Townhall Takeaways podcast:

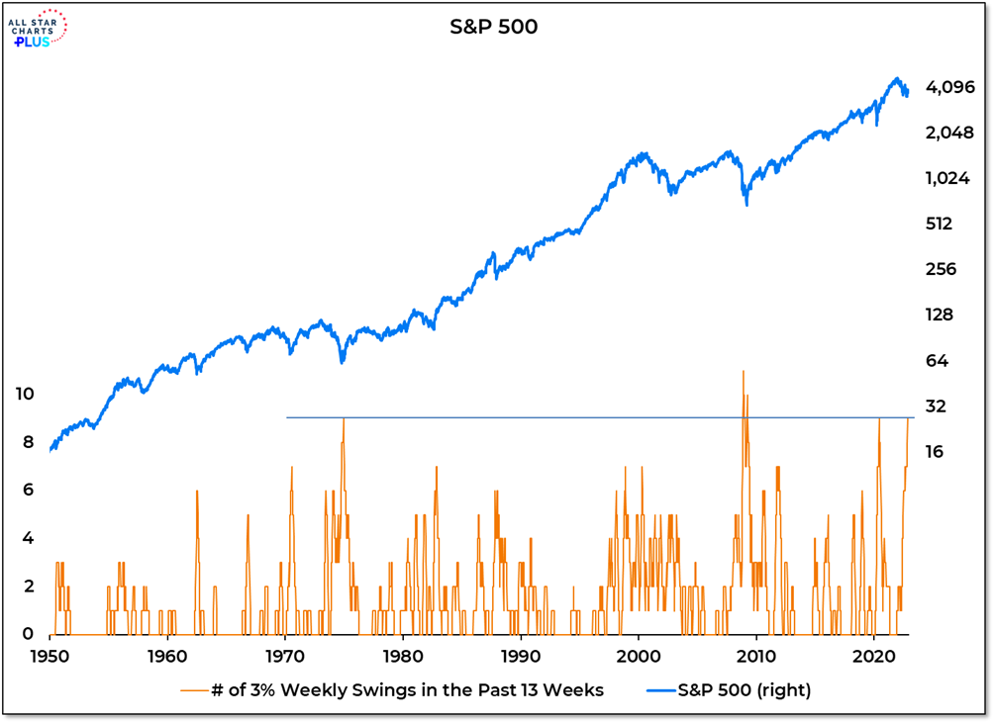

Big weekly swings in both directions leave 2022 with few historic parallels. After four consecutive 3% weekly swings, the S&P 500 has experienced nine in the past 13 weeks. Only 2008 has had more in a similar time period.

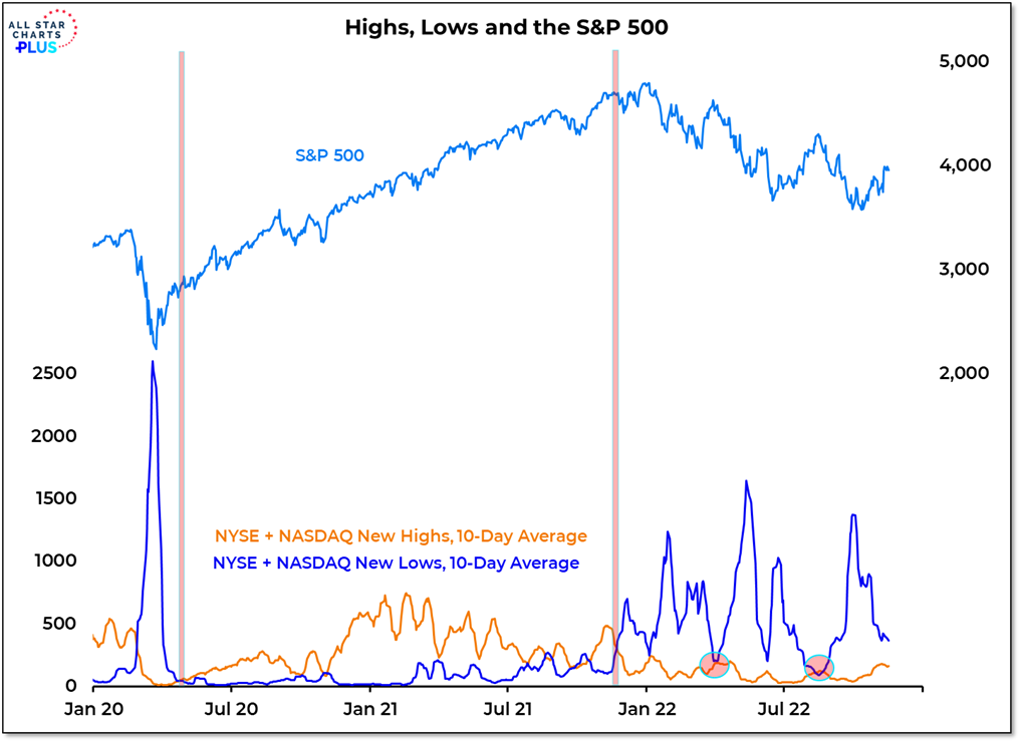

New bull markets are more characterized by the absence of new lows than the presence of new highs. Bear markets aren't usually over when the new low list peaks anymore than bull markets are over when the new high list peaks. It's when new lows collapse and cross below new highs that matters most.

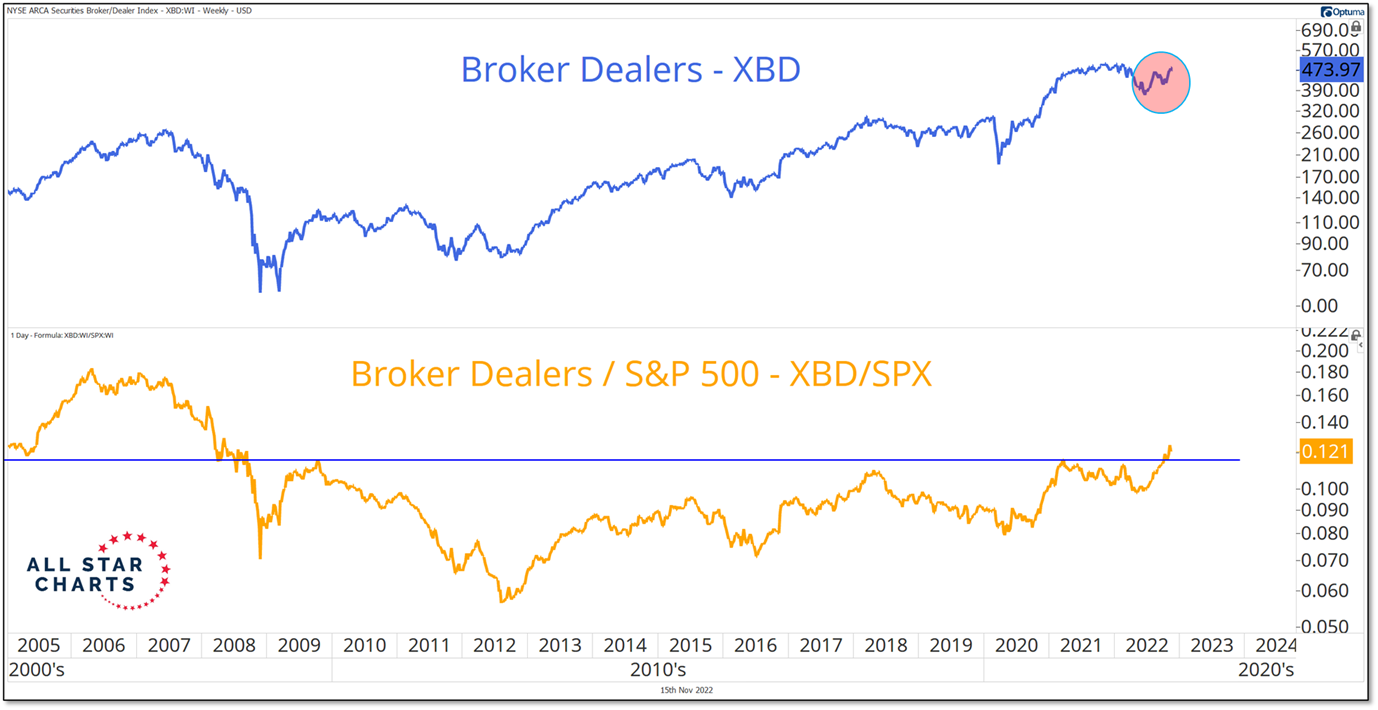

One of my favorite leading indicators has broken out to its highest level in over a decade. Broker-dealers (at least those not associated with Ponzi schemes) are making higher lows and higher highs on an absolute basis and are at their highest level relative to the S&P 500 since 2008.