As Stocks Struggle, Re-Allocation Risks Rise

Broad market pressures could prompt investors to rethink their exposure to equities

Paid subscribers can download our latest Weekly Chart Pack.

Key Takeaway: After being on the cusp of breakout earlier this year, equities are now teetering on the brink of a breakdown. Investors who are still positioned for an exhausted paradigm could begin to re-think their positioning.

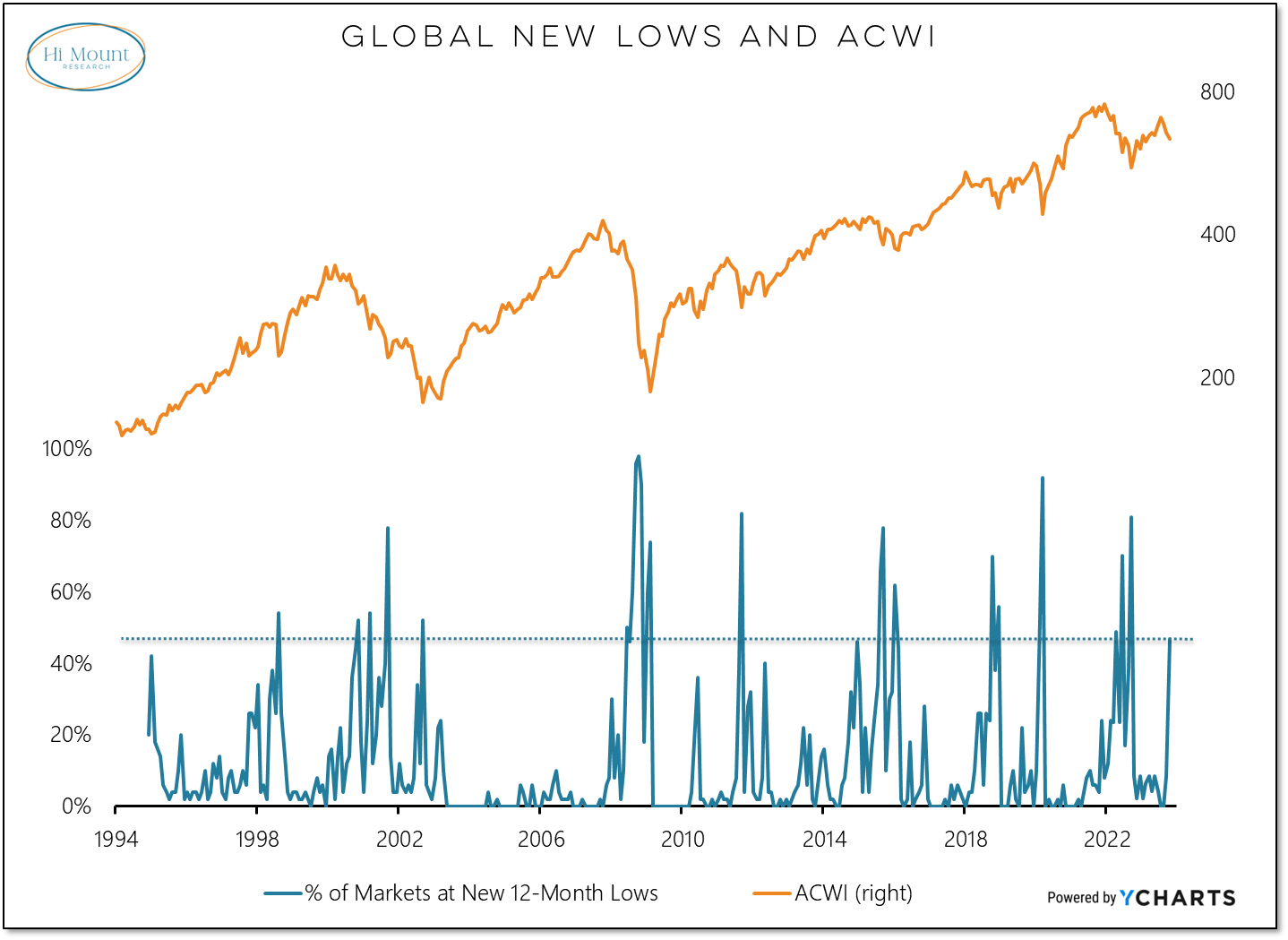

47% of ACWI markets finished October at new 12-month closing lows. This is consistent with past periods of elevated risk and is not something that has been observed in the midst of ongoing bull markets.

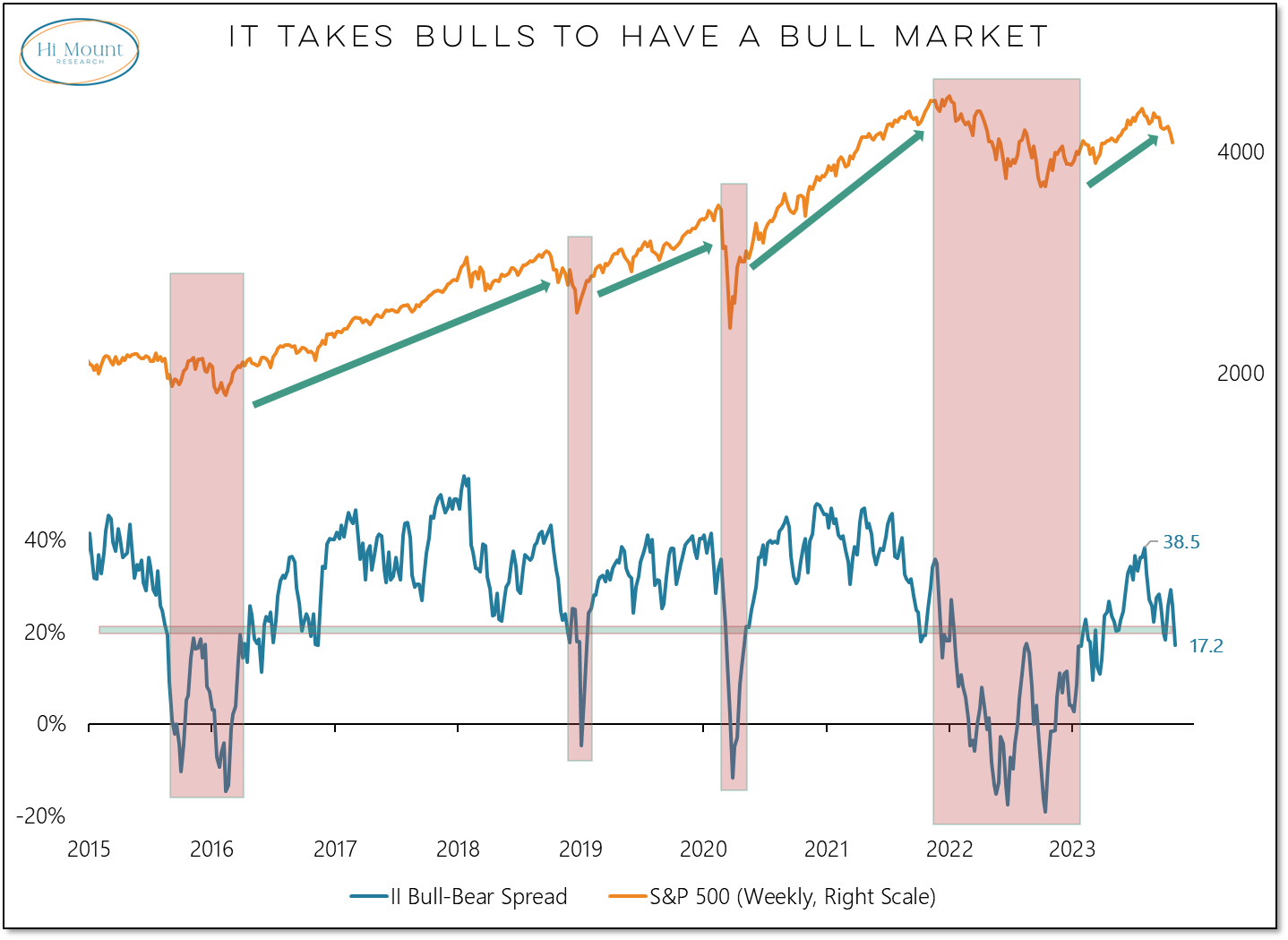

As stocks come under increasing pressure, even the optimists are having second thoughts. All the net gains over the past decade have come when the II bull-bear spread has been above 20% and right now it is dropping below that level. It is difficult to have a bull market while bulls are heading for the exit.

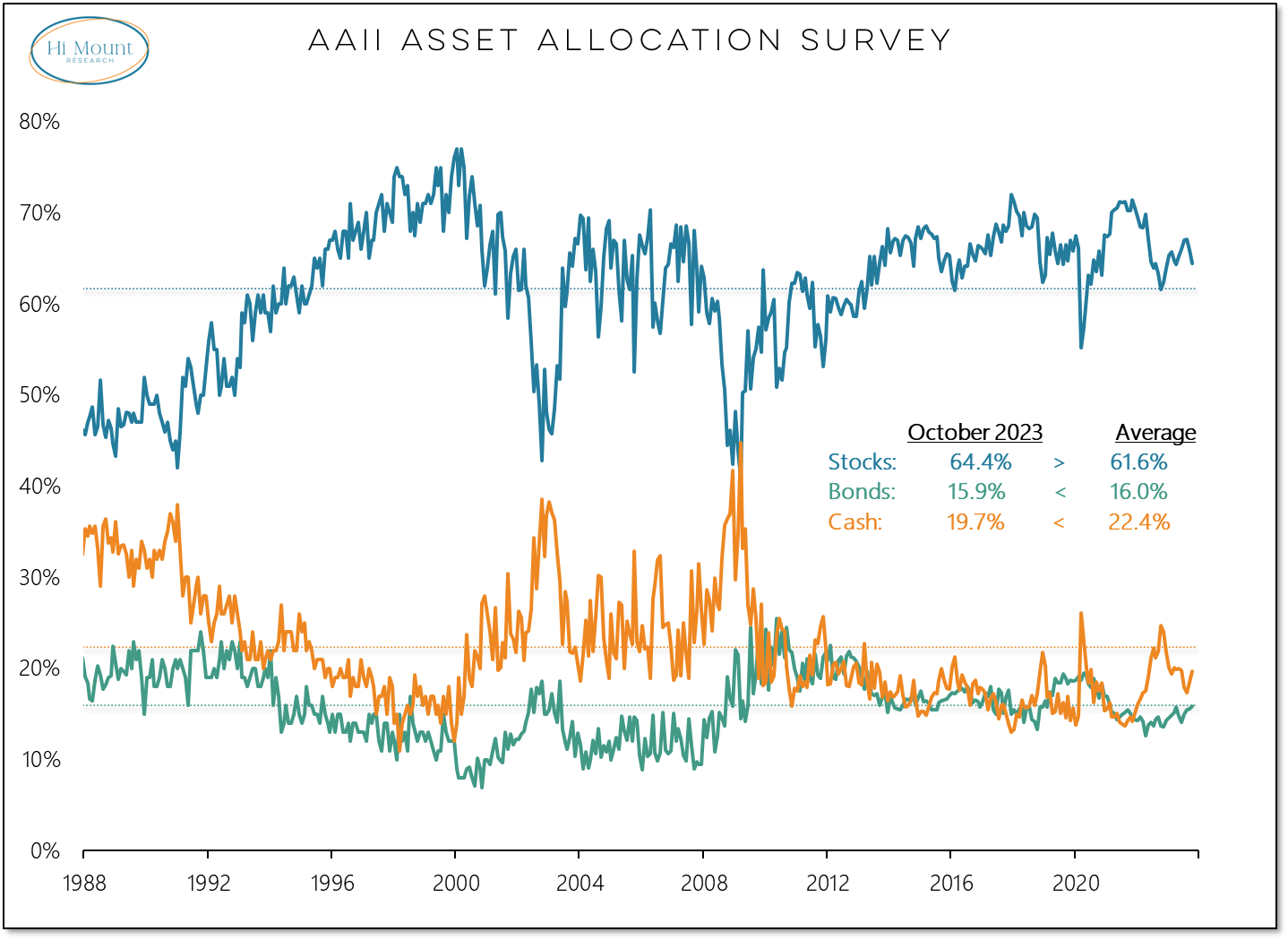

While pessimism is picking up, investors remain heavily tilted toward stocks. The October asset allocation survey data from AAII shows has equity exposure still above average even as it has down-ticked in recent months. Exposure to bonds is just below its long-term average and there is little evidence that piles of cash have been accumulated on the sidelines.

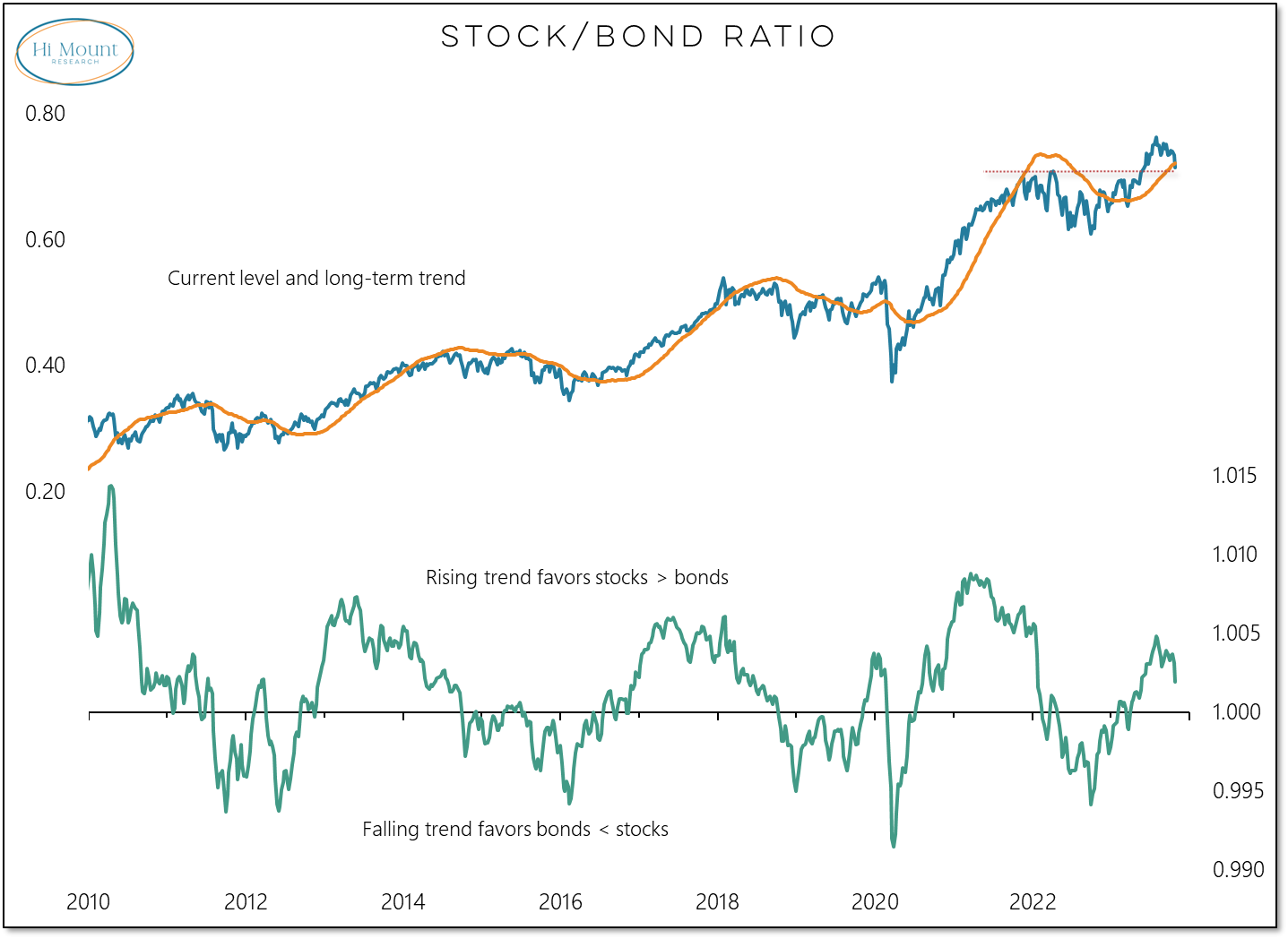

While stocks may get a short-term boost if the rise in bond yields becomes a bit less relentless, the larger, longer-term impact may be a re-allocation away from equities and toward bonds. After breaking out to new highs earlier this year, the stock/bond ratio is now testing that breakout level from above and the trend favoring stocks over bonds is cooling. If this persists it could give trend followers the confidence to re-allocate from stocks to bonds and open the door to an overdue shift in asset allocation.

We take a closer look at the latest developments from a breadth, trend and sentiment perspective in this week’s chart pack: