Bonds Gain Strength and Threaten Stock Market Leadership

Risk Off environment returns as commodity trends roll over

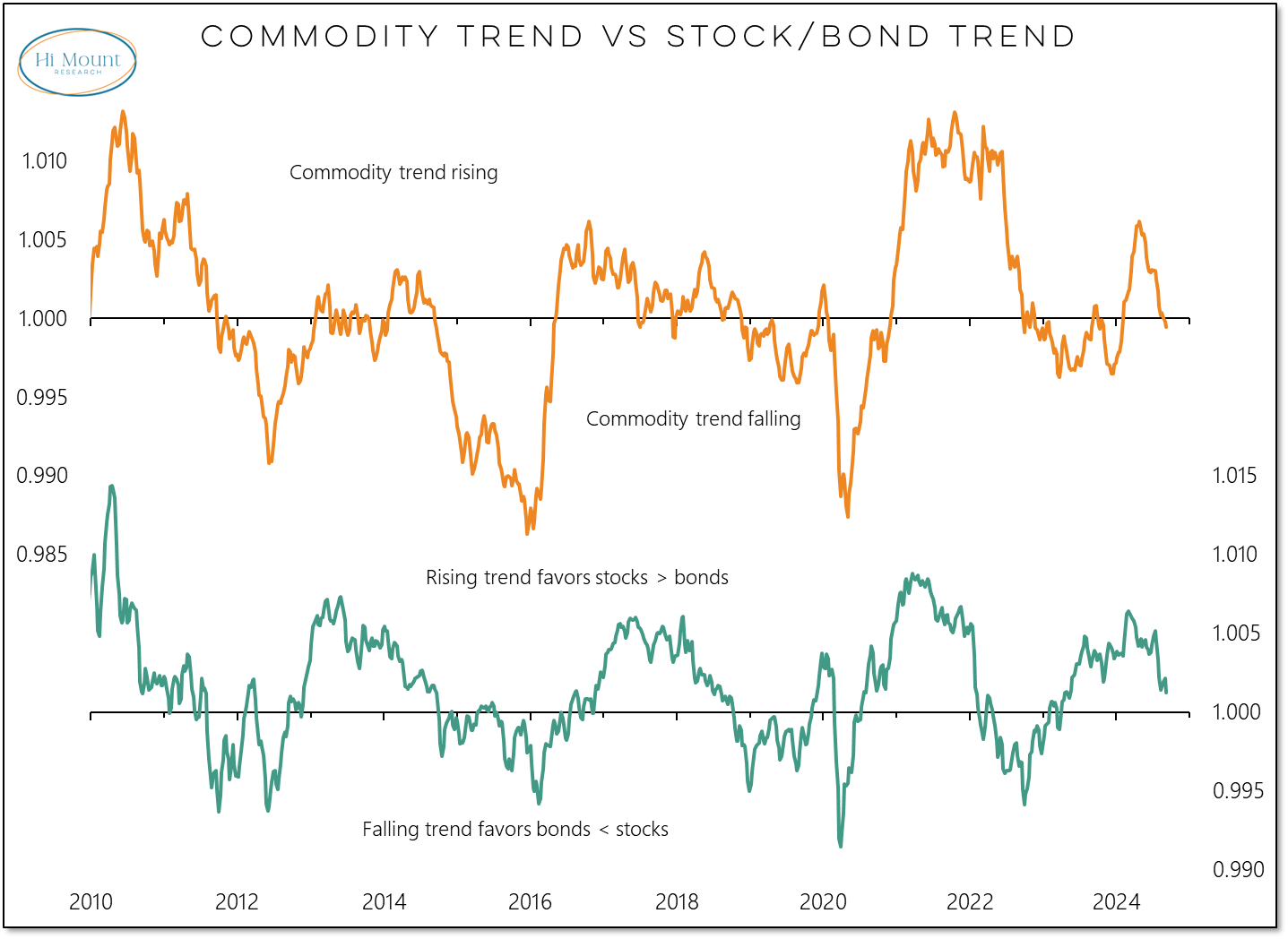

Portfolio Applications update: Our Blue Heron Systematic Portfolios have been updated and show a shift toward equities and fixed income as the trend in commodities has rolled over. As we discuss in our latest Relative Strength Rankings update (and show below) weakness in commodities can be a harbinger of a shift from stock leadership to bond leadership.

Key Takeaway: Gold is in an up-trend versus stocks but commodities overall are making new lows. It’s up to the stock market bulls to avert a protracted Risk Off environment.

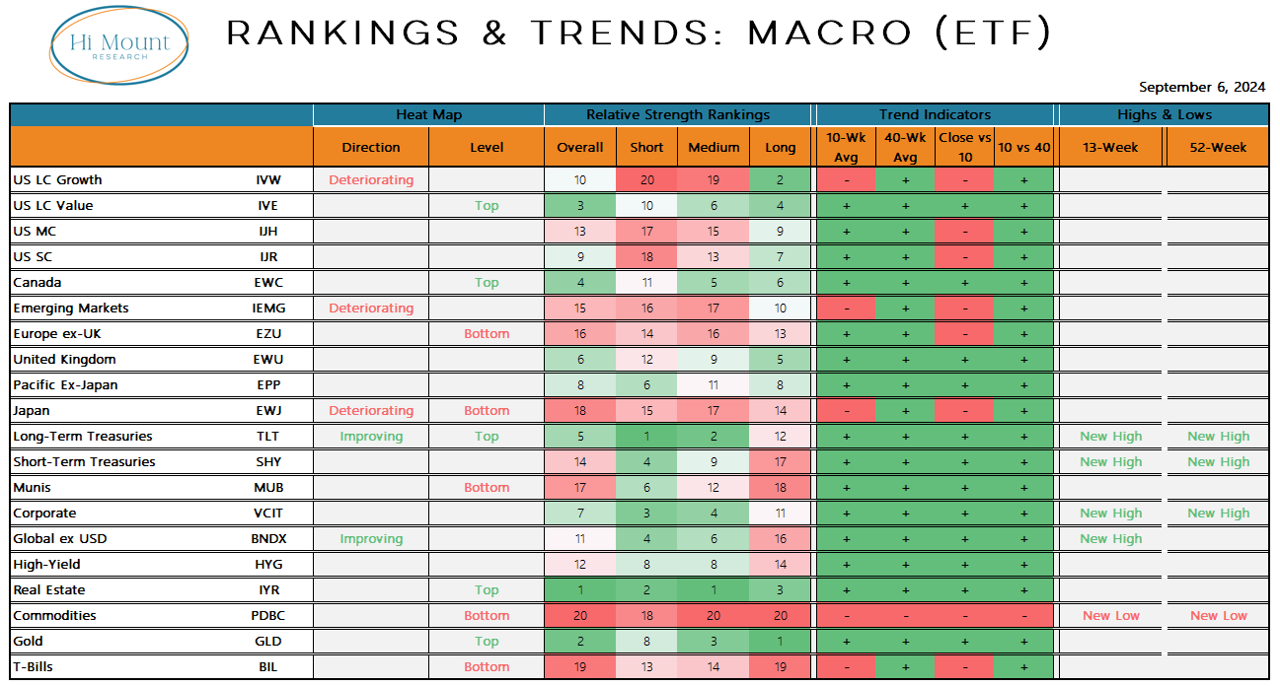

Our Macro Relative Strength Rankings show that while commodities overall are breaking down (and making new lows), Gold has been more resilient. The broader point from these rankings is that Risk Off assets (like Gold and Bonds) have been relatively strong while equity market strength has been deteriorating.

We see this explicitly in the trend in the Gold / S&P 500 ratio which has turned in favor of Gold in recent weeks. Trend following systems have rewarded investors for following relative leadership between Gold and stocks even as the overall ratio itself is unchanged over the past 50 years.

Our stock/bond ratio also shows vulnerability for stocks and an increasing opportunity for leadership from bonds.

While investor risk appetite rebounded following the early-August bout of volatility, it struggled to get back into Risk On territory. This month’s weakness has pushed our indicator back into the Risk Off zone.

While macro risks are elevated, market behavior has been more resilient. If that changes and investor sentiment sours, then the weakness experienced last week could end up being more than just sorry September seasonals. We discussed this last week with Charles Payne on Fox Business.

Looking further out, weakness in commodities suggests we could be on the cusp of trend in stocks versus bonds moving from favoring stocks to favoring bonds. It’s not one-for-one, but when the commodity trend is falling, we often see the stock/bond trend usually favors bonds > stocks.