Biotech Makes Its Move

With yet another group breaking out, market behavior only looks bad if you leave all the good stuff out

To summarize our comments from earlier this week and late last week:

Finding potentially bearish indications in price and breadth trends is a matter of straining out gnats and swallowing camels.

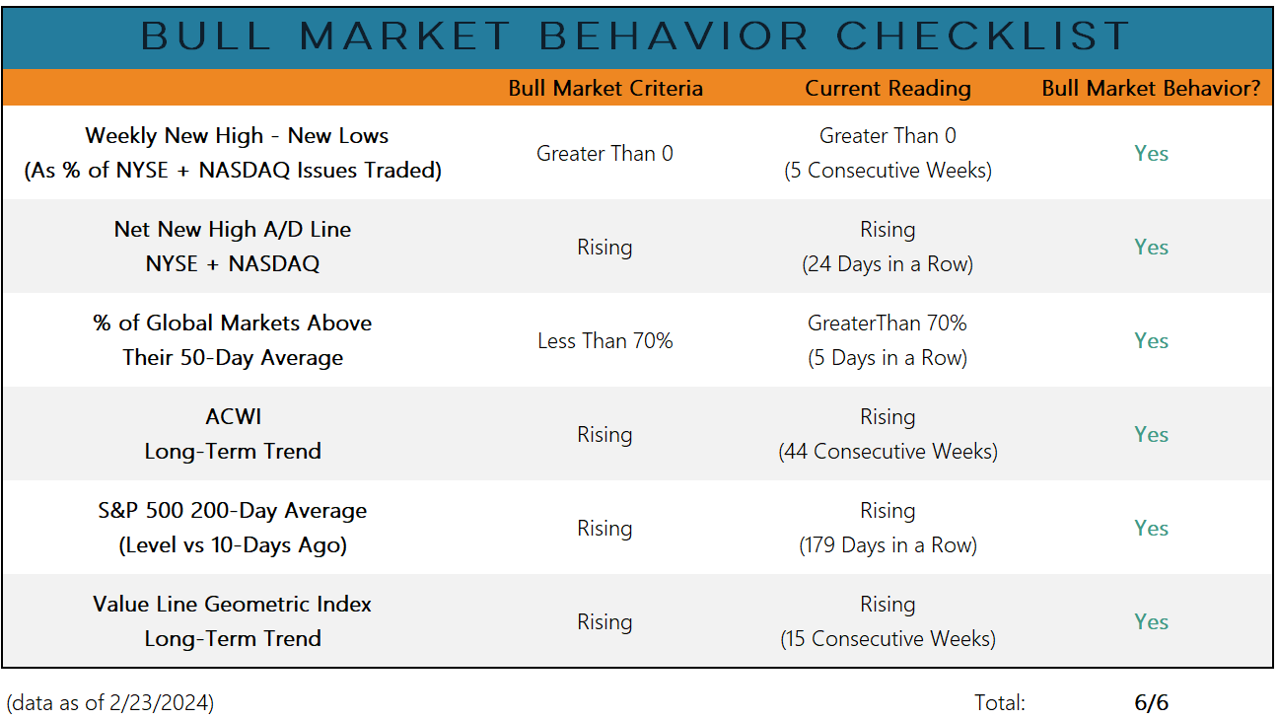

Bull Market Behavior persists and that is guiding our portfolio management decisions.

Speaking of portfolios. . .

The timing doesn’t always work out this well - so when it does, we want to highlight it.

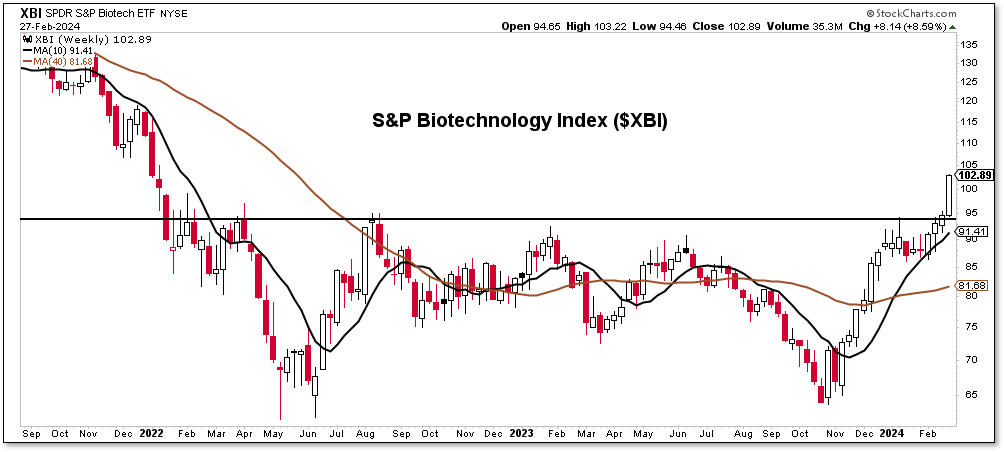

This week Biotechnology (XBI) is following the lead of the broader Health Care sector and breaking out to a new multi-year high.

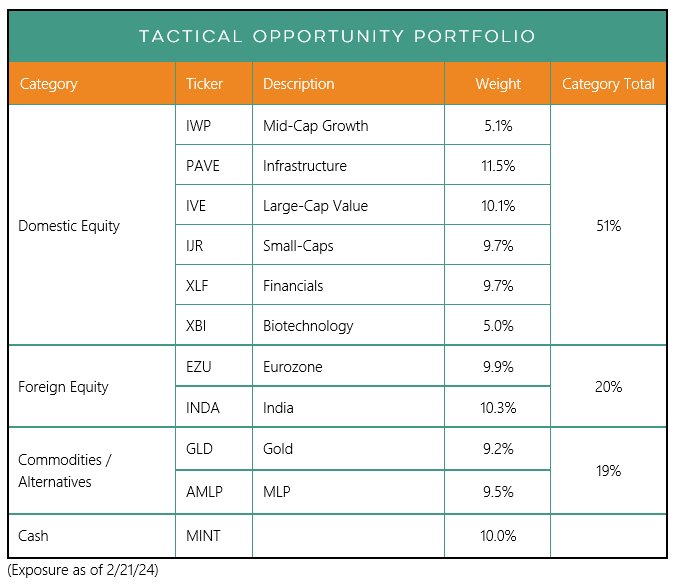

While it is just one of many areas making new highs, we are calling it here to remind readers that we added it to our Tactical Opportunity Portfolio (see: Staying Long But Playing the Field) last week:

Please reach out if you would like more information about our suite ETF portfolios and other rules-based asset allocation tools.

In case you missed it, last week we also tweaked exposure to our Dynamic Cyclical Portfolio, adding Industrials (XLI) and the equal-weight S&P 500 (RSP):

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.