Better Breadth Buoys Bull Market Behavior

Broad gains and widespread strength add to the market's bullish message

First, what hasn’t changed: Bonds are again pricing in a pivot from the Fed but stocks are still making new highs versus bonds. Read this unlocked post about these longer-term trends and the current message from our adaptive asset allocation model.

Also what hasn’t changed: A rising 200-day average for the S&P 500 has been a bullish support even when breadth has been lacking.

Last week did bring an expansion in new highs that not just a US phenomenon.

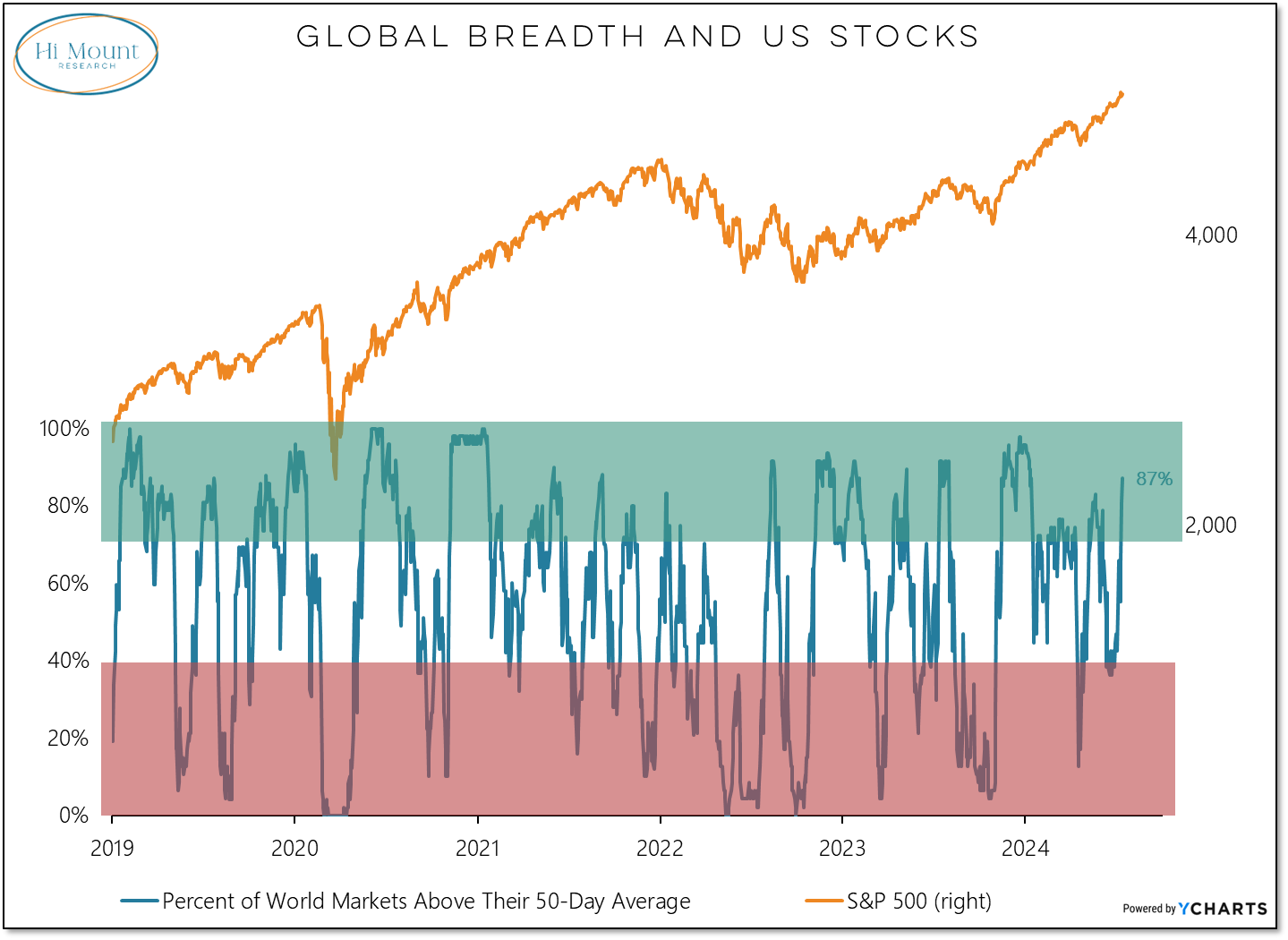

Global breadth got back in gear as new highs expanded and the percentage of ACWI markets above their 50-day averages soared to the highest level since early January.

Overall, the expansion in new highs and evaporation in new lows means we’ve got a smiley face market once again. Our Bull Market Behavior Checklist back to 6 out of 6.

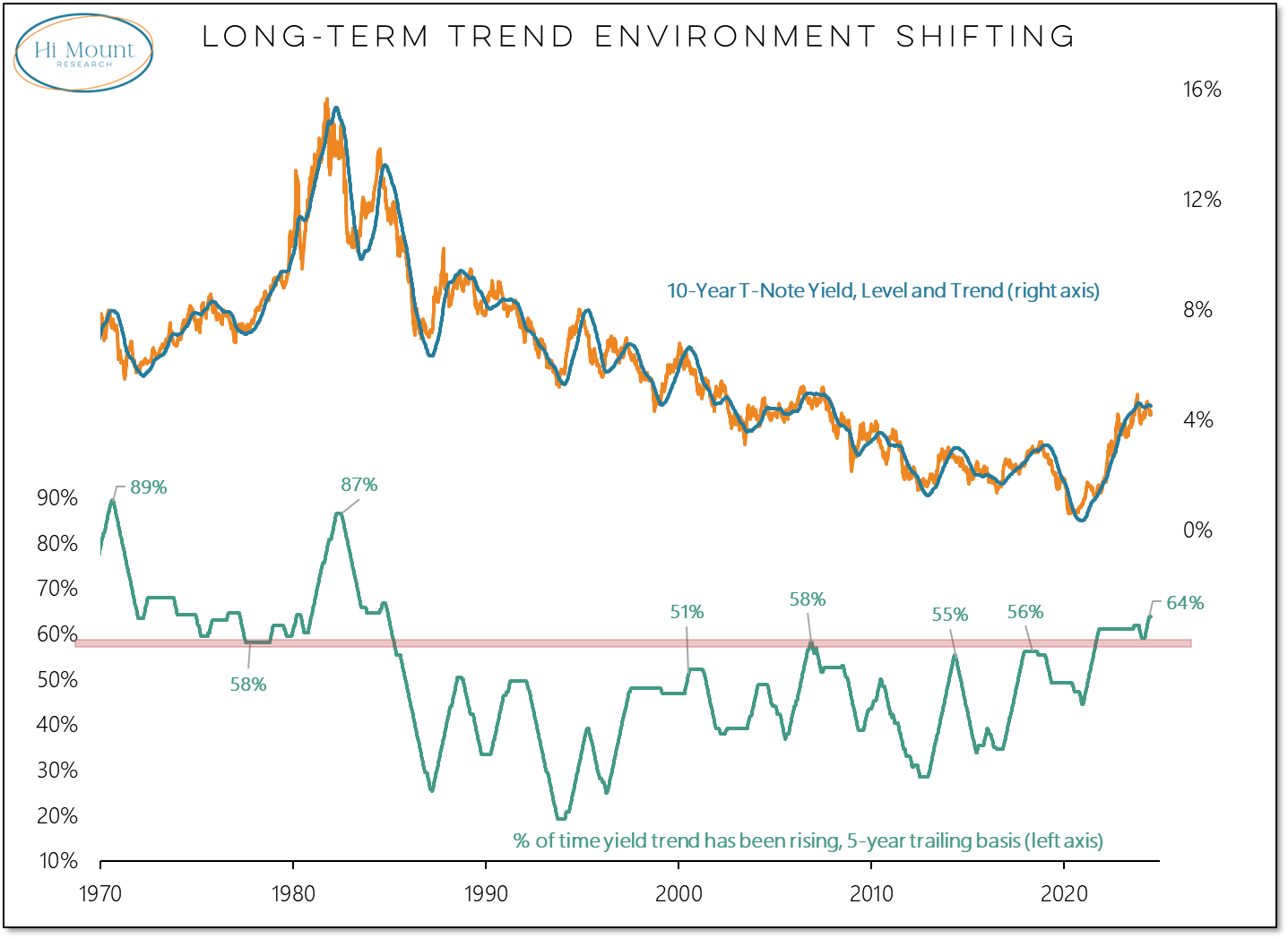

While price and breadth trends are supportive and investors are looking forward to a more favorable liquidity environment (fueled by lower bond yields and a Fed pivot), keep in mind that the longer-term bond yield environment has shifted in recent years. The pattern of lower highs is in the past and while higher yields may not be relentless, the trend is likely to be persistent.

Key takeaways from this week’s Relative Strength Rankings report:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.