A Bounce Or A New Beginning?

A drop in bond yields sparked interest in stocks, now lets see if it's sustainable

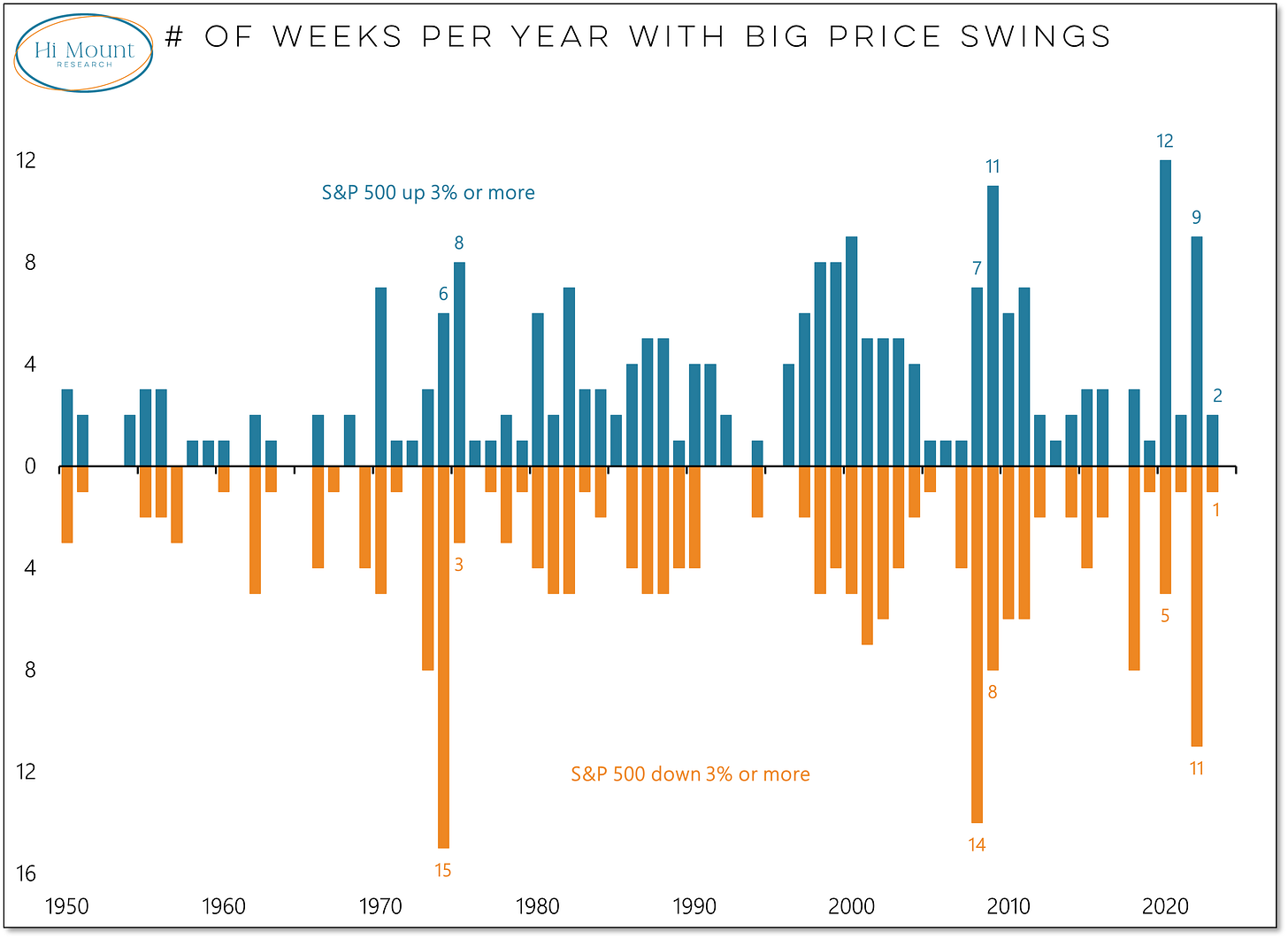

Key Takeaway: If bulls are going to build on top of last week’s rally, the market’s foundation needs further solidification. Big daily & weekly moves tend to be two-sided. Strong markets are usually quiet markets.

The S&P 500’s nearly 6% bounce last week was its largest increase 1-week increase in a year. The 5.90% increase in the second week of November 2022 was the fourth consecutive weekly swing of 3% or more. It was also the ninth in twelve weeks and the 19th 3% swing in for the year. 2022 would finish with 20 weekly moves of 3% or more, the most since 2008 and the 3rd highest in the past 70+ years.

This year has been different. Last week’s 5.85% gain was only the third weekly move of 3% or more this year and the first since the last week of March.

In the midst of last week’s big market moves, I had the chance to record conversations with two friends:

On Wednesday I appeared on the Schwab Network with Oliver Renick and later in the week I visited with Chuck Jaffe on his MoneyLife show.

I want to re-iterate and expand on a point that I made to Chuck:

Keep reading with a 7-day free trial

Subscribe to Hi Mount Research to keep reading this post and get 7 days of free access to the full post archives.