions continue to create a challenging environment. Historically, stocks do very well in the wake of breadth thrusts (more on this in a moment). At the same time, historically do quite poorly when bonds yields are pushing higher (30-year Treasury yields are at a level rarely seen in the past 2 decades).

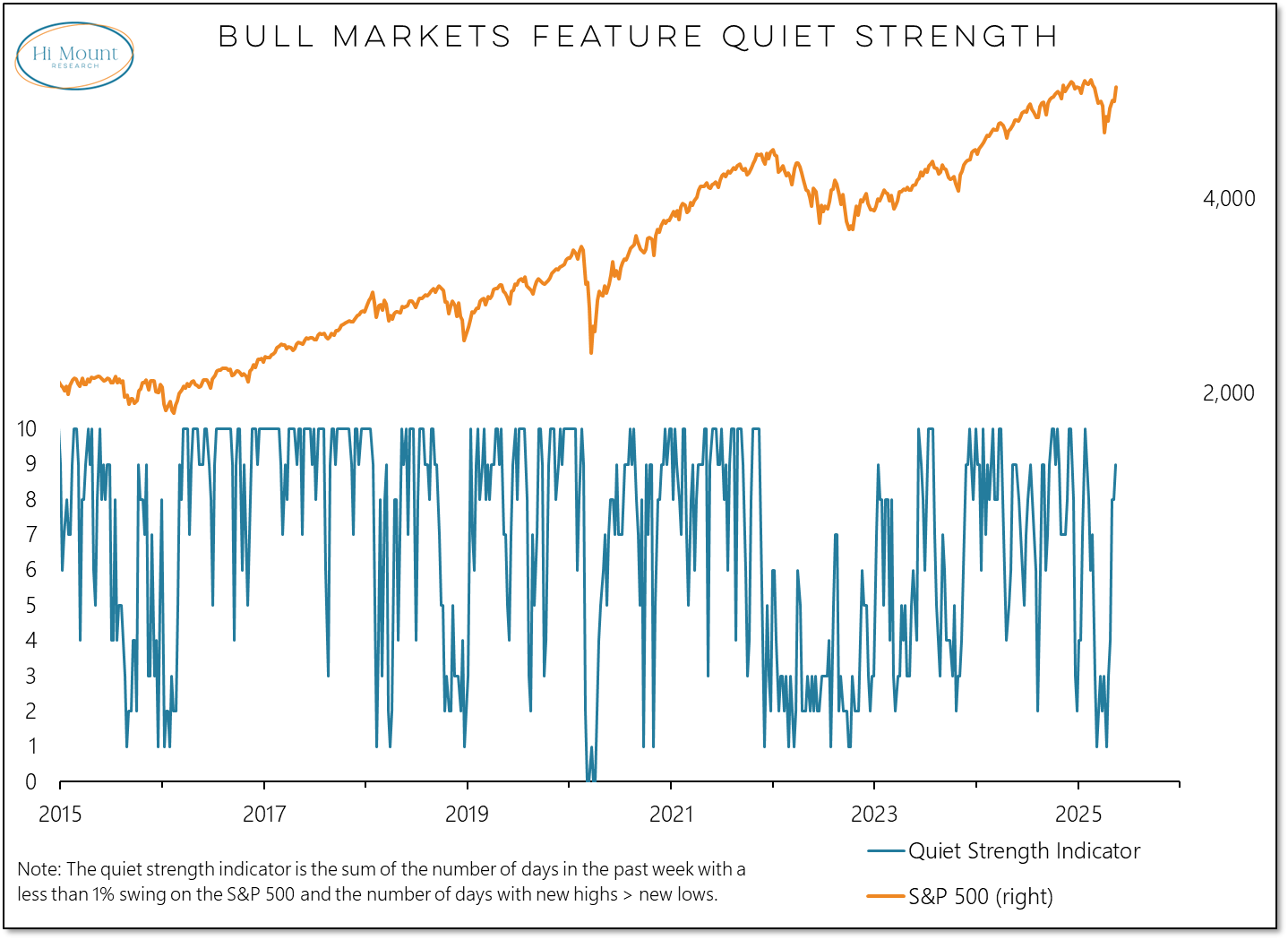

If you missed it, last Monday’s stock market surge produced a spike in new 20-day highs on the S&P 500 and a related breadth thrust (the first since December 2023). Last week’s breadth thrust came after a significant bounce off the lows, but, unlike the majority of previous breadth thrusts, was not accompanied by a new 6-month high in the index. Either way, breadth thrusts overall tend to be followed by a year of consistent, quiet strength (we label these periods Breadth Thrust Regimes) and pullbacks that are limited in degree and duration.

The re-emergence of quiet strength in recent weeks has been an encouraging development and its persistence would be evidence of a healthier balance between risk and reward.

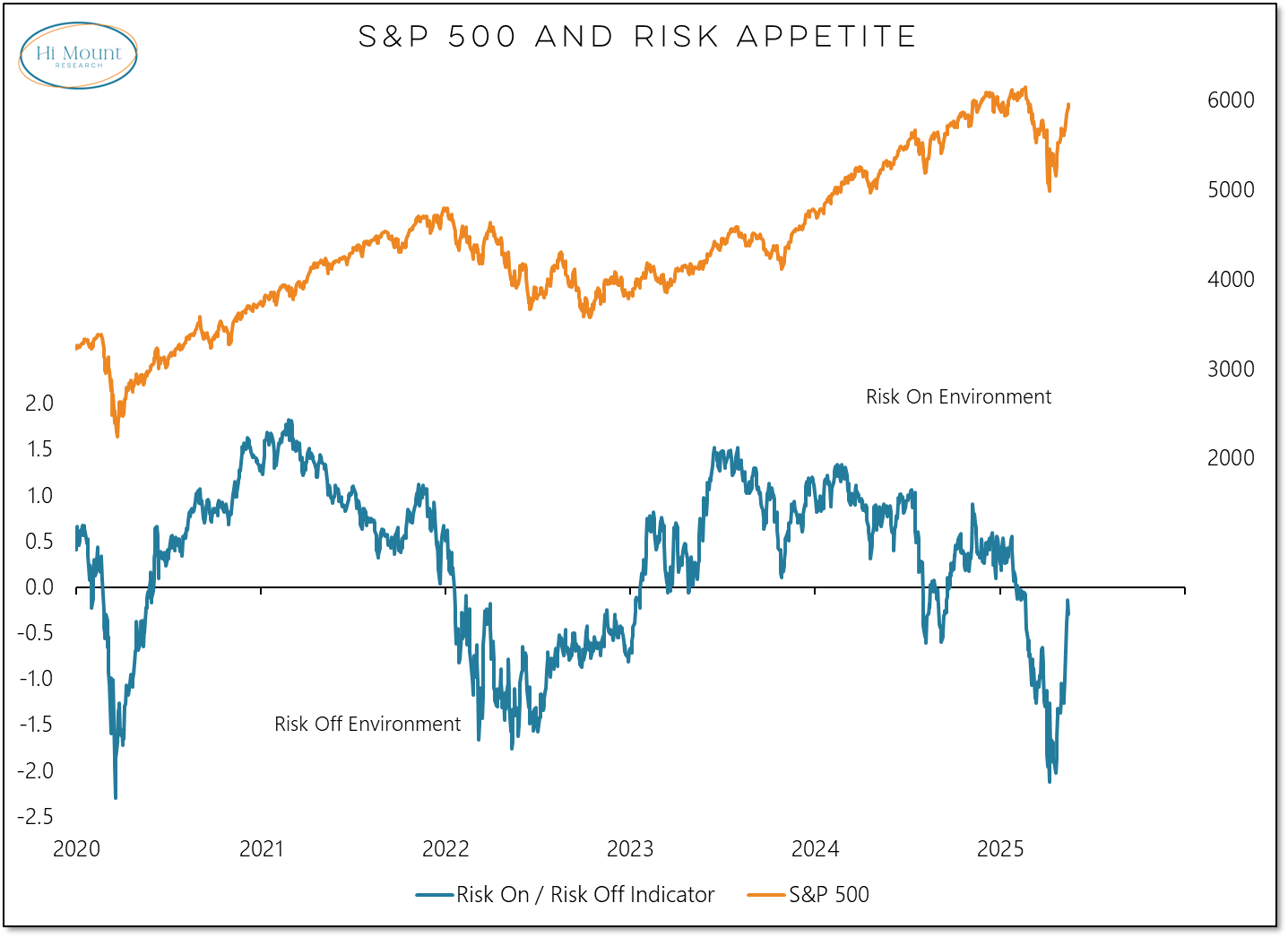

We are also seeing an improved appetite for risk with our risk-on/risk-off indicator approaching balance and on the cusp of returning to Risk On territory.

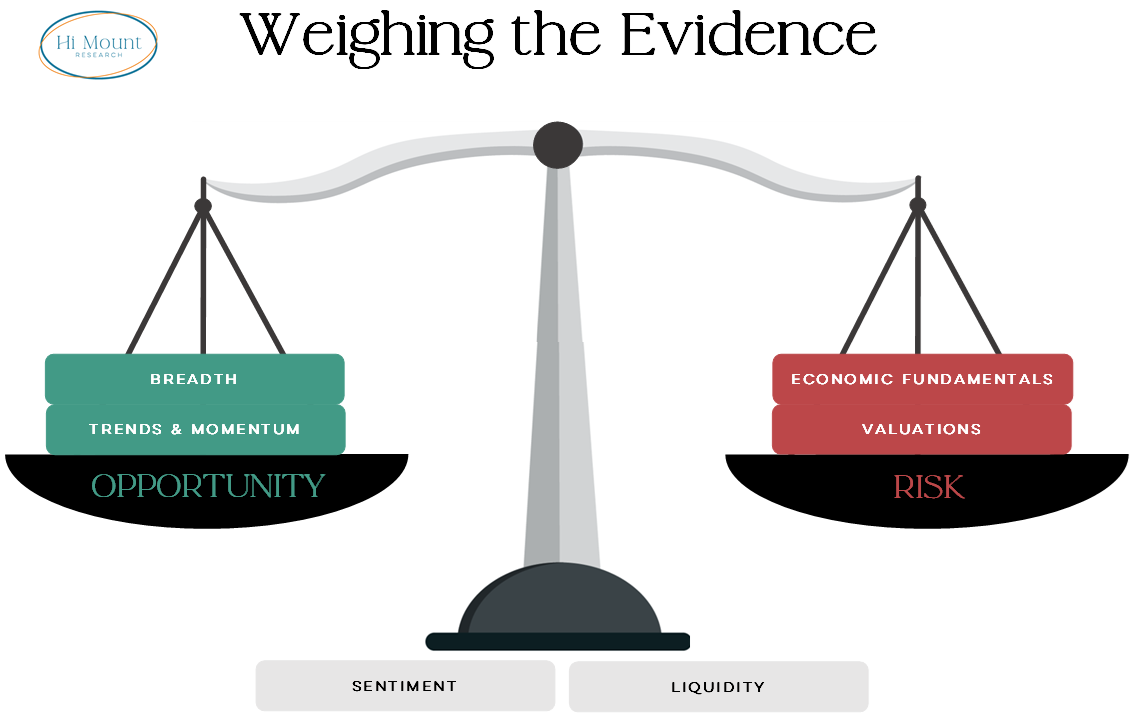

Our weight of the evidence scales are also in balance between Risk and Opportunity. Trends & Momentum have improved from neutral, while Breadth has moved directly from Risk to Opportunity.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.