Bounce Needs Better Breadth To Believe Bull Market Is Intact

The indexes are off their lows, but broad market trends have been slower to respond

Portfolio Applications note: We are adding Commodity exposure in our Dynamic Portfolios, moving away from Bonds in our Strategic portfolio and Stocks in our Cyclical portfolio.

First things first: The FOMC meets this week and an objective look at the latest PCE and CPI data suggests the inflation fight is far from over. Price pressure is rebuilding and even at the recent lows, inflation was higher than cyclical peaks of the recent past.

While we are considering the role of policy makers in the current environment, a longer-term view shows that we continue to private gains and socialize the costs. In our corporatocracy, public debt continues to grow faster than household net worth (which is highly concentrated in the hands of the most well off).

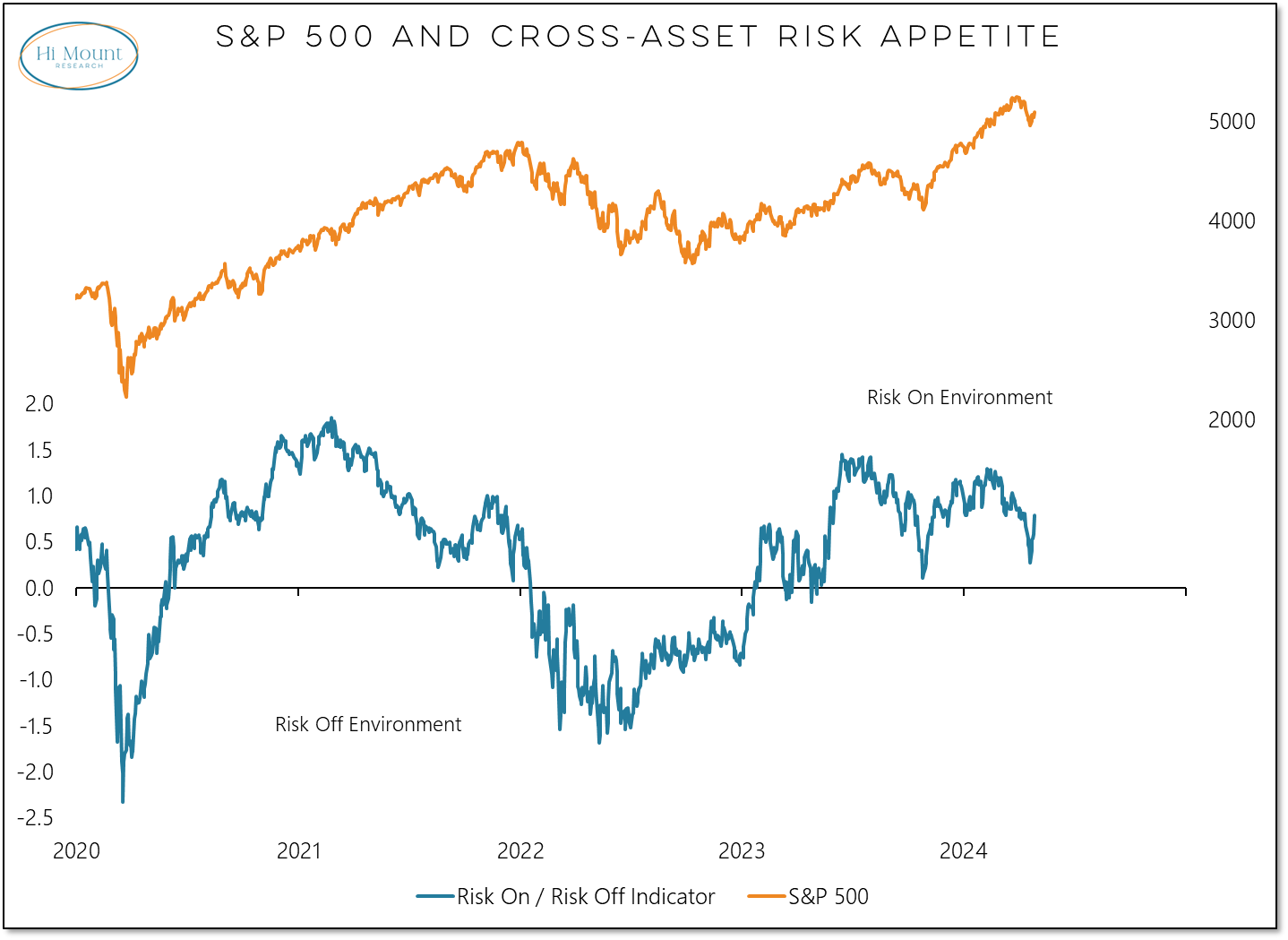

Secondly, last week brought relief rallies in the indexes, and some evidence of a renewed appetite for risk. This could help stock market bulls from stampeding away from equities (remember: we need bulls to have a bull market).

Breadth trends, however, continue to move lower.

Our Bull Market Behavior Checklist has yet to register any improvement:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.