April Pause Refreshes Cyclical Rally

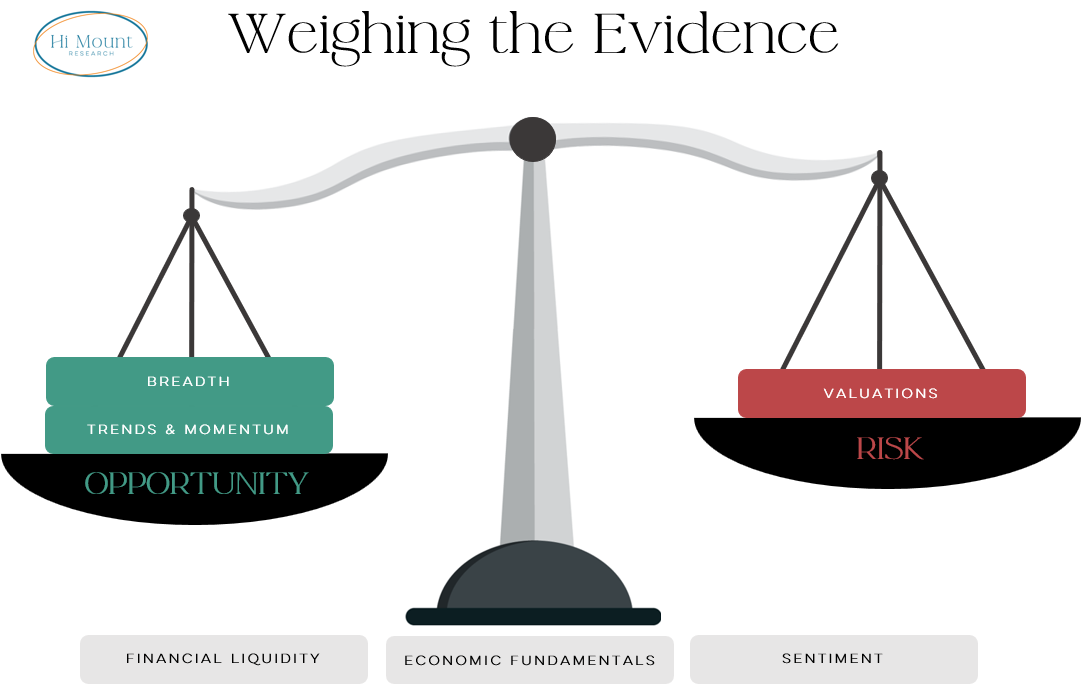

The weight of the evidence remains Bullish despite a challenging macro backdrop

The release of the April CPI data helps keep alive the hopes of rate cuts by the Fed later this year. Stocks took notice and today’s rally is sending the indexes to new highs across various sectors, capitalization levels and geographies.

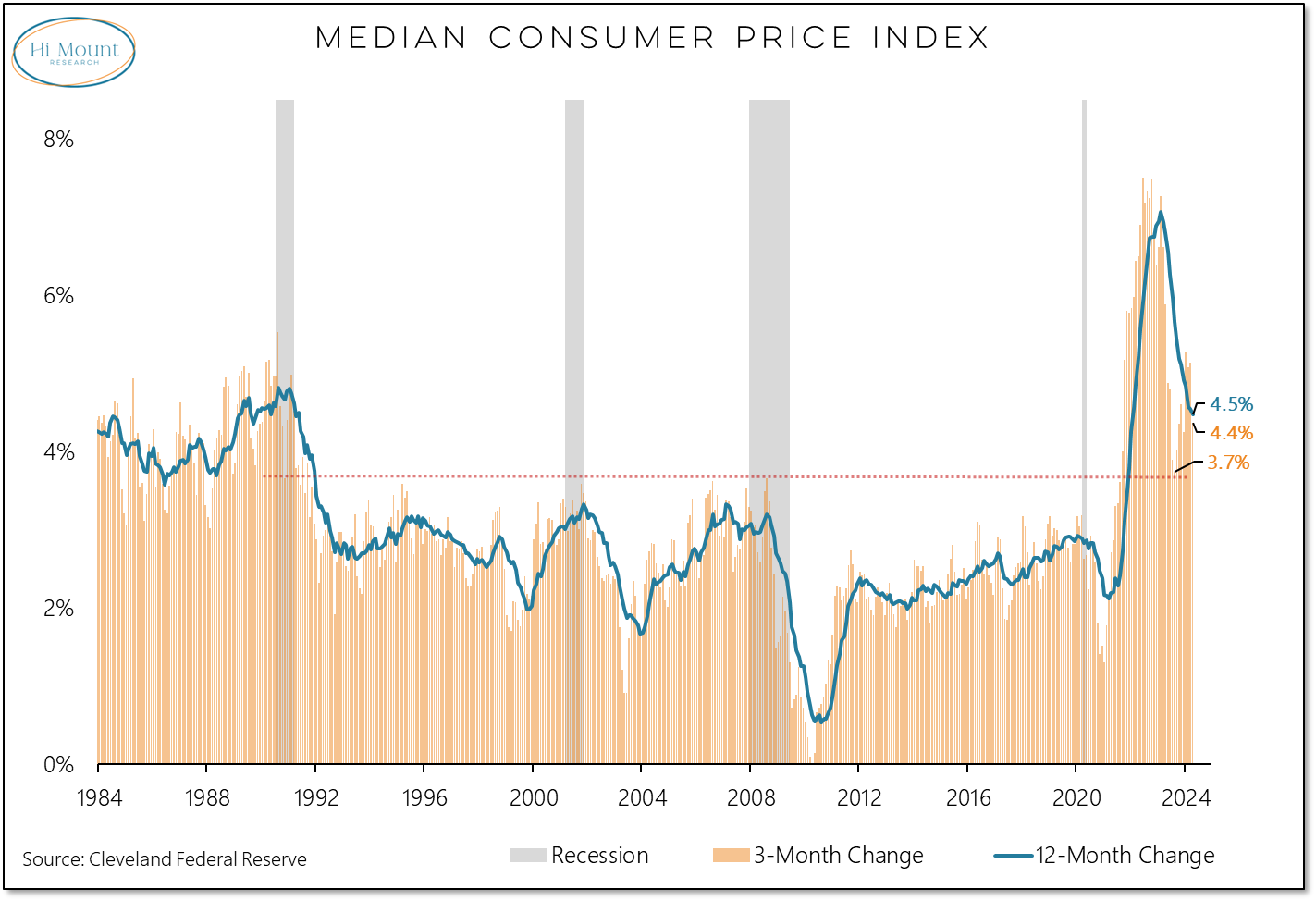

On the encouraging front, the 3-month change in the Median CPI has dropped back below the 12-month change. It would be difficult to make the case that inflation is moderating if shorter-term rates of change are consistently running hotter than longer-term rates of change.

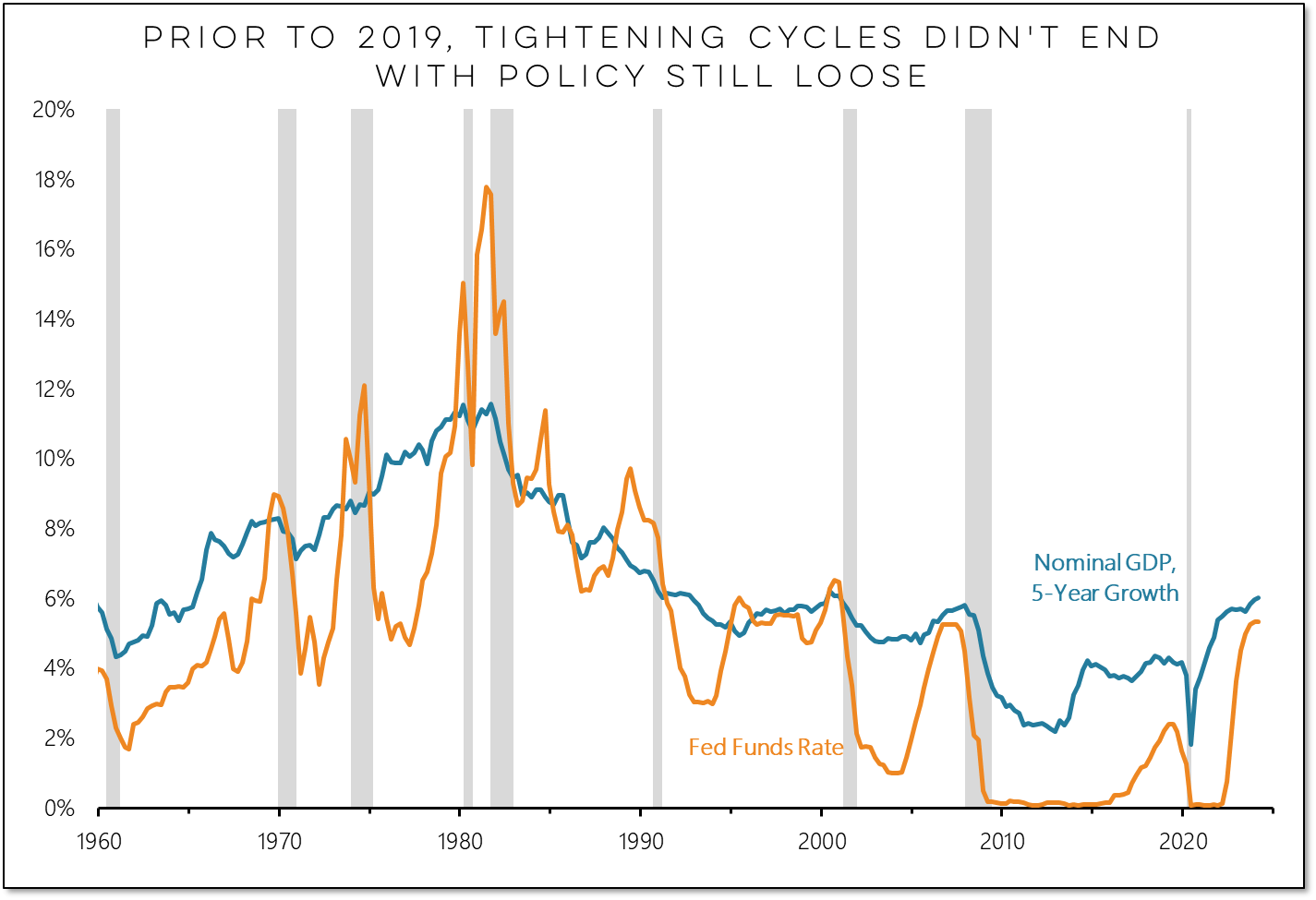

But even at its recent low, the 3-month change was higher than previous cyclical peaks over the past 30 years. The Fed’s decision to pivot in 2019 prior to the completion of that tightening cycle lit the match for the inflation fire that is burning now. The stimulus in the wake of COVID was just more fuel. While the conflagration may have died back, it is clear from the inflation data that the coals are still hot and flare ups remain a risk.

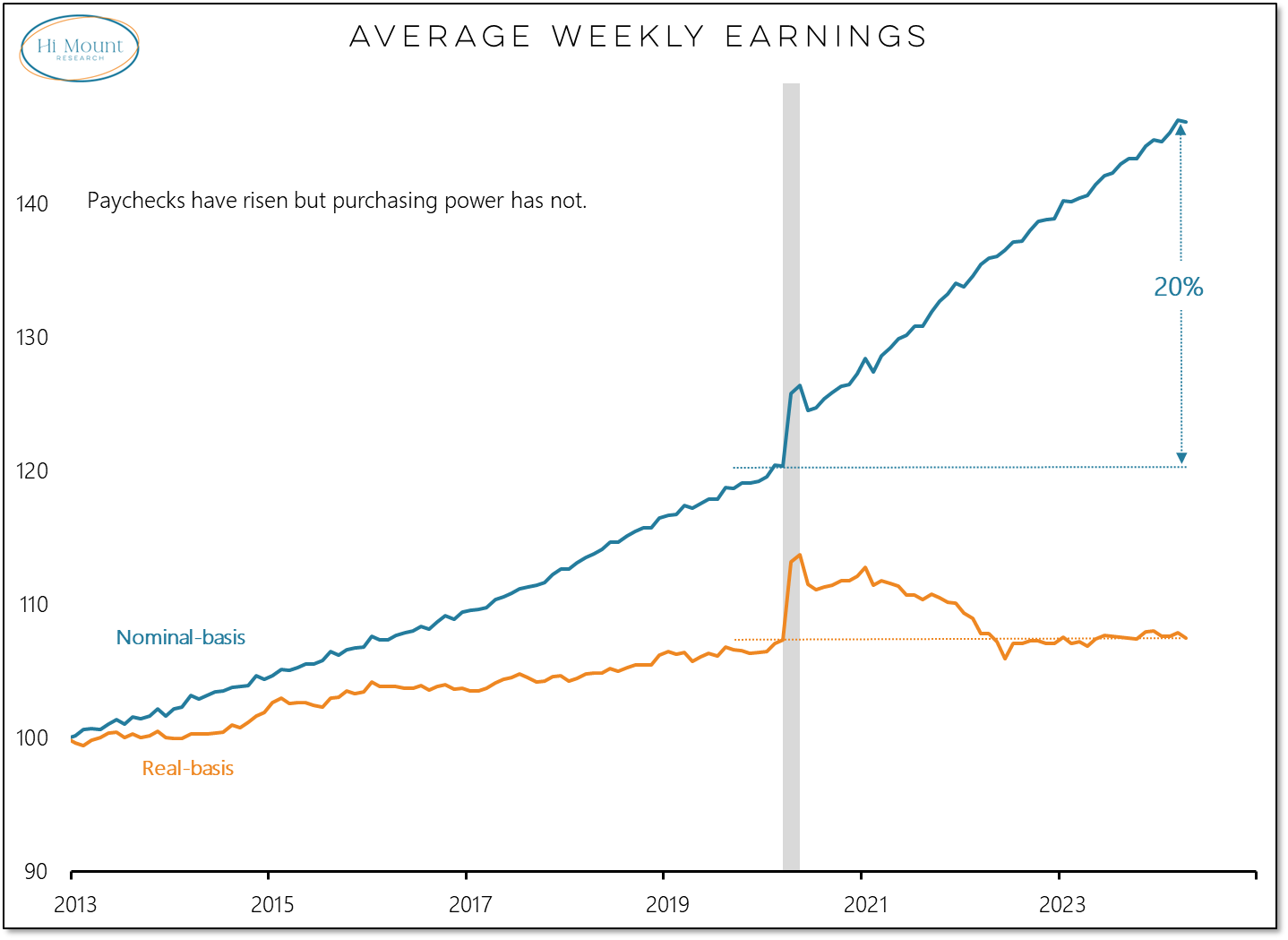

Persistent inflation has provided a veneer of resiliency and strength. Cash registers have kept ringing, but real retail sales have been trending lower since peaking three years ago.

Weekly paychecks have swelled by 20% over pre-COVID levels but their purchasing power is unchanged.

This leads to the key takeaway from this month’s Weight of the Evidence update:

The weakness that emerged in April has proven to be short-lived and key indexes in the US and around the world have quickly returned to record territory. While the macro backdrop remains unsupportive for stocks, the market has proven resilient. New high lists are again longer than new low lists, price trends did not roll over, and bulls buckled in for the ride rather than jumping ship.

Subscribers can keep reading for more detail and to access a link to the entire report.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.