A New Bull Market (In Bear Market Behavior)

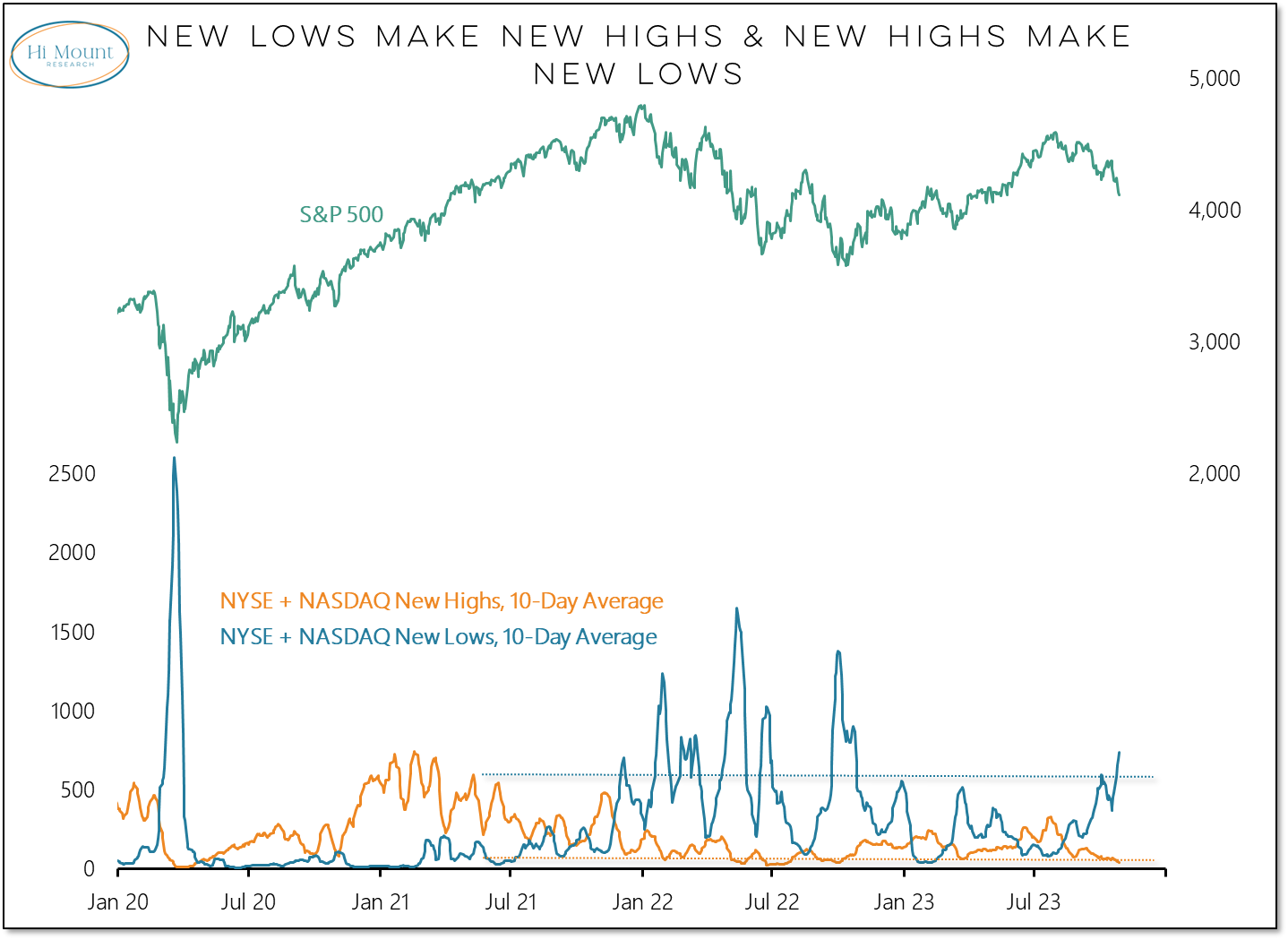

Reducing risk as the new low list moves to new highs and the new high list drops to new lows.

Client Note: We are reducing equity exposure in our Tactical Opportunity Portfolio.

Key Takeaway: Broad market weakness is impacting index-level performance. New lows (among ACWI markets, S&P industry groups, and NYSE + NASDAQ issues) have climbed to their highest level in a year as the indexes try to find support and stability.

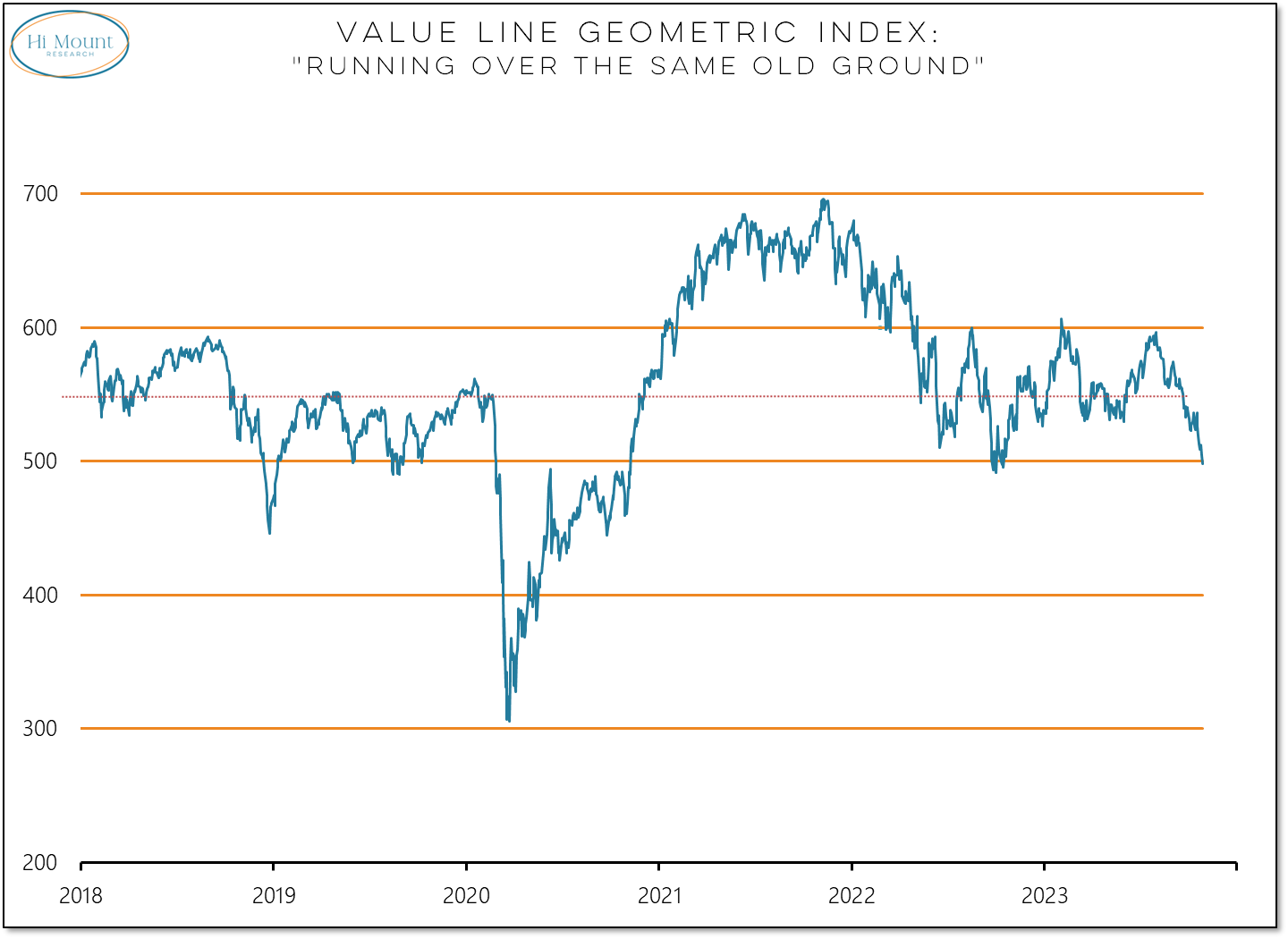

The long-term trend in the Value Line Geometric Index has rolled over and last the index pulled back to support near 500. This is the level from which the breakout occurred in 2020 and where the selling stopped in 2022. If bulls want to make a stand, this is certainly a logical place to do so.

Sitting tight during periods of weakness & volatility can dig a financial and emotional hole that your future self will need to climb out of.

As equity market trends overall continue to deteriorate, managing risk may mean stepping aside.

Paid subscribers can keep reading to see how this this messy market environment is not just reflected in slightly obscure indexes like the Value Line and where our rankings are seeing relative leadership.

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.