A Mixed Messages Market

The S&P 500 is making new highs as more stocks make lows than new highs.

Subscriber update: We have updated our Blue Heron Model Portfolios. Uptrends remain intact across most asset classes, but on a relative basis the trends favors Stocks > Commodities > Bonds. For a closer look at recent relative strength trends, read this week’s Relative Strength Rankings report (or see the preview following the break below).

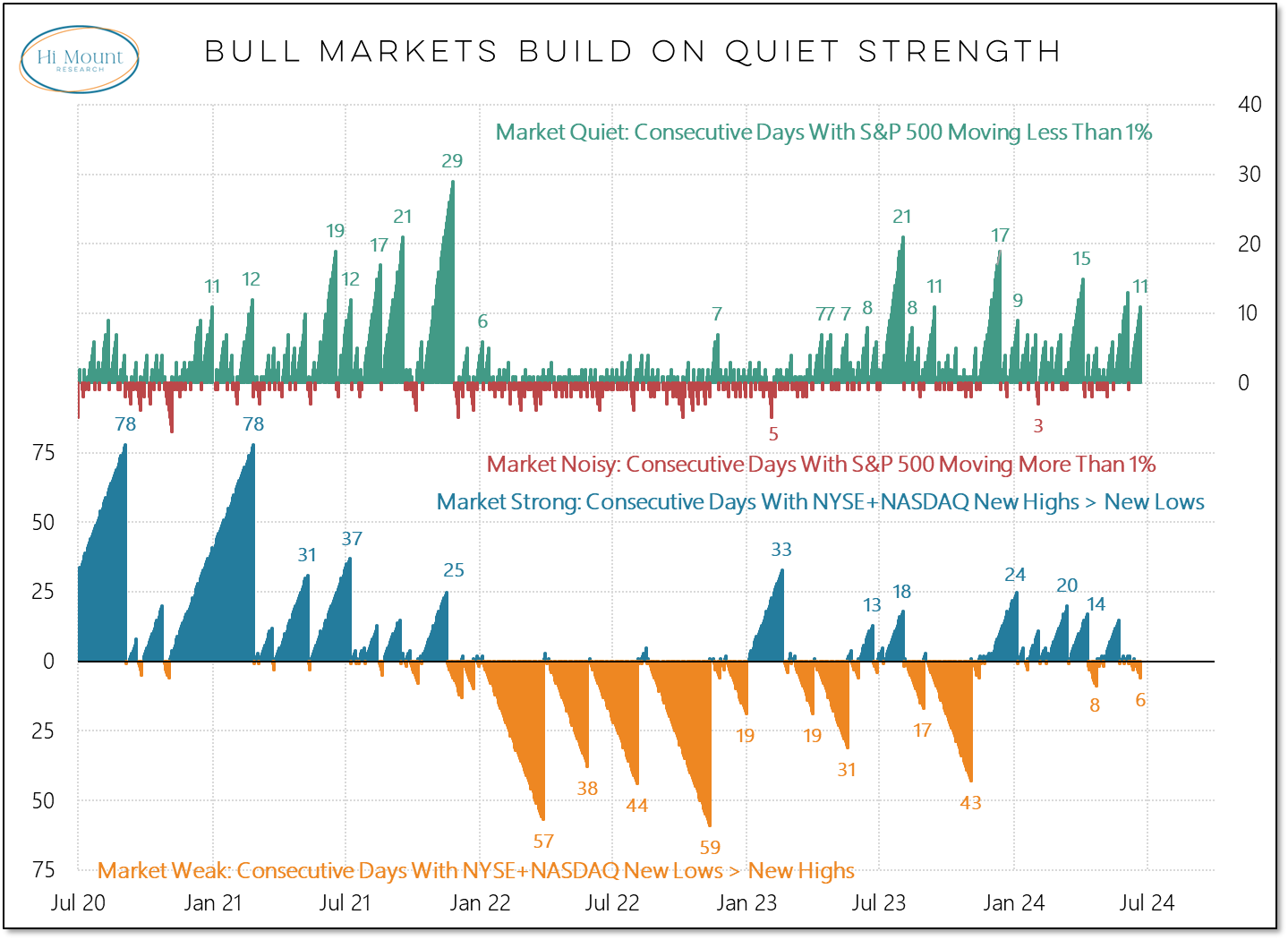

Key Takeaway: Bull markets usually feature quiet strength and bear markets are characterized by noisy weakness. Right now the market is quiet (11 days in a row with less than a 1% move on the S&P 500) but weak (6 days in a row with new lows exceeding new highs).

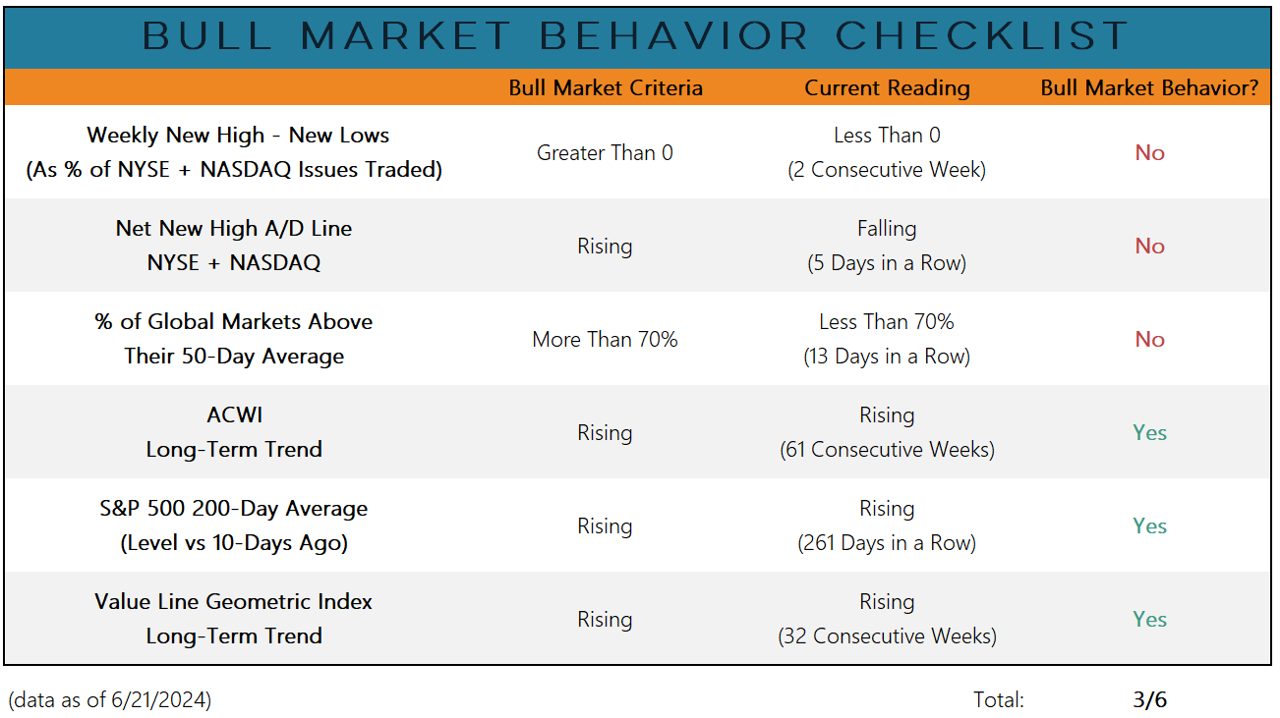

Another way to picture this is the disparity that has emerged between the breadth (all bearish) and trend components (all bullish) on our Bull Market Behavior Checklist.

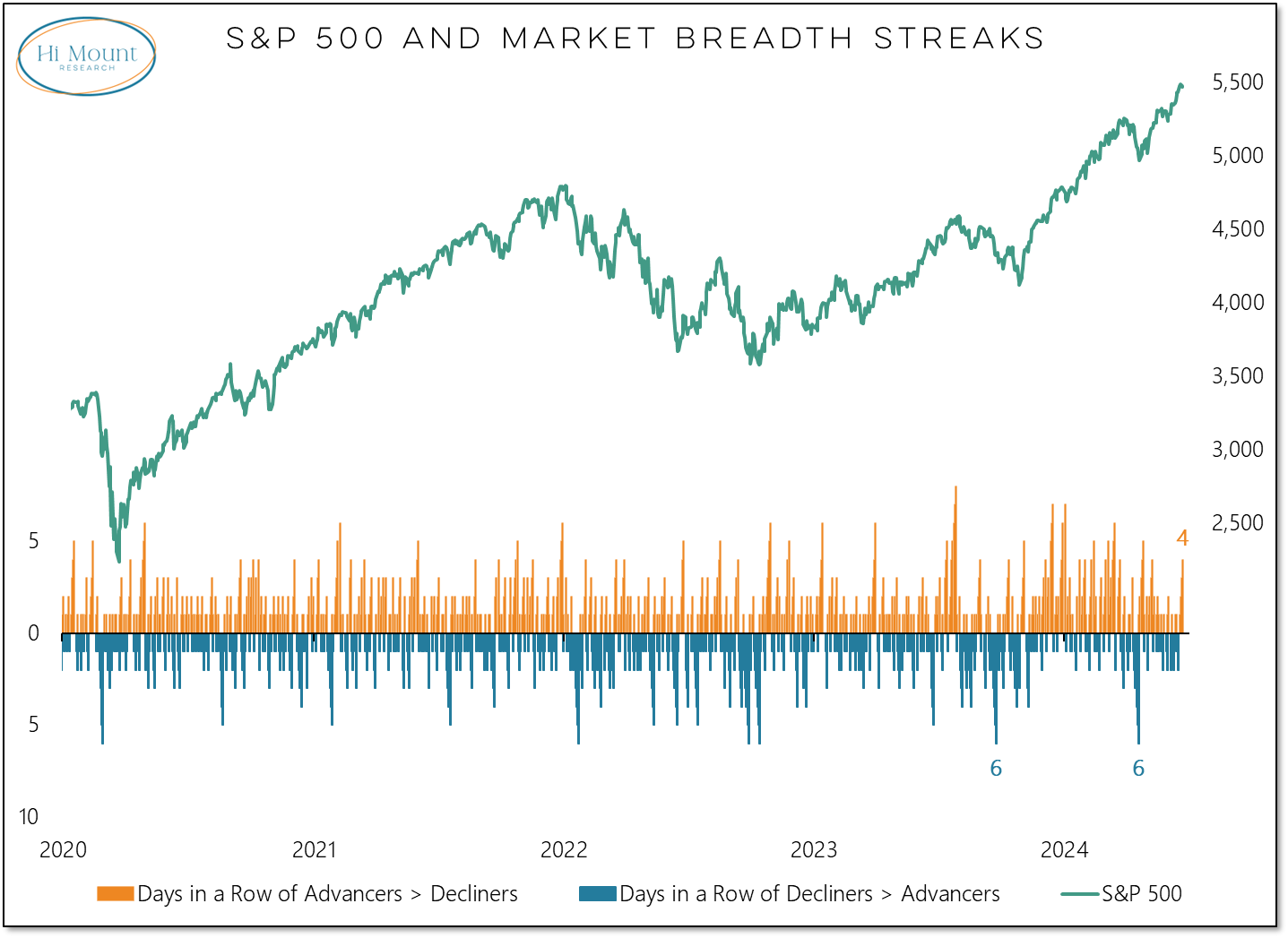

While there is the threat of storms from a breadth perspective, it is not totally overcast:

Last week saw 4 days in a row of more S&P 500 stocks advancing than declining. That’s the longest streak in 2 months.

We haven’t had more than 2 consecutive days of decliners exceeding advancing since mid-April.

All 11 sectors of the S&P 500 are above their 200-day averages. We continue to see more new highs than new lows at the industry group-level.

Navigating this environment means being mindful of the risks while remaining in harmony with the underlying trends:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.