A New High, But Not More New Highs

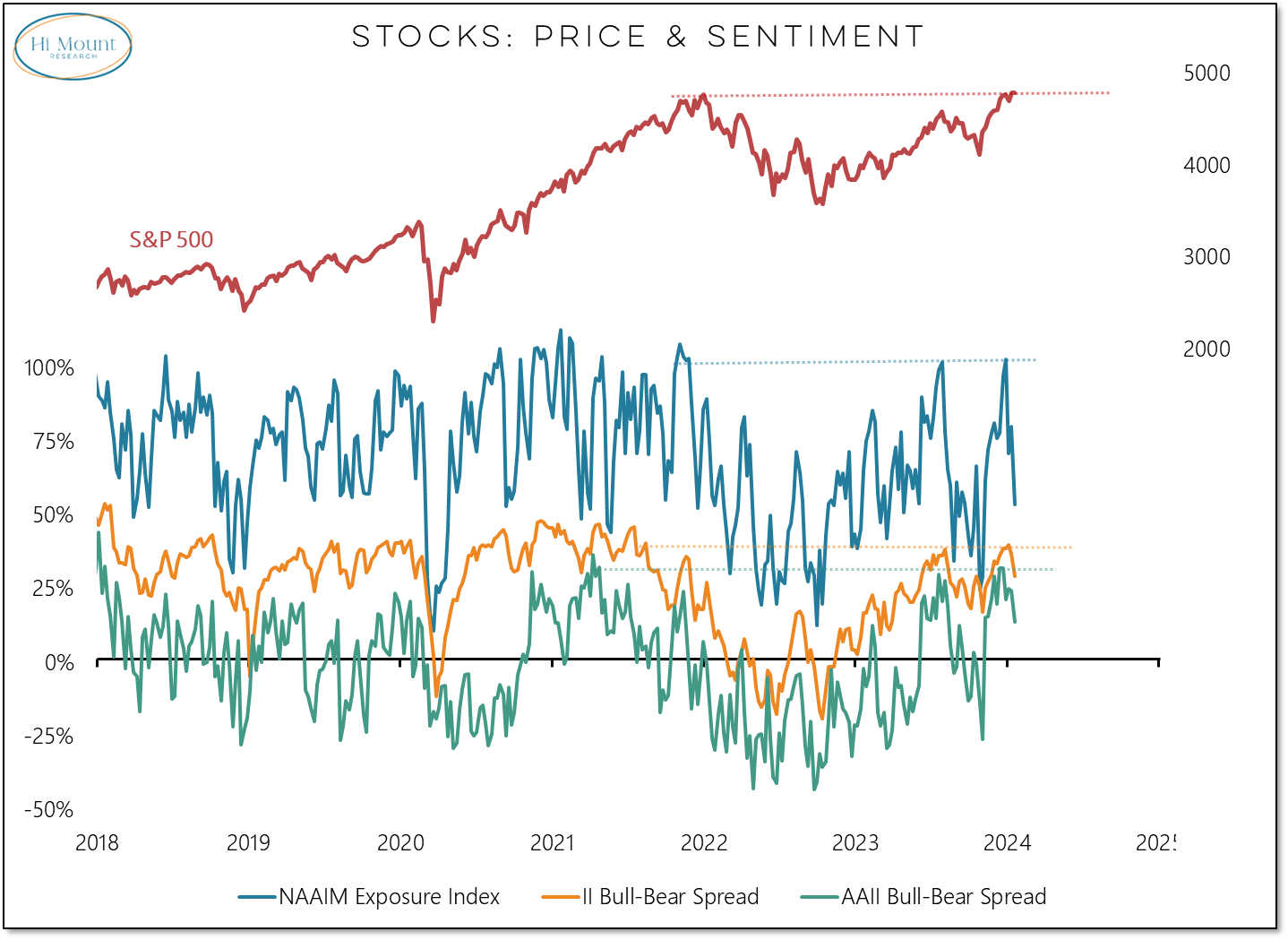

US strength is not being echoed around the world while investor sentiment has becoming more mixed.

What: The S&P 500 made its first new high in more than 500 days on Friday - snapping what had been the 6th longest streak on record (back to 1950) without a new high. At the same time, the number of stocks making new lows (on both the NYSE and NASDAQ) has expanded every week this year and now exceeds the number of stocks making new highs for the first time in 9 weeks.

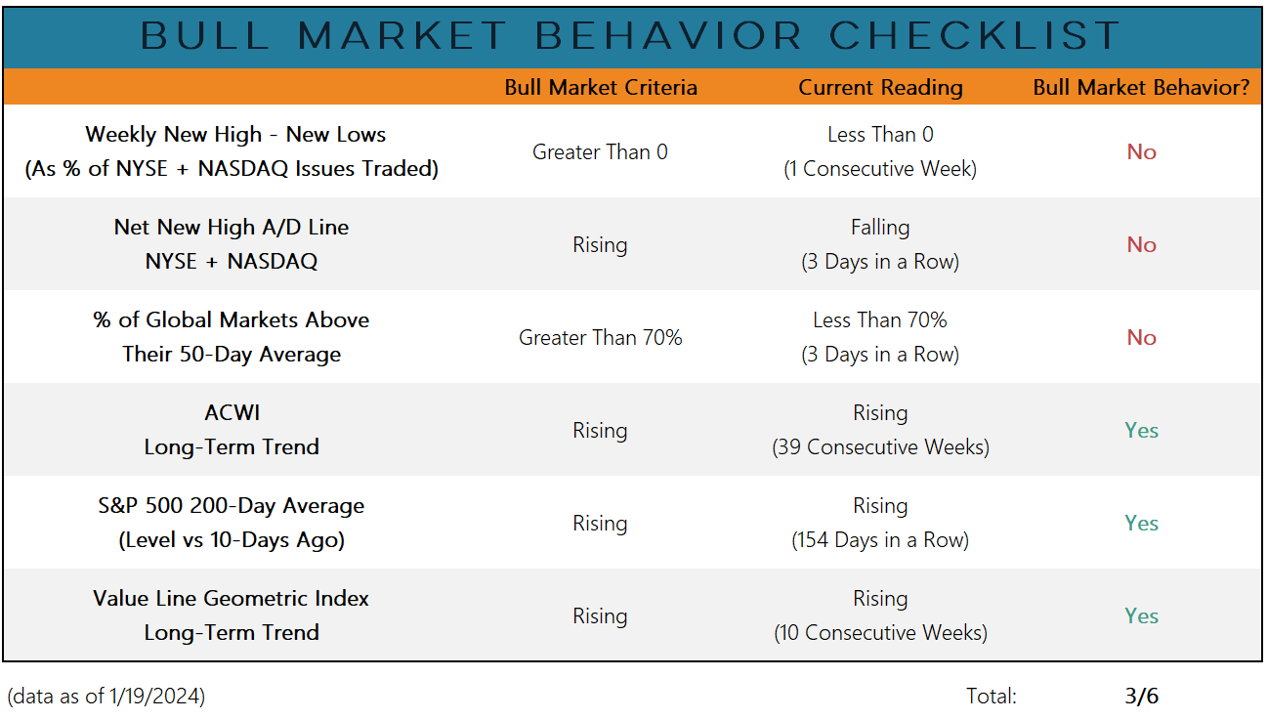

So what: Price trends remain robust, but breadth is getting more ragged. This is reflected in the mixed readings on our Bull Market Behavior Checklist.

Now what: New highs tend to be followed by strength but with optimism cooling and breadth not confirming, some consolidation here would not be too surprising. Downside risks rise if investors turn pessimistic or if breadth continues to deteriorate.

Paid subscribers can keep reading to preview this week’s Sentiment Report and our latest Relative Strength Rankings:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.