As we reflect on 2022 and anticipate 2023, my hope is that you get what you need this year, even if it isn’t necessarily what you want (it is a true blessing to have your needs and wants be in harmony - but that is not always the case).

In this week’s podcast we look at how this year's fast start contrasts with 2022 and how investors will need to embrace the rally if recent strength is likely to be sustained. How investors respond could help resolve the imbalance between sentiment and positioning that intensified last year:

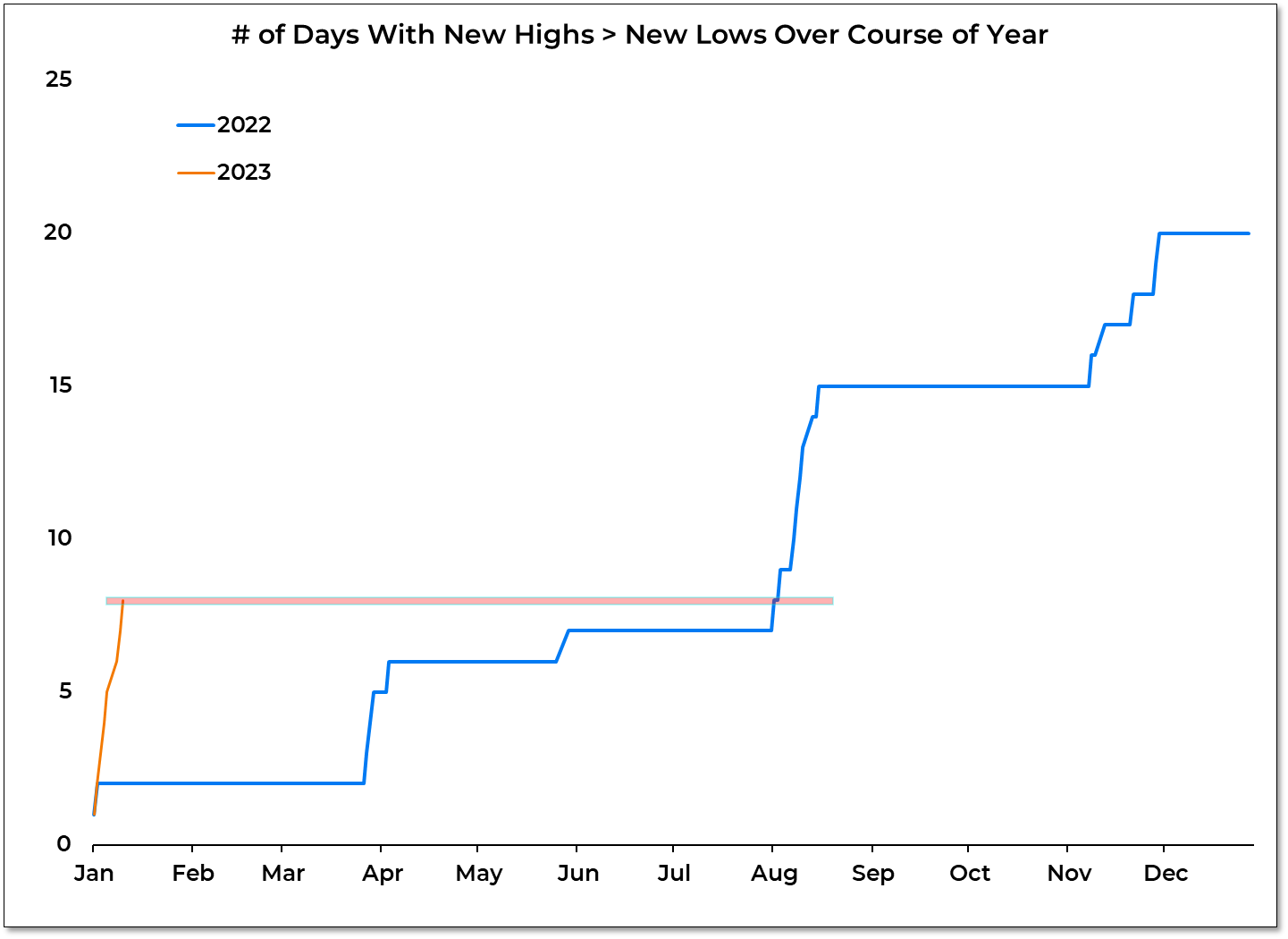

A strong start and better breadth in 2023. Stocks have surged out of the gate in 2023. The S&P 500 is up nearly 4% already this year but the US is lagging vs the rest of the world. And this comes with better breadth as well: Highs vs Lows data achieved on the 8th day of 2023 what took until the 8th month of 2022.

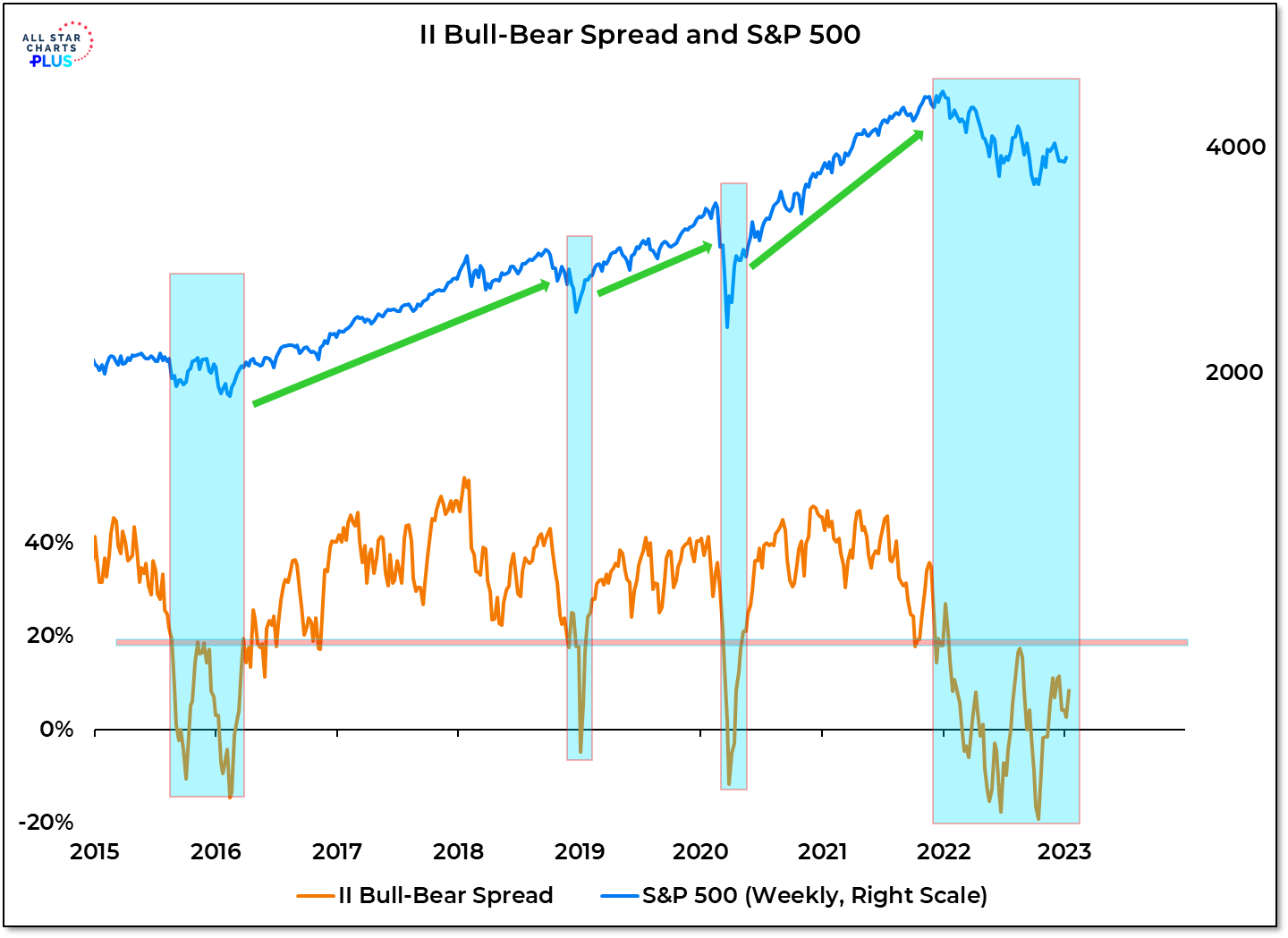

Hard to have a bull market if bulls remain in hiding. The August high for the II bull-bear spread came at a pivotal level. In recent years, stocks have struggled when the mood has been so dour. After the extreme pessimism of 2022, investors may need to embrace strength if we are going see a sustained bull market in 2023.

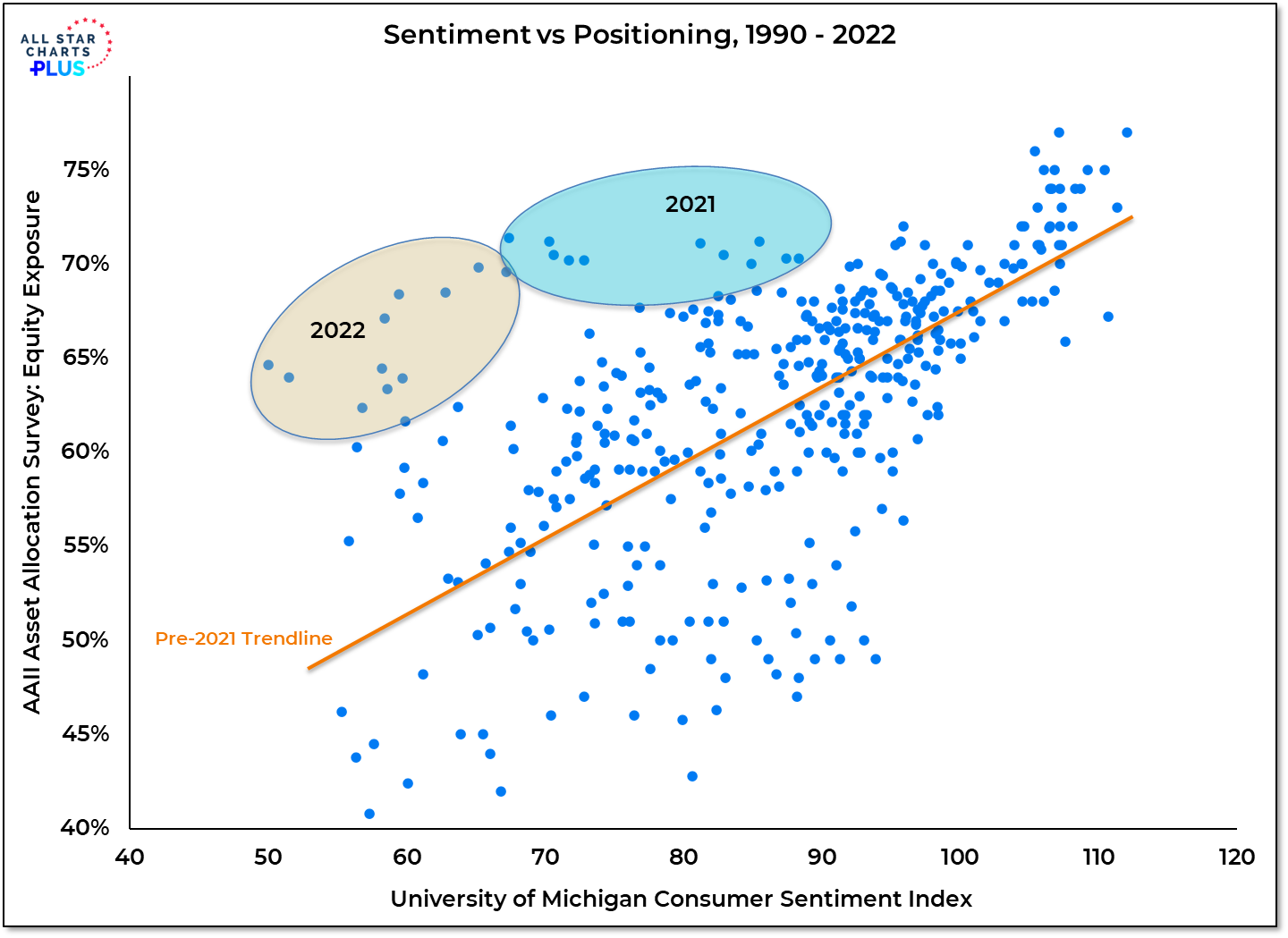

After recent aberrations, look for reconciliation in sentiment vs positioning. Mixed messages from sentiment and positioning are not the norm. What began as an aberration in 2021 turned into an even larger anomaly in 2022. One way or the other, I expect this to resolve itself (and a move toward the pre-2021 trendline) this year.

Townhall Takeaways on YouTube: