Bears Hear An Alarm Bell As Bulls Receive A Wake-Up Call

Last week's market action moved the needle in ways that mattered

This will be our final update for 2024. Thank you for take the time to read and engage with our commentary this past year. Merry Christmas and may 2025 bring a multitude of blessings to you and yours. Our weekly commentary/chart deck is unlocked and available for all subscribers (paid and free).

Portfolio Applications update: With breadth breaking down and liquidity conditions becoming more challenging, we have reduced our equity exposure in both the Cyclical and Tactical Opportunity portfolios.

Key Takeaway: Rising bond yields are a challenge for stocks as bull market behavior becomes more scarce. The balance of reward vs risk is tilting more toward risk.

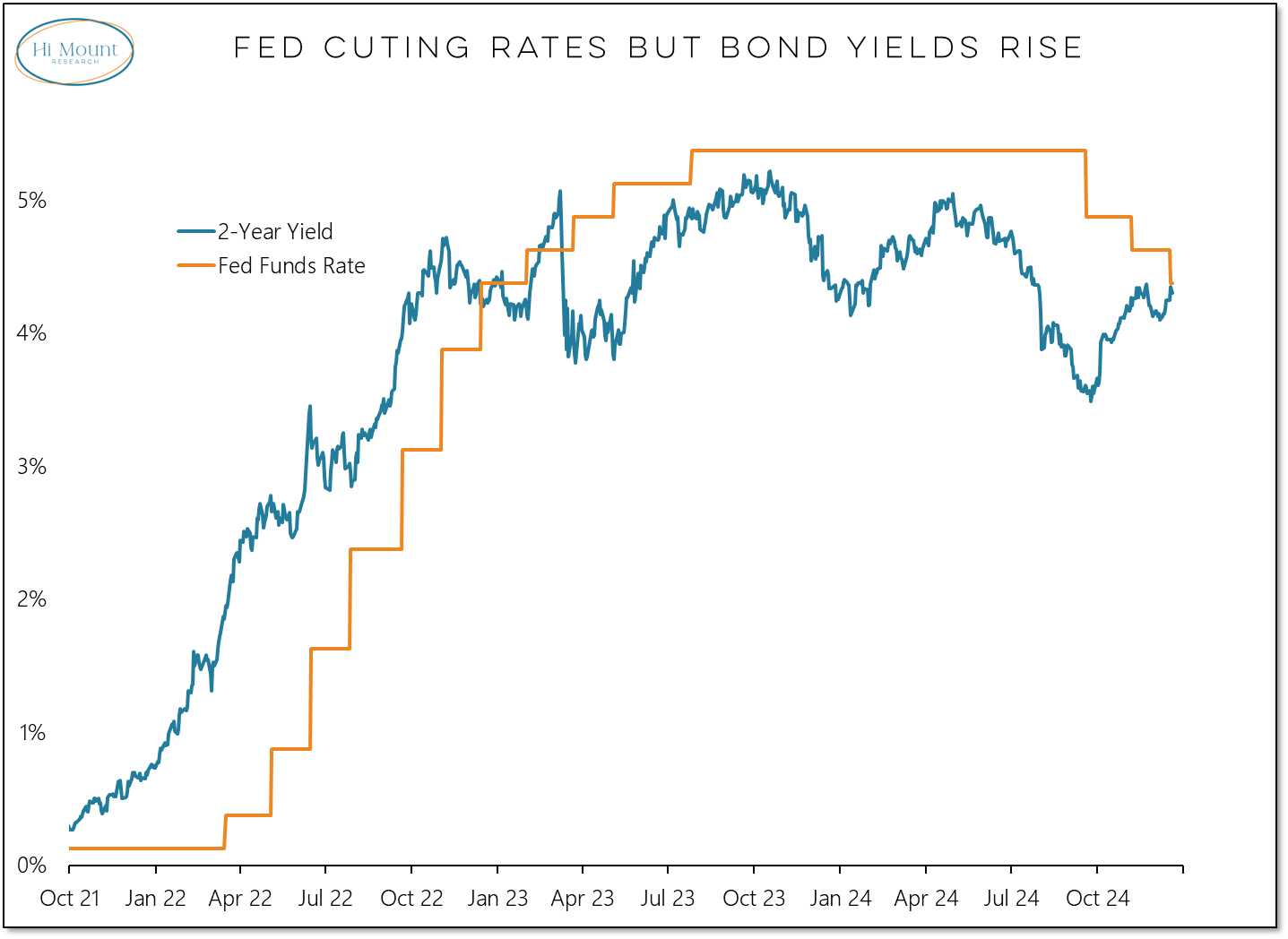

The Fed delivered another 25-basis point rate cut last week but bond yields have been moving higher ever since the Fed started its easing cycle. Now the 2-yearT-Note yield and Fed Funds Rate have converged as the market suggests that the Fed is (or should be) done cutting rates.

Not only has the bond market re-priced the likelihood of future rate cuts, but upward pressure on corporate bond yields has become a direct headwind for stocks. BAA corporate bond yields are now higher than they were 6-months ago and all the net gains for stocks in recent decades have come when bond yields have been moving lower, not higher.

Expectations and action in the bond market pressured equities last week. This led to a 13-1 down volume day on Wednesday (when the Fed announced its rate cut) and even though stocks bounced on Friday, the volume flows were less than convincing.

Friday did produce the first positive breadth day of the month for the S&P 500. 14 down days in a row is the worst stretch of breadth that I have ever personally witnessed. While it has now ended, it has left weakness in its wake.

The corollary to “bull markets feature quiet strength” is noise and weakness are characteristic of bear markets. If Santa-related strength is going to show up over the next couple of weeks, the best case for bulls is that it is quiet on the surface and strong beneath the surface.

Overall, bull market behavior is less evident. Our bull behavior composite has pulled back to its lowest level of 2024. Breadth has broken down, but price trends have remained resilient.

Global weakness led the deterioration and has not yet signaled improvement. The percentage of ACWI markets above their 50-day averages or 200-day averages are near their lowest levels of the year. Without a domestic breadth thrust regime to provide a tailwind, US stocks are increasingly dependent on global rally participation – and that is not coming through right now.

In terms of the cyclical weight of the evidence, both liquidity and breadth are under pressure. From a tactical perspective, our fear or strength model has turned negative. It is true that stocks rise 75% of the time, but the data suggests we are currently in the 25% of the time during which stocks struggle to even tread water.

For more charts & commentary, download our latest Weekly Deck.